The Department of Finance have released the end of year Exchequer Statement for 2011. The relevant documents are:

- Exchequer Statement

- Analysis of Tax Receipts

- Analysis of Net Voted Expenditure

- Information Note from the Department

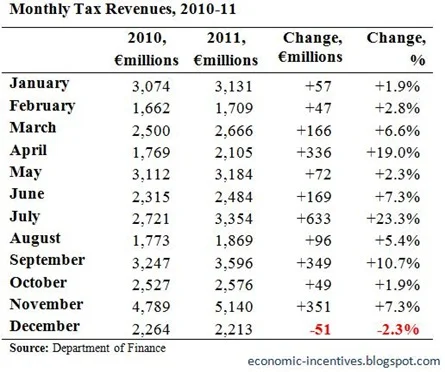

Here we will have a look at the figures in the usual detail. First up cumulative tax revenue by month.

Cumulative tax revenue has been ahead of the 2010 outturn for every month of the year. The increase peaked in September at 8.7% (when the new pension levy was collected) and has eased since then to finish the year up €2.3 billion or 7.2%. This has been hailed as the first rise in tax revenue in three years.

By looking at the individual tax heads we can see that virtually all of this increase is due to Income Tax.

The CSO reports that employment fell 46,000 in the year to September and that average weekly earnings rose 1.4% over the same period. These do not seem like labour market indicators that support a 22.4% rise in Income Tax. Budget 2011 contained a series of measures that were forecast to bring in about an extra €1 billion of Income Tax in 2011. So where did the other €1.5 billion come from?

It came about as a result of the reclassification of the old Health Levy into the new Universal Social Charge. The Health Levy was a departmental receipt collected by the Department of Health and did not appear in the Exchequer Account. All money collected under the Universal Social Charge enters the Exchequer Account and is included under the Income Tax heading.

In 2010 the Health Levy raised €2,018 million. This money was collected again in 2011 but under the guise of the Universal Social Charge in Income Tax receipts rather than as a receipt for the Department of Health. There might have been an increase in tax revenue in the Exchequer Account but there was little or no increase in government revenue.

The other tax showing a strong increase on 2010 is Stamp Duty. As we said when the September Exchequer Statement was released:

This again is not the positive sign the bare numbers would suggest. Stamp Duty is only up because the €457 million collected as a result of the Pension Levy introduced in May’s “Jobs Initiative” is included here. If we compare like-for-like Stamp Duty revenue is performing just like every other tax – i.e. worse than last year.

VAT is down €360 million but about one-third of that is due to the reduction in the 13.5% to 9% for certain goods and services in the same Jobs Initiative.

On a monthly comparison every month was ahead of the 2010 equivalent bar one: the last one. Tax revenue for December 2011 was €51 million lower than in December 2010.

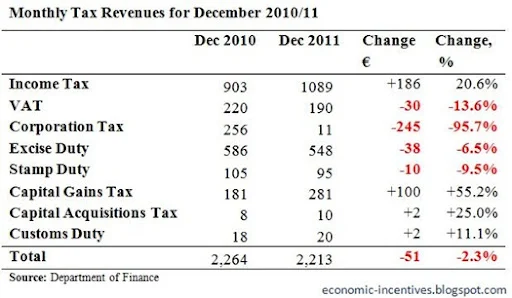

If we look at the individual tax heads we can see the causes of this.

The standout figure is obviously the 96% drop in Corporation Tax receipts. The Information Note offers an explanation for this:

[…] some €261 million in corporation tax receipts due for receipt in December were not received into the Exchequer account in time to be accounted for in 2011. The bulk of these receipts have since been received and will form part of the January 2012 tax revenue outturn.

It is not really clear what has happened but this will add a bit of new year ‘pep’ to the Exchequer Returns in 2012.

If we just look at the last quarter of 2011 the picture is a little more benign.

Apart from the continued weakness in VAT receipts and the glitch in Corporation Tax all tax heads in the final quarter of 2011 are ahead of their performance from 2010. The 40% rises in Capital Gains and Capital Acquisitions Taxes are noteworthy, but the contribution of these taxes to total tax revenue remains small (just 5.8%).

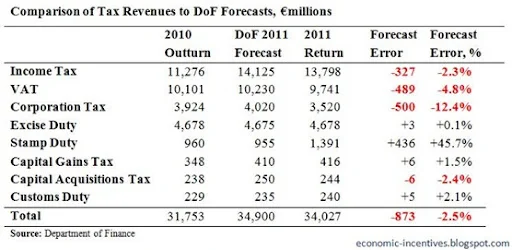

No analysis of Tax Revenue is complete without investigating whether receipts are “on target” which were published last February. They’re not.

Tax revenue in the final quarter of the year might be up on its 2010 performance but it is clear that the Department of Finance was expecting a much greater bounce. Over the last three months of the year tax revenue went from being €160 million ahead of target to €873 million behind target. If we omit the measures introduced in the Jobs Initiative that did not exist when these targets were set it is likely that tax revenue is around €1,200 million or 3.5% below target.

In each the last three months of the year tax revenue was more than €330 million behind the DoF forecast. It was hoped that there would be a rise of €1,383 million to €10,962 million of tax receipts in the final quarter. It is not clear why the DoF expected a 15% rise in tax revenue in the final quarter of the year but receipts were actually €9,929 million, almost 10% below target.

For the year as a whole three of the four main tax heads are significantly below their target and the overshoot in Excise Duty is a relatively inconsequential €3 million.

The tax to strongly outperform the target for it set last January is Stamp Duty and this is only because €457 million was collected from a 0.6% private sector pension levy that was only introduced in May. On that basis of what was to be collected at the time the forecast was made Stamp Duty is also below target.

If we look at the last quarter of the year when it all went wrong.

There is some cover for the almost 25% underperformance of Corporation Tax, but even if the €261 million of delayed receipts are added in Corporation Tax receipts would still be 10.8% behind the target for the quarter. The largest taxes for the quarter were forecast to be Income Tax and VAT and these were both almost 10% below target.

To be fair the performance in December was slightly better.

Although there is plenty of red in the table most of the shortfall is due to the Corporation Tax issue. There is no such explanation for the large undershooting of tax receipts in October and November that is reflected in the quarterly table above.

For 2012 the Department are forecasting a 5.3% increase in tax revenue.

This is largely based on a €1.2 billion increase in Income Tax receipts during the year. Budget 2012 contained no Income Tax measures so this €1.2 billion increase will have to be the result of the carryover from the measures introduced in the 2011 Budget (estimated at €600 million) and a general upturn in Income Tax receipts (accounting for the remaining €600 million). I can’t say that I can see that coming down the track.

Tweet

It's curious that the 2010 and 2011 excise tax receipts were exactly the same at 4,678m. Odd.

ReplyDeleteSeamus

ReplyDeleteOutstanding analysis, particularly the extraction of the trend over the last three months.

On the increase for 2012

1. If the Corp Tax deferred receipts are taken into account, then the increase of 250 becomes a decrease of 11, not a resounding vote of confidence in recovery.

2. The increase in the VAT rate should bring in the €254 million forecast, other things being equal.

3. The Income tax increase of €1202M as you point out is simply not realistic. They keep talking about carryover measures but what are they. In general terms there is usually no more than one month's carryover.

There is a way of bridging the gap in income tax through elimination of pension reliefs but this was not done in the budget.

I doubt if correction can wait until the budget in December.

PS

(the year headings on the last chart need to be amended).

Hi Joseph,

ReplyDelete1. The 2012 forecasts are from page 11 of the Economic and Fiscal Outlook published with the Budget. The €261 million of delayed Corporation Tax was not known then. They are forecasting a €250 million in Corporation Tax.

2. Hopefully!

3. The carryover measures for Income Tax can be significant. The measures introduced in Budget 2011 came into effect last January but for non-PAYE earners the tax deadline for 2011 is not until November 2012. A lot of the tax collected next November will reflect the changes introduced in December 2010. These are estimated at €600 million but as income tax came in under forecast this year we can expect the size of these carryover effects to be lower than that.

PS

Headings changed. Thanks!