Ireland continues to face a massive budget deficit. In 2013, the deficit is forecast to be 7.5% of GDP which will be the largest in the EU. There are almost incessant arguments on how best to close the deficit. One common refrain is that Ireland is a “low-tax economy” and that the gap should be closed with tax increases, in particular increases in income tax on the “rich”.

When it comes to income tax, there is not much evidence at an aggregate level to support the thesis that Ireland is “low-tax”. In fact as a percentage of GDP, Ireland collects the eighth highest amount of income tax in the EU and is equal to the EU average. Here are 2011 figures from Eurostat on personal income tax as a percent of GDP.

Ireland’s social contributions rates are low and on a combined measure of income tax and employee social contributions Ireland ranks 13th in the EU on 10.5% of GDP below the EU27 average of 13.0%. Table here. (Though the Irish figure is 12.7% of GNP).

In 2013, it is projected that there will be a general government deficit of €12.7 billion. Around one-ninth of this will be because of the deficit in the Social Insurance Fund. It is forecast for 2013 that there will be €7.1 billion of PRSI contributions, while there will be €8.6 billion of claims on the Social Insurance Fund. More PRSI is needed to fund the expenditure of the social insurance fund but the deficit is a little less than 1% of GDP.

We could choose to move higher in the above table using employee social contributions. However, as this table (excel) from the OECD shows, all 34 countries in the OECD adopt a flat-rate system for employee social contributions. This approach may not be attractive to all owing to the lack of progressiveness in the measure. The deficit in the Social Insurance Fund could be closed by upping the employee PRSI contribution rate from 4% to 7%.

However, the main hole in the public finances is for expenditure financed out of general taxation. Of course, there could be further increases in employee PRSI contributions beyond that necessary to close the deficit in the SIF up to say the 12.5% average for the OECD-EU21, with scope to also increase employer and self-employed social contributions. Such an increase could be accompanied with the transfer of the funding of certain expenditures from the Exchequer to the Social Insurance Fund, thereby reducing the need for tax increases.

Accepting that is possible, let’s assume that tax-funded expenditure continues to be tax funded and we are looking to raise additional tax revenue, and in particular income tax revenue. Let’s see how some of those countries with higher income tax receipts than Ireland manage it. This table (excel) from the OECD gives effective income tax rates at different income levels.

For Ireland, it gives effective income tax rates and tax bills (income tax plus USC) for a single person with no children at the following wage levels:

- 67% of Average Wage: €22,000 = 8.8% with €1,900 tax

- 100% of Average Wage: €32,800 = 14.9% with €4,400 tax

- 167% of Average Wage: €55,000 = 28.1% with €15,400 tax

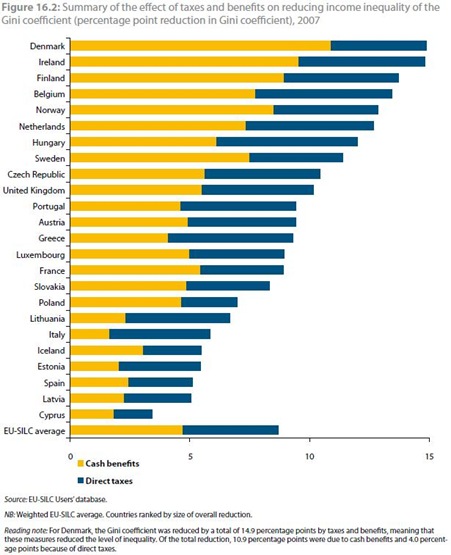

Ireland has a progressive tax system. In fact it is the second most progressive in the OECD and the most progressive in the EU.

The following table shows what happens to personal tax bills if we apply the effective income tax rates of the six EU countries who collect more than 10% of GDP from personal income tax. These countries are Denmark, Sweden, Finland, Belgium, Italy, the UK. In the table their effective tax rates (as well as their mean) at 67%, 100% and 167% of the average wage is applied to those wage levels in Ireland?

Tax system are complicated so this crude analysis may miss some of the finer points of each system but it gives a good impression what would happen if the effective tax rates from the top income-tax-collecting countries were applied in Ireland.

Ouch! Unsurprisingly, 20 out of 21 of the country rates result in an income tax increase. The only reduction is in the case of the UK effective tax rate for those earning 167% of the average wage.

The arithmetic average of the effective income tax rates for the six countries implies tax increases at all three income levels, but the size of the tax increases varies hugely. If applied those on €22,000 would see their tax bill more than double, those on €32,800 would see their tax bill increase by half and those on €54,800 would see their tax bill rise by around one-twelfth.

In proportionate terms the hit would be 13 times greater for those on €22,000 than those on €54,800. The extra tax on €22,000 would around €170 a month, the extra tax on €54,800 would be €95 a month. And increases in flat-rate employee social insurance contributions might be dismissed because they are not progressive! Adopting the average effective tax rates of these six countries for single people with no children would be monstrously regressive.

We can collect as much income tax as Denmark, Sweden and Finland but let’s be clear how they do it. Countries with higher tax income revenues as a percentage of GDP than Ireland do not achieve it by levying more taxes on higher incomes (€55,000 would be in the top quintile of earnings in Ireland), they do so by levying more taxes on average incomes and much more taxes on lower incomes.

An equivalent table for married couple with two children looking at the effective income tax rate less child-related transfers is below the fold.