A previous post looked at loans in Irish banks. Here will we confine ourselves to mortgages and will start from this graph in the earlier post.

The Central Bank report Private Household Credit and Deposits Statistics which allow us to look at this in a little more detail. Here is the same graph (going back to 2003) from the Household Credit series. The data is quarterly and runs to Q3 2011 so does not include the shifts that occurred in October 2011 that guided the previous post.

In general, the series from the two graphs are similar though the securitised series in the latter graph shows a ‘jump’ in the second quarter of 2009 that is not evident in the first graph. As there is no corresponding decrease in “on balance sheet” loans it is not clear what was securitised (if anything).

It can be seen that banks in Ireland began securitising mortgages in the middle of 2006 and stopped by the end of 2009 (apart from €17 billion that was “derecognised” in October 2011 of course!)

The benefit of the household statistics is that we can look a little deeper into this although most of the data series only start from the fourth quarter of 2010. We can, however, get the breakdown of the “on balance sheet” loans for house purchase back to 2003.

Most of the significant step decreases can be explained by increases in securitised loans although the drop that can be seen at the end of 2010 is as a result of Bank of Scotland (Ireland) leaving the Irish market.

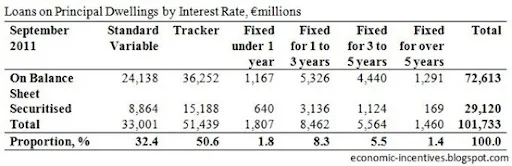

The more detailed series are only available for four quarters. There has been little movement in the series over this period so there is little value in graphing the series. Here is the most recent data for September 2011 in tabular form.

First, the total amount of loans for house purchases.

The €102 billion total of residential mortgages in September 2011 is significantly lower than the €114 billion reported in the Financial Regulator’s Residential Mortgage Arrears Statistics for the same time. The primary reason for the difference is the absence of Bank Scotland (Ireland)’s mortgage loan book from the above figures.

We are also provided with a breakdown of the €132 billion of mortgages by interest rate type: standard variable, tracker and fixed for different periods.

More than half of mortgages in Ireland are tracker-rate loans linked directly to the ECB base rate. With the ECB rate now back to 1% the repayments on these loans are now much lower than when these loans were taken out in the 2006 to 2008 period. Finally, we can get a breakdown by interest type for residential, buy-to-let and holiday home mortgages.

Here is a breakdown of the €102 billion of residential mortgages by interest rate type.

Just over half of residential mortgages on are on tracker rates. If the €10 billion or so of mortgages in the former Bank of Scotland (Ireland) were included this proportion would be even higher as most of its mortgage book comprised tracker-rate loans.

The proportion of buy-to-let mortgages that are on tracker rates is even higher.

"More than half of mortgages in Ireland are tracker-rate loans linked directly to the ECB base rate. With the ECB rate now back to 1% the repayments on these loans are now much lower than when these loans were taken out in the 2006 to 2008 period. "

ReplyDeleteSéamus

This is a point which very few commentators seem to recognise. The focus is on mortgage arrears and mortgage rescheduling. The focus is on how people's incomes have been hit by unemployment, increased taxation and salary cuts.

Despite the huge prices paid for houses and the reduced net incomes, the arrears levels are still very low. A major reason for this is the very low interest rates. Even those on SVRs are probably paying less than they were paying when they took out their mortgages. In June 2007, the AIB SVR rate was 5.2%. Today, it is 3%.

http://www.askaboutmoney.com/showthread.php?t=163841

Brendan Burgess

Seamus

ReplyDeleteI note that a significant proportion of mortgages is 'securitised'( Approx 25%).

Does this mean that the mortgage income is being passed on to the purchaser of the mortgage and can it be determined if the banks are breaking even or making a small profit on these by virtue of some of their funding at least being at ECB rates.

One further question re securitised mortgages.

ReplyDeleteIf the mortgagee is in arrears or stops paying, who bears the loss? The bank or the person that has purchased the securitised mortgage?

Joseph,

ReplyDeleteIf a securitised mortgage is in arrears the investors take the losses. The originating bank collects interest and capital on behalf of the investors and keeps a small fee. However, in some cases the originating bank may also be the investor.

The securitised (or covered) bonds being eligible as Eurosystem collateral would allow banks to use the mortgages on their books for liquidity purposes. This may explain the spike in 2009 and again in 2011. If I am correct, many of these mortgages and any related losses may still, in effect, be on the banks balance sheet.

Further to above. I see Fergus O'Rourke has fully covered and explained internal securitisations in the previous topic, 'Loans in Irish Banks'.

ReplyDelete