The quarterly IMF Reports generated as part of the EU/IMF programme now include an useful table that summarises the state of the “Irish-headquartered banks” (known as “covered” before the withdrawal of the ELG). The banks included, and their level of state ownership, are:

- Allied Irish Banks (as merged with EBS) – 99.8%

- Bank of Ireland – 15.1%

- Permanent TSB – 99.2%

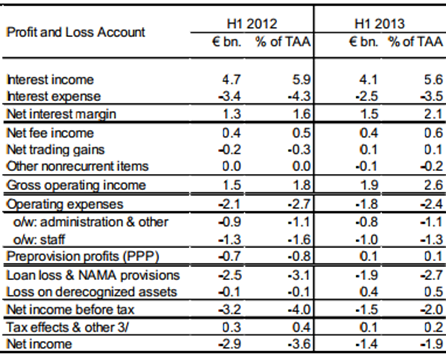

The most recent review, the eleventh, includes the table aggregating the results of the three banks on page 43. First is the Profit and Loss Account:

One important measure of the state of the banks is pre-provision profits. For the past few years the banks have not been able to generate enough income to cover their operating expenses. Regardless of loan losses that is unsustainable. The March 2011 PCAR projected that the banks would make €3.9 billion of operating profits in the three years from 2011 and 2013. This was a wild over-estimate.

Compared to the first half of 2012, the banks managed to slightly increase their net interest margin (from 1.6% of total average assets, TAA, to 2.1% of TAA). A small turnaround in trading gains and a reduction in operating expenses from €2.1 billion in H1 2012 to €1.8 billion in H1 2013 resulted in pre-provision profits swinging around from –€0.7 billion to +€0.1 billion. This is still well shy of what was envisaged under the PCAR.

Although the banks returned a small aggregate pre-provision profit in H2 2013 continued loan loss provisions mean that net income remains negative. If the level of non-performing loans (NPLs) continues to rise the banks will have to continue provisioning for losses which will continue to be a drag on the P&L account.

Next up is the balance sheet where we will ultimately see the effect of these provisions.

The balance sheets of the banks are getting smaller. Total assets dropped €40 billion over the year, falling from €322 billion last year to €288 billion at the end of June this year. Only ‘securities and derivatives’ showed an increase on the asset side, possibly down to valuation effects. All other asset categories fell with net loans dropping by €22 billion.

On the liability side the bulk of the reduction was seen in the money ‘due to Eurosytem’ which fell by nearly 50% over the year. The other drop was in ‘Debt and derivatives’. Both interbank deposits and customer deposits rose over the year. The €3.6 billion rise in customer deposits must be tempered against the fact that government deposits in the covered banks increased by around €10 billion over the year as the NTNA placed around half of the €25 billion cash reserve that has been accumulated with them.

The net equity in the banks (difference between assets and liabilities) was just over €20 billion. The value of the liabilities is easy to determine; the value of the assets is less immutable.

As shown, the banks had €65 billion of debt securities at the end of H1 2013. These are mainly NAMA bonds, Irish government bonds and bonds from each other. “Oh what a tangled web we weave, when we practice to deceive” (Walter Scott).

The loan books of the banks continue to both decline and deteriorate. As good loans are paid off the relative size of the defaulting loans increases. This is a chart on SME lending up to the end of 2012 from the Central Bank’s Macro-Financial Review.

The proportion of impaired loans has risen to around 25% but the amount of lending outstanding has fallen from €60 billion to €43 billion. For Q1 2011, 15% of €60 billion is €9 billion; for Q4 2012, 25% of €43 billion is €11 billion. The proportion of impaired loans has increased far more than the amount of impaired loans. This is not the case in the mortgage market where the level of loan reduction is lower and the increase in impaired loans is faster. The question of whether the ultimate losses will be above those set out in the 2011 PCAR is still uncertain.

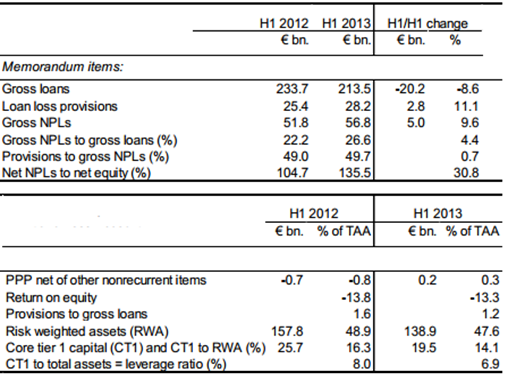

Finally, the IMF include some “memorandum items” that give some further insight into the balance sheet and profit & loss account.

We see that the banks have a gross loan book of €213.5 billion. The balance sheet value of €186 billion is as a result of the €28 billion of loan loss provisions that have been set against the loan books. Non-performing loans in the banks grew another €5 billion over the year but that provisions as a percentage of NPLs is almost 50%.

The second half shows that the banks’ Core tier 1 capital ratio fell from 16% to 14% over the year and is still above regulatory requirements. Operating losses eating cash and provision reducing the value of loan assets will have eroded the banks’ capital. A relapse to pre-provision losses and further provisioning on bad loans will erode this further.

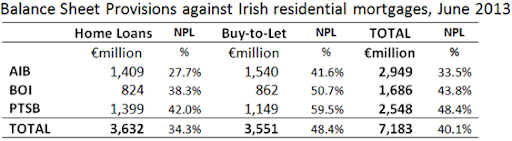

This will arise because additional loans go sour or because they banks may not have set aside enough to cover existing non-performing loans (NPLs). For example, AIB may not have been conservative enough with provisions against its Irish residential mortgages. We have seen that AIB has made a provision equal to 34% of its non-performing mortgages, as against 44% for Bank of Ireland and 48% for Permanent TSB. The banks do have slightly different methods of measuring ‘non-performing’ which may be a factor in the provisions they set aside.

So what is the overall state of the banks? Will they pass the forthcoming stress test? It is likely that the Irish banks will pass the stress test. Reports suggest that the ECB will require a 7% CT1 ratio in the stress test with a 1% surcharge for “systemically relevant” banks.

The ECB wants to unearth potential risks hidden in banks' balance sheets before banking supervision is centralised under its roof from November 2014 as part of a broader plan for closer European integration to head off future financial crises.

To do that it plans to run an asset quality review (AQR) early next year, for which it will reveal details on Wednesday.

Two sources familiar with the matter told Reuters on Tuesday that the central bank will ask banks to fulfil an 8 percent capital buffer in its review.

The buffer will require a core tier one capital ratio of risk-weighted assets of 7 percent, as foreseen in the final 2019 stage of the Basel III regulatory framework, plus a 1 percent surcharge for systemically relevant banks.

Could the results show that the Irish banks will drop below this level? It’s possible but unlikely. The Irish banks must strengthen their operating profitability and will have to continue making provisions against bad loans (but at a much reduced rate) but a drop below the level set out in the ECB stress test is unlikely.

What could cause the Irish banks’ capital ratios to drop below 8% (in aggregate)? A further write down in the value of their assets of around €10 billion would probably do it. This could happen for a number of reasons:

- If a further €20 billion of loans become non-performing, the current provisioning rate (c. 50%) would knock €10 billion off the book value of the loans.

- If there was an increase in the provisioning rate against current NPLs from 50% to 66%. Equivalently, if losses on existing NPLs are crystallised at a level above those currently provided for.

- If the book value of loss-making, low-interest ‘tracker’ mortgages was reduced (unlikely to be €10 billion though)

- If the book value of other assets such as Irish government bonds or NAMA bonds was reduced (again unlikely to be €10 billion).

Of course further operating losses and possible changes to the items eligible as Core Tier One Capital will also have a role to play. The above list are fairly pessimistic scenarios and even if they were to play out (and they are possible) they would still bring the aggregate capital ratio across the banks to around 8% – which is the threshold set by the ECB.

Under the conditions set out by the ECB no additional capital would be required. As noted above, the 2011 PCAR was designed around keeping the capital ratios above 10.5% in the base case (and a buffer above that was also provided for).

If something like the above does play out and the capital ratios in the banks do drop to below 8% where will the money come from to make up the gap? The shareholder is mainly the State and the amount of subordinated debt in the banks is relatively small (and any write down there would hit the State which holds €1.4 billion of sub-debt between AIB and PTSB). Similarly there aren’t many senior bonds in issue from the banks. So where to next? A depositor haircut a la the botched Cypriot example?

That is very very unlikely in Ireland. The worst of the banks are now off the stage (Anglo, INBS and Bank of Scotland(Ireland)); the remaining banks are not going to be shutdown. As projected here the “Irish headquartered banks” probably have around €10 billion of headroom before more capital is required (to stay above the 8% level). This will be eroded but it will take even larger problems again to generate a hole that has to be filled. A hole of any substantial size is unlikely but not impossible.

If it comes to it is there a “National backstop” available? Yes, the NTMA have accumulated a cash reserve of more than €25 billion. Using that to recapitalise the banks is an unlikely scenario but the backstop is there. The Irish banks will pass the ECB stress (and maybe we should be doing more stringent tests of our own) but passing a stress test is not a sign that a bank is healthy. It just means it’s unlikely to die. Even when the banks do pass the ECB’s test cleaning up the delinquent loan-book shown on the balance sheet above is a long way from being completed.

Tweet

No comments:

Post a Comment