In today’s Irish Independent Cormac Staunton has a piece that responds to a piece yesterday by Dan O’Brien which in turn was a reply to a documentary by David McWilliams shown by RTE on Monday night. The print articles discuss data on inequality. One would think that given these are discussions of research carried out by other organisations it would be fairly easy to reach an agreement on what the numbers are. This is not so.

Staunton’s piece runs under the headline that “There's no denying inequality's a growing problem in Ireland - and everywhere else”. On wealth inequality is begins by saying:

It [the documentary] showed that people believe that the top 20pc in Ireland have more than 60pc of all wealth.

In fact, they have 72pc of all wealth - that's one in five people owning almost three quarters of the value of all the land, housing and financial assets in the State.

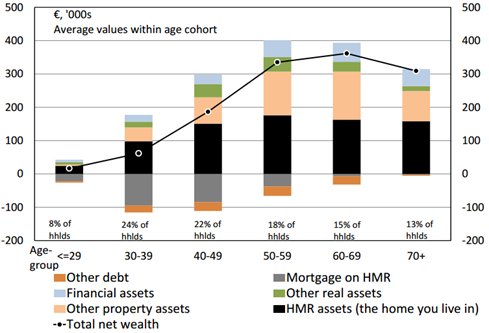

That is not what wealth distribution figures measure. Wealth distribution figures do not show who owns the assets. It is a net wealth figure. If a person owns €10 million of assets they obviously have lots of assets. But if they also have €10 million of liabilities their net wealth is zero. This person will be towards the bottom of the wealth distribution even though they own lots of assets.

Examples such as this are extreme and there is likely a high correlation between net wealth and ownership of assets but it is not correct to say they are the same as one includes the impact of liabilities and one doesn’t.

Next Staunton says:

The programme showed how growing inequality in Ireland was part of a global phenomenon which is causing great concern amongst economists and leaders across the political spectrum.

Except the documentary showed no evidence of growing inequality [unless you count flashy cars being shown on the screen, the fact that food on private jets is nice and that there’s a fella in London who sells expensive watches.]

On data sources Staunton says:

The programme also cited Credit Suisse data showing how the 'middle 60pc' in Ireland had 30pc of all wealth, which is less than that held by the top 5pc. Again, the CSO data shows similar results.

Haggling over data and sources, or judging the level of inequality only in relation to other countries, ignores the bigger picture.

So lets look at the Credit Suisse data. Here are the net wealth shares going to the top 10 per cent of the wealth distribution.

According to the Credit Suisse data the net wealth held by the top decile was 58.2 per cent in 2000 and was 58.5 per cent in 2014. There is no evidence there of growing inequality in the share of net wealth held by those at the top of the distribution. If people use the 2014 figures to talk about the level of inequality now and then talk about increasing inequality why don’t they use the earlier figures to show how inequality has changed?

Research from the Central Bank has estimated a gini coefficient for net wealth in Ireland since 2006.

Staunton though is adamant that inequality is increasing:

The simple fact is that inequality of wealth and income has been growing in every country in the developed world over the last 30 years.

It would be helpful is there was a reference to evidence that supports this. Inequality is growing in lots of countries but not all of them. From above we have evidence that wealth inequality is not growing in Ireland (or at least is not growing since 2000 in the Credit Suisse data).

We do know that income inequality is bad for the economy and we can agree on the following:

But inequality is also bad news for the economy. Studies from the IMF and others have shown that higher inequality can negatively affect the economy because the wealthy spend less of their incomes than middle- and lower-income groups.

This is true. Here is a study from the OECD on this topic called “Trends in Income Inequality and its Impact on Economic Growth”. Paragraph 25 and Figure 3 on page 18 are where we need to turn. The section concludes [emphasis added]:

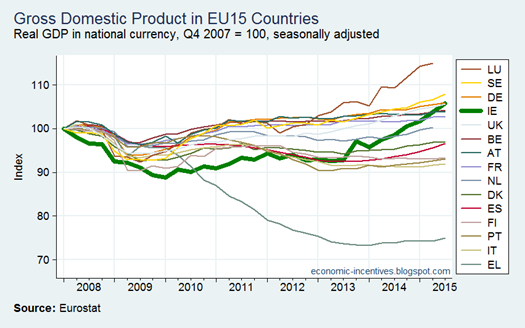

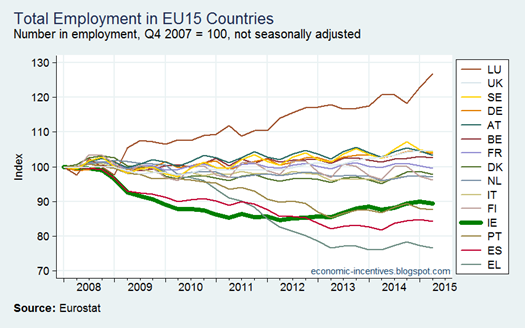

Rising inequality is estimated to have knocked more than 10 percentage points off growth in Mexico and New Zealand. In the United States, the United Kingdom, Sweden, Finland and Norway, the growth rate would have been more than one fifth higher had income disparities not widened. On the other hand, greater equality helped increase GDP per capita in Spain, France and Ireland prior to the crisis.

For a start the research shows that income inequality has not been increasing in every country in the developed world. There are three countries where inequality has fallen and this “greater equality helped increase GDP per capita”. And, yes, Ireland is one of those three.

The fine print is in the paper but that seems like an important point for Ireland when citing studies that show the negative link between inequality and per capita GDP. Falling inequality in Ireland helped increase GDP per capita.

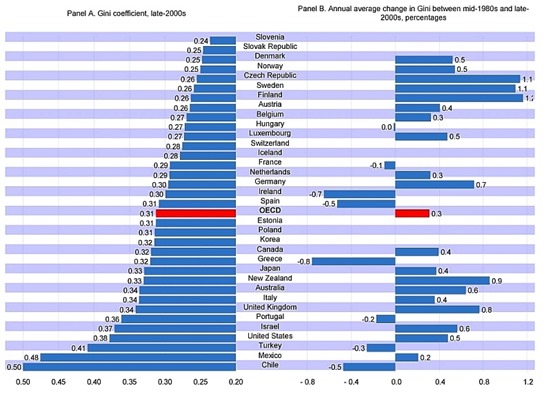

Here is a chart using OECD data on gini coefficients (click to enlarge).

Across the OECD inequality has been increasing on average by 0.3 per cent per annum. In Ireland it has been falling by 0.7 per cent per annum.

Most of the countries above Ireland have been showing increasing inequality with some of the largest increases in inequality seen in Sweden and Finland. If this positive trend for Ireland continues our ranking should continue to improve.

We do have major issues with inequality (market income distribution and joblessness in households for income, and debt and negative equity among a certain cohort for wealth) but an inability among those discussing it to agree on the facts can only hinder rather than encourage progress.

Can we not agree that Ireland is not unusually unequal when it comes to disposable income or net wealth and that neither of these are showing an upward trend? And turf out the absolute statements about inequality increasing everywhere. It would be a helpful starting point.

Tweet