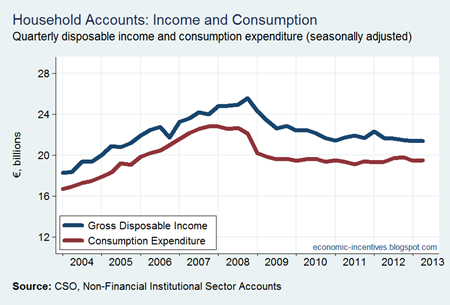

Yesterday the CSO published the Q2 2013 Non-Financial Institutional Sector Accounts. Here we will focus on the household sector and the main aggregates in H1 2012 and H1 2013.

A year-on-year comparison does not show any improvement. Earnings and social benefits received are down while taxes and social contributions paid are up. All told, gross disposable income in the first half of 2013 was 3% lower than in the first half of 2013.

Even though income for the half was down, consumption expenditure held up and rose slightly on 2012. This means that savings (income not used for consumption) were down. Savings in the first half of 2013 were around €1.5 billion lower than in 2012. This will be reflected in reduced deposit accumulation, debt repayments and/or capital investment from the household sector.

The gross savings rate, including an adjustment for the net equity position of pension fund reserves (income earned by pension funds that those not form part of disposable income as it is locked in), fell from near 15% in 2012 to just under 12% this year.

It is has long been expected that a fall in the savings rate would lead to an increase in household consumption expenditure. In H1 2013 the savings rate fell but consumption did not rise commensurately. The savings rate fell because households had less disposable income; not because they increased expenditure.

The seasonally adjusted data produced by the CSO highlight this lack of improvement.

Tweet

No comments:

Post a Comment