Yesterday’s release of December’s Retail Sales Index has led to some reasonably upbeat headlines.

- RTE: Stronger spending finish to 2011 – CSO

- Irish Independent: Festive shoppers hike sales by 3pm for retailers

- Irish Times: Retailers get December boost as sales rise by 3%

Retail sales did rise towards the end of the year but the 3% figure for December is for the All-Business Index. This includes the Motor Trades which even in December has a significant impact on the index. The Motor Trades weighting for December is 8% (for January it is 35%).

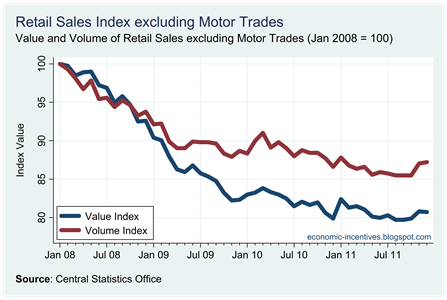

Instead we will focus on ‘core’ retail sales which strips out the effect of the Motor Trades. Here is this index since the start of 2008.

The drops seen in 2008 and 2009 have eased but signs of a sustained recovery remain absent. Although there was an increase in retail sales towards the end of the year the ‘bump’ occurred in November, not December. December showed a small monthly increase in sales by volume (+0.2%) but there was a decrease in value index (-0.1%).

[Sales in December are going to be much greater than those in November but the Retail Sales Index is adjusted for such seasonal patterns and the monthly weightings given to each sector also reflect this seasonality.]

One positive-looking graph is the annual changes in the value (+1.1%) and volume (+0.7%)indices. These are both positive for the first time since March 2008. We must be wary though. The CSO can adjust the index for seasonal consumption patterns but they cannot adjust the series for seasonal weather patterns. Sales last December were disrupted by a cold snap that brought snow and ice.

It will only be over the coming months that we will know if the bump seen in November will be maintained. It is difficult to see how the annual rates will stay positive next month. There will have to be a monthly increase in sales value of 2% in January just to ensure that the Value Index does not have a negative annual change.

Here are the monthly changes showing that the recent bump occurred in November.

Tweet

No comments:

Post a Comment