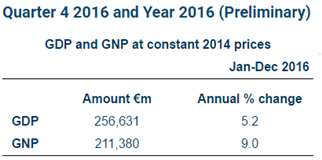

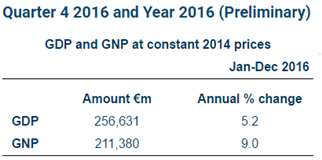

The CSO have published the Q4 Quarterly National Accounts which give a preliminary view of the full-year outcomes for 2016. All the caveats about these being preliminary figures were hammered home last year when the initial 7.8 per cent GDP growth rate for 2015 published in March became the infamous 26.3 per cent growth when the full national accounts were published in July. Anyway, this time around the preliminary figures show that real GDP grew by an estimated 5.2 per cent in 2016 with real GNP recording an increase of 9.0 per cent.

At first glance a five per cent growth rate seems about right for the Irish economy but the nature of Ireland’s macro statistics means we cannot simply take it at face value and, given the gap to the nine per cent growth in GNP, there may be reason to believe that the underlying growth rate of the economy could a bit above the five per cent growth seen in GDP.

One explanation for the differing GDP and GNP growth rates could be if MNC profits in Ireland contracted in 2016. This would mean that the value-added from the “domestic” economy grew by more than five per cent, and as this accrues to Irish-residents this would translate into a higher growth rate for GNP. If ten per cent lower MNC profits was the only thing affecting the net-factor-income-from-abroad adjustment to get GNP then we could take the nine per cent growth rate of GNP as reflecting the performance of the “domestic” economy. But such simplicity is a realm that Irish economic statistics have long departed.

In recent years there have been a few things other than the level of MNC profits in Ireland that have affected net factor income from abroad. For example, the additional growth in GNP seen in 2016 could be due to an increase in MNC profits in Ireland not counted as a factor outflow because, say, of increased depreciation on MNC assets in Ireland (including intangibles) or it could be because of an increase in net factor inflows to redomiciled PLCs with their nominal headquarters in Ireland.

We cannot see the first of these effects in this week’s release as a depreciation figure will not be available until the full National Income and Expenditure accounts are published in a few months. Outflows of direct investment income fell from €59.7 billion in 2015 to €57.5 billion. This could be because of a fall in MNC profits earned in Ireland or an increase in the amount of MNC profits consumed by the depreciation of their Irish assets. However, looking (as best we can) at things like contract manufacturing suggests that MNC profits did indeed fall in 2016.

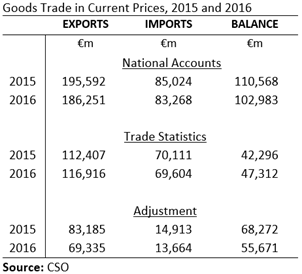

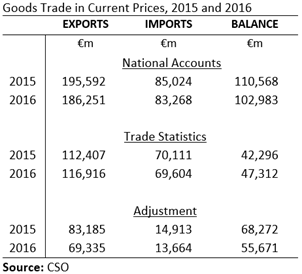

In the National Accounts, the value of Ireland’s goods exports fell by around €9 billion in 2016. However, in the custom-based External Trade data the value of the goods which were physically exported from Ireland rose by €4.5 billion. The difference arises from the adjustments made for things like contract manufacturing in other countries undertaken for Irish-resident companies. Here is the difference between the goods export figures in the Quarterly National Accounts and the External Trade Statistics since 2010.

As the previous table shows there were €83.2 billion of additional goods exports in the 2015 National Accounts. The preliminary 2016 figures suggest that this fell to €69.3 billion. We can see that the associated trade balance of these adjustments with this fell by €12.6 billion in 2016.

We have to be careful about inferring the GDP effect of this. For a start there may have been a fall in royalty imports (though assuming most of the €12.6 billion fall is related to the activity that came with the 2015 surge that will not have been the case) and, secondly, these trade figures are nominal so there may have been price and/or exchange rate movements involved which would need to be accounted for before putting them in the context of changes in real GDP.

And with nominal GDP growing by 3.9 per cent compared to the 5.2 per cent real growth rate, it is clear there was some price deflation with a lot of this arising on the goods trade side. Nominal goods exports fell by 4.8 per cent but real goods exports only fell by 1.2 per cent. We sold almost the same volume of goods in 2016 as we did in 2015 but lower prices meant the value was almost five per cent down.

But back to the higher growth in GNP. There may have been more MNC profits consumed by depreciation in 2016 but we have no evidence of that (yet). We do have evidence, through the contract manufacturing channel, of reduced MNC profits though there could be offsetting profit increases from their actual activities in Ireland. Still, this hint of reduced MNC profits would suggest that the underlying growth rate of the economy in 2016 was above the five per cent GDP growth rate.

It is not all the way to the nine per cent GNP growth rate as there is very likely to have been a redomiciled PLC effect pushing up GNP. Inflows of direct investment income rose from €15.8 billion in 2015 to €18.8 billion in 2016. Some portion of this may be increased foreign earnings of Irish MNCs but redomiciled PLCs contribute significantly to these inflows.

The fall in outbound profits of MNCs and the rise in inbound profits of, presumably, redomiciled PLCs explains most of the change in net factor income from abroad which, in nominal terms, rose from –€53.2 billion in 2015 to –€47.5 billion in 2016. It is because of these direct investment flows that GNP grew faster than GDP. Whether that means the “domestic” economy grew by more than five per depends on what caused the fall in outbound MNC profits.

These are precisely the problems that it is hoped the new national income measure, GNI*, will address. In rough terms GNI* will be the standard “GDP less net factor income from abroad” to get to GNP with the (positive) balance of EU taxes and subsidies used to get to GNI. After that, additional adjustments will be made for the depreciation of intangibles that MNCs have located here and the net income earned by redomiciled PLCs. With these adjustments we should get a better measure of aggregate income developments for Irish residents. It’s little more than a guess but, assuming some fall in MNC profits last year, a growth rate in 2016 for GNI* of somewhere around 6 to 7 per cent may not be too wide of the mark.

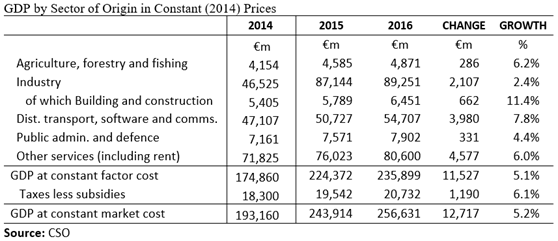

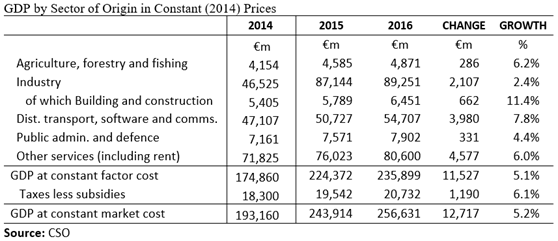

So lets look at some of the sources of that growth. First, the output approach:

We see that all sectors of the economy grew in 2016. The slowest real annual growth was the 2.4 per cent for the MNC-dominated industry sector and, of this lower growth in 2016, around one-third was due to building and construction even though it makes up only around seven per cent of the sector’s value added. Value added in building and construction grew by 11.4 per cent in 2016.

MNC profits in the industry sector were the source of almost all of the excess that made up the 26 per cent growth in 2015 (as comparison to the 2014 figures show) but nothing like this happened in 2016. This is reflected in the sectoral Corporation Tax receipts published by the Revenue Commissioners which show that CT receipts from manufacturing grew by three per cent in 2016.

As well as building and construction, the other non-MNC dominated sectors also grew fairly strongly with agriculture (6.2 per cent), public admin (4.4 per cent) and other services (6.0 per cent) all contributing strongly to growth. Product taxes grew by 6.1 per cent and combining all of these gets us to the 5.2 per cent growth in real GDP at market prices. With an overall MNC performance that seems weak this looks like the odd occasion when we can attribute the most of the growth to the non-MNC part of the economy.

That is not to say that there were not MNC effects in the accounts; just that they were largely GDP neutral. The preliminary 2016 figures for the output approach might be relatively clean but the expenditure figures are a mess.

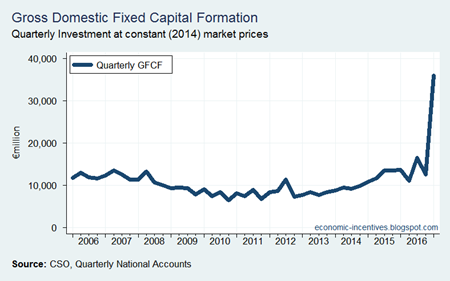

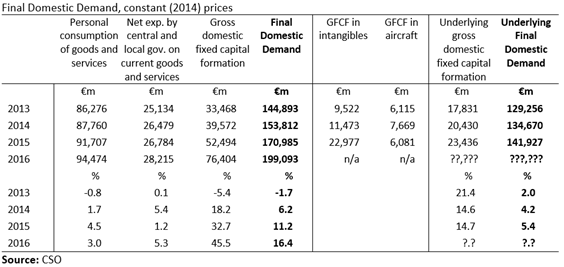

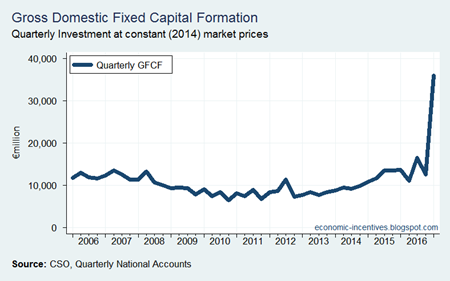

OK, public and private consumption are fine with real private consumption growing by 3.0 per cent and public consumption motoring along with a real growth rate of 5.3 per cent but after that the figures are all over the place. One chart is enough to highlight the nature of it. Here is real quarterly investment (2014 prices) since 2006.

This series had been volatile recently because of aircraft and intangibles but it went “off the chart” in Q4. More investment took place in last quarter of 2016 than in each of the years from 2010 to 2013. The spike is bizarre but this is what we have come to expect in Irish economic statistics. Like other recent changes it is related to the onshoring of intangible assets but the nature of the transaction that brings the intangible here is important.

Some of the recent onshoring has been achieved by the company holding the IP becoming Irish-resident. This involves a balance sheet relocation and while the IP is added to Ireland’s capital stock there is no domestic transaction to be reflected in the investment series. The profits that the IP generates will be included in Irish GDP.

The fact that the large onshoring in Q4 appeared in the investment data indicates that this was a transaction undertaken by an entity that was Irish-resident at the time the acquisition took place. Although the size of the transaction runs to tens of billions of euro it is actually GDP neutral as the intangible has to be imported. We can see this in the Balance of Payments current account which shows a huge spike in all business services imports.

We know that the spike relates to intangibles (the CSO press statement says so) but unfortunately the Q4 figures for R&D imports and intangible investment have been suppressed. Here is an extract from the CSO response to the recent group set up to explore ways to improve the presentation of Ireland’s macroeconomic statistics:

Recommendation 6: Quarterly publication of underlying investment and underlying domestic demand measures that take account of the impact of IP relocations, contract manufacturing, aircraft leasing and re-domiciled firms.

Deliverable: The CSO currently publishes a breakdown of investment by tangible and intangible assets on a quarterly basis. We will add to this detail by quantifying the flows of IP relocations and aircraft leasing activity in 2017, in current and constant prices, at the time of the annual National Income and Expenditure results in mid-2017.

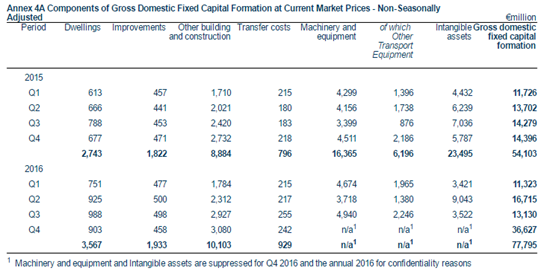

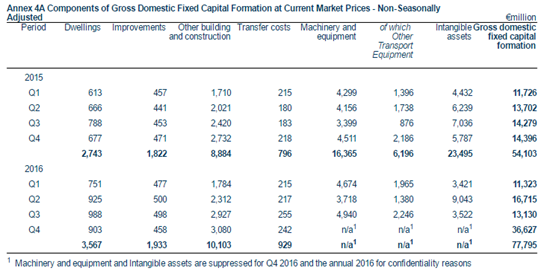

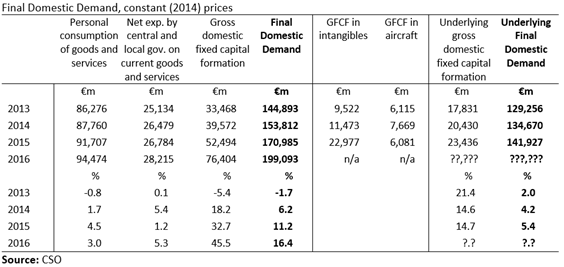

Well “currently publishes” is what they used to do. Here is the table from this week’s release (click to enlarge).

The breakdown of investment by tangible and intangible assets for Q4 or 2016 as a whole was not provided. So instead of going forwards we’re going backwards. It is not clear what has been achieved by this suppression. It seems pretty clear that intangible investment in Q4 2016 was in the range of €28 billion +/- €1 billion.

Investment in intangibles is made up of three components:

- in-house R&D carried out by the public and private sectors in Ireland

- net service imports of R&D carried out for/in other countries

- net outright purchases of IP assets to/from other countries

The Q4 spike (on the assumption of no similar sized transaction in Q1 2017) will have been in the last of these reflecting the one-off nature of the onshoring. But how much more would we learn about the onshoring that took place if the figure for intangible investment in Q4 was actually provided? We know it happened and we could probably have a good stab at working out the size of the transaction as the first two items are reasonably steady.

But not knowing the precise level of intangible investment isn’t that serious an issue. We don’t need to know it and to get measures of underlying investment and underlying domestic demand these transactions relating to the onshoring of IP are actually something we want to strip out. But suppressing one figure is not enough; a minimum of two figures must be suppressed to make it effective. And this means losing one of the key components of underlying investment.

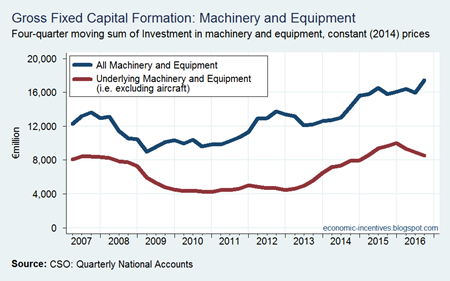

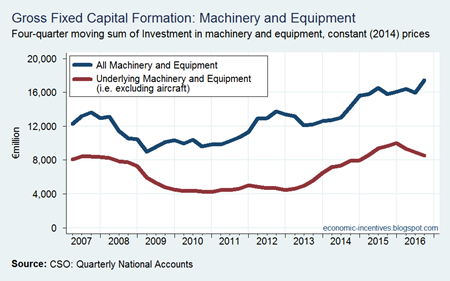

In this instance, it is machinery and transport equipment. After netting out ‘other transport equipment’ (i.e. rail, air and sea transport equipment but almost exclusively wide-bodied aircraft related to leasing activities) we are left with underlying machinery and equipment investment and this has ranged between €1.0-€3.0 billion per quarter (in 2014 prices) for the past six years. Underlying machinery and equipment investment increased strongly from late-2012 through to the middle of 2015 but since then has been on a firm downward trajectory.

The fall is notable but it is just another quirk in the statistics. It is related to investment in equipment to manufacturer semi-conductors and processors (item 728.21 in the Trade Statistics). Irish imports of such equipment spiked from virtually nothing in 2012 to around €1 billion in 2014 and 2015 and have fallen away again.

This is what has caused the fall in the red line above. We could make yet another adjustment for that but pretty soon you get to the stage where there is no point in aggregating anything and we just look at everything individually. And these machines are being installed here so while it is a useful pattern to be a aware of it does represent activity actually happening in Ireland.

While we don’t have any Q4 2016 figures for machinery and equipment investment in the QNAs it has been possible to identify investment in ‘other transport equipment’ in other data series published by the CSO, namely the External Trade statistics. The following chart shows quarterly net imports of category 79: other transport equipment in the Trade Statistics and investment in other transport equipment in the Quarterly National Accounts since the start of 2010.

It is hard to tell but there actually are two lines shown for the period from 2010 to 2014. The near perfect relationship stumbles a bit in 2015 before sundering completely in 2016. It seems the ability to identify investment in ‘other transport equipment’ from the Exterbal Trade statistics is no more for some reason. Net imports of ‘other transport equipment’ were €2 billion in Q4 2016 and that seems as likely as figure as any for investment in ‘other transport equipment’ in the quarter but it is a (somewhat informed) guess.

If we use that €2 billion figure we are left with €30 billion of investment in Q4 to allocate between underlying machinery and equipment and intangibles. The likely figure for underlying M&E in Q4 is between €1 billion and €3 billion. It is this that gives us the €28 billion +/- €1 billion for investment in intangibles in Q4.

The equivalent Q4 underlying machinery and equipment investment figures for the prior two years were €2.0 billion and €2.3 billion respectively and are in the middle of the €1 billion to €3 billion range but determining the annual growth in underlying machinery and equipment investment is no longer possible. As shown above the reported figures for Q1 to Q3 2016 showed a rather alarming 18 per cent drop in underlying machinery and investment investment compared to the same period in 2015. Given the likely range of figures for Q4 the annual change in underlying machinery and equipment investment could have been anything from –27 per cent to –7 per cent. We simply don’t know.

For underlying investment the likely range for growth in 2016 is from –3.7 per cent to +4.8 per cent with the poor performance of underlying machinery and equipment being offset by strong growth in dwellings (+27.6%), improvements (+6.4%), other building and construction (+11.4%) and transfer costs (+9.7%) . The poor performance in underlying machinery and equipment may seem puzzling (-18% year-to-date to Q3) given the strong growth in the other categories, but outside of equipment relating to processor manufacturing it too is probably showing positive growth as well.

With the 45.5% annual increase in investment driven by the onshoring of intangibles it would be nice to know what is happening to underlying investment in the economy. Even with the growth in the categories shown in the above table the performance of underlying investment has been flat for the past year (noting that the chart below does not have Q4 figures). But if strip out all machinery and equipment (a crude way of overcoming the issue with processor manufacturing equipment highlighted above), the story is much more positive. This gives the red line in the chart below and that has growth of 14.4 per cent in the year-to-date to Q3 2016 (from 7.6 per cent in the FY 2014).

But the absence of Q4 figures for underlying investment also feeds into determining the growth of underlying domestic demand, though at the scale of that (c.€150 billion) the €2 billion range we have identified is not as significant with the likely growth in underlying domestic demand last year being somewhere between 2.3 per cent and 3.8 per cent.

After growing by 4.2 per cent in 2014 and 5.4 per cent in 2015 it looks like the growth of underlying final domestic demand slowed in 2016, pulled down by slower consumption growth and the fall in machinery and equipment investment. But because of the suppressed figures we don’t know to what extent. And just when the need to adjust for intangibles has never been greater.

And all this uncertainty derives from an onshoring event that we probably wouldn’t learn a whole lot more about if the suppressed figure for intangible investment in Q4 was actually provided. Maybe we were lucky to get what we got, but still…