The downward slide of Irish government bond yields continued today and the nine-year yield as calculated by Bloomberg finished at 7.91%. Apart from a two-week period at the start of October this is the only time that this has been below 8.0% in the past year. This time last year the yield was at 8.4%.

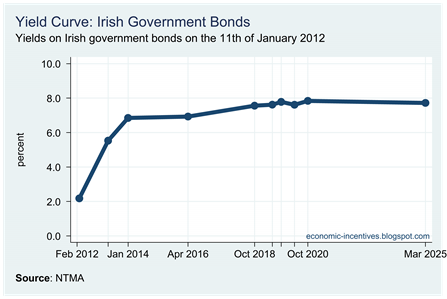

Here is the one-chart for the nine-year yield.

What is perhaps of even greater interest is the Daily Outstanding Bonds Report published by the NTMA.

We can see that no Irish government bond is yielding more than 8%. Michael Noonan has spent the day proclaiming that “Ireland is fully funded until 2013” (or two-thirteen in Noonan-speak). This is true. What happens in 2014?

The €11.9 billion bond due to mature on the 15th January 2014 is now yielding 6.85%. It now costs €94.84 to buy a unit of this bond. Last July this bond could was trading at less than €70 giving a yield of close to 20% (if you could find someone willing to sell). The perceived risk of this bond has dropped considerably in the past six months.

Finally, it is interesting to see the reasonably normal shape of the yield curve for Irish government bonds.

It would be more than reasonably normal if we could knock a few more percentage points off the yields but lets take it one step at a time. It’s a good deal better than this yield curve from just five months ago.

Tweet

And at least it's a proper yield curve with longer maturities accruing higher interest rates. What's interesting is that we're paying the same for 6-month paper as the US is paying for 10-year paper. Shows how much ground we have still to make up in order to return to the markets in "two thirteen". That being said, we've made a big improvement from the 16% interest rates of the summer as last year. Hopefully we get a resolution to the European crisis (which would stop exogenous shocks sending the rate up) and a continued growth in the belief that Ireland is following the right fiscal policy. We could then envisage 6% rates on our 10-year bonds which would encourage us to go to the markets next year.

ReplyDeleteIs this not more indicative of the ECB actively buying this junk paper? (€600 billion balance sheet growth in 6 mths)

ReplyDeleteI can't see any improvement in the fundamentals of the Irish Sovereign position!

@ AL,

ReplyDeleteI would say that the ECB was more active in buying Irish government bonds back in August when the yield curve was inverted than it is now. There is little value in the ECB buying large amounts of these for a "programme" country as the yields are only an indicator rather than having any real meaning. They will matter when we go to "dip our toes" in the market although they may now be only months away.

If the ECB buy large-scale amounts of Irish sovereign bonds it reduces the effectiveness of PSI (or increase the haircut) in the event of a debt restructuring. At present there are €85 billion of bonds outstanding. There are some suggestions that the ECB could hold up to a quarter of them .This is unconfirmed at the ECB does not reveal what bonds it has bought. (The covered banks also hold about one-sixth of the bonds.)

Anyway, excluding the estimated ECB holding there is around €63 billion of bonds "in play". If the Greek approach was followed a 50% haircut was applied then that would generate around €32 billion.

At the end of 2012 the General Government Debt will be €183 billion. The 50% haircut would reduce that by only 17%. As we are funded through to 2013 it is likely the GGD would be over €200 billion before this haircut would be applied and by then who knows what amount of the bonds would be held by the ECB or the covered banks.