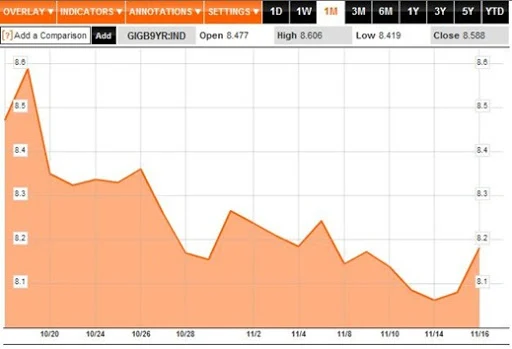

There has hardly been a day in the past fortnight when bond yields have been outside the top three stories in the news. However, it is been Greece, Italy and Spain and latterly Belgium and France that has been attracting the attention. Our bond yields have already caused a peep. Here is the nine-year Irish government bond yield as calculated by Bloomberg for the past month.

For the past month yields have been in a range between 8.1% and 8.6% and are at the lower end of that range now. It could be that attention is directed elsewhere but it is noteworthy nonetheless.

Also interesting is following graph which gives the relative performance of Irish nine-year yields and German ten-year yields for the past year. A reading of 0 means the yield is unchanged relative to the yield on the starting day of the graph. A reading of 100 means the yield is twice as high.

Irish bond yields are at almost the exact level they were at 12 months ago (8.1%). The surge in the summer ahead of the July 21 summit is clearly visible and that quickly dissipated which these gains largely maintained. German yields are about 33% lower than they were this time last year (2.6% down to 1.8%).

How are Irish yields relative to those of France?

French yields took the same downward pattern as those of Germany during August and September but have been rising since the start of October and are now about 20% higher than they were this time last year.

On a pure price basis compared to this time last year:

- a German bond is worth more

- an Irish bond is worth about the same, and

- a French bond is worth a bit less

What does this mean? Not a whole lot. It does suggest that we have gotten most the uncertainty surrounding the solvency of the State into the open, in particular in relation to the banks. Clearly there are doubts that remain (reflected in the yield above 8%) but in a period of European volatility the relative tranquillity in the Irish setting is interesting.

Tweet

I spoke to two bond traders today, essentially the lull exists because trading is non-existent in these markets. The figures as you say need to be interpreted on the basis that for the moment no one cares one way or the other about Ireland either in 2/5 or 9 year markets.

ReplyDeleteHi Stephen,

ReplyDeleteIt does seem to be the case that the Irish market is largely being ignored. The EMH is truly dead. We need a test to include an indicator for times when "no one cares" about prices!

I feel that our bond prices will largely be determined by factors beyond our control, ie a Greek default, a Spanish bailout, a euro break-up etc.. Most of the domestic factors which would drive the Irish bond market - a change in government, new developments in the banks, a shift in our budgetary position, a deterioration in macroeconomic outlook have all been aired over the past 4 years and have been priced in by the markets. Moreover, there is likely to be little change in our domestic determinants of bond prices given the relative stability in the Irish economy We have stopped falling and we are now in the slow but steady process of picking ourselves off the ground. That said if the eurozone crashes then the ground beneath our feet will shake and we, along with everyone else, will be back firmly on the ground.

ReplyDeletehttp://www.bloomberg.com/quote/GIGB9YR:IND/chart

ReplyDeleteLooks like the tranquility is over.