As it stands Ireland’s public debt is made up of five distinct types (estimated size at 30th June 2011)

- Government Bonds (€89.7 billion)

- Retail Debt (€13.7 billion)

- EU/IMF & Bi-lateral Loans (€22.4 billion)

- Promissory Notes (c. €28 billion)

- NAMA Bonds (c. €28 billion)

These all come with different costs and interest rates. The interest coupons on the €89.7 billion of outstanding bonds can be seen here and ranges from 3.9% to 5.9%. The retail debt pays prizes to winners in the case of Prize Bonds and fixed interest rates in the case of Savings Certificates and Bonds.

The concern here is with the costs of items three and four. Here is a very useful table which was provided via an interested reader. (HT: Kevin). This table shows the drawdown amounts and interest rates on the EU/IMF loans at the end of June.

The outcome of the Brussels summit on the 21st July was that our borrowings under the EFSF would be reduced to something close to 4%. As we can see from the above table we have drawn down around €3.6 billion at an interest rate of 5.9%. In total we are due to borrow €17.7 billion from the ESFS so there will be some savings.

It remains to be seen if the interest rate reduction will also apply to our borrowings from the EFSM. As we can see above these funds carry on interest rate of up to 6.48%. Under the programme it is expected that we will borrow €22.5 billion from the EFSM so substantial savings will be earned if (or when) the reduced interest rate is applied.

The other €4.8 billion of the €45 billion in loans from the EU is being arranged through bi-lateral agreements with individual countries and we already know that the UK has committed to reducing the rate on the loan it is providing. It is not expected that there will be any change on the €22.5 billion of loans from the IMF.

Yesterday’s statement from S&P takes account of this uncertainty.

Following the Heads of State or Government of the Euro Area and EU Institutions statement of July 21, 2011, we expect the interest rate on the European Financial Stability Facility portion (€17.7 billion) of Ireland's €67.5 billion external support package to decrease to about 4.5%, from about 6.0%. We estimate the saving to the Irish government on interest payments will be around €0.9 billion (0.6% of GDP) cumulatively over 2012-2015. The maturities on EFSF loans are also expected to be lengthened as part of the Heads of State agreement. Meanwhile, it is also possible that interest rate reductions will be extended to Ireland's European Financial Stability Mechanism (€22.5 billion) and bilateral borrowings (€4.8 billion).

When thinking about these rate reductions a sudden thought flashed across my mind that maybe these would have some impact on the interest rate charged on the Promissory Notes provided to Anglo and INBS. I briefly hoped that the interest rate might be calculated from some blended average of other government borrowing rates. Hopes were soon dashed. From the Information Note provided by the DoF last November.

The interest rate charged is based on the long term Government bond yield appropriate to when the amounts will be paid.

The interest rate on the Promissory Notes has nothing to do with government interest costs but is directly related to the yields on governments bonds in the secondary market. Pretty quickly my hope had turned to fear. These are not very low.

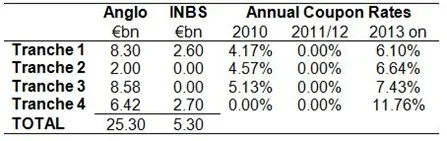

Information provided by the DoF shows the interest rates chargeable on the Promissory Notes. This is not new information and was provided by the then Minister for Finance, the late Brian Lenihan, back in January. See here.

The interest rate on the first three tranches is not out of line with our other borrowings. However, the €9.1 billion that makes up tranche four has an annual coupon equivalent to 8.6%. This is by far our most expensive debt.

We were up in arms at the 6% being charged to us by our EU partners, but we ourselves are paying nearly 9% to the two zombies that now make up the Irish Bank Resolution Corporation (IBRC).

We have been told that this new entity will not need any further capital injections from the State. This must be considered in the light of the €17 billion interest cost the Promissory Notes will impose on us during their lifespan. This is an implicit injection by the State.

Should we just payoff this €9 billion of 9% Promissory Notes with extra money borrowed at 4% from the EFSF? This would generate an annual interest saving of around €350 million. Of course we would actually have to pay the interest if we borrowed it from the EFSF rather than just rolling it up as accrued interest in the Promissory Notes.

This would eliminate the possibility of ever reneging on this portion of the Promissory Notes, but according to the current Minister for Finance we have no intention of doing so anyway.

Tweet

Seamus, just so I have this right, the government issued €31billion worth of promissory notes to the three institutions. In addition to this €31 billion the government will pay a coupon on the parts of the notes yet to be paid. These coupons will be accumulated and paid after the payment of the principal amount. The rates charged for each of the tranches depend on the yields at the time they were issued. Since the tranches were issued throughout 2010 with the last on December 31st 2010 the rates on the promissory notes rose in tandem with rises in government yields.

ReplyDeleteAfter looking at this, the obvious question was why the banks are getting a coupon from the government on the very capital they got from the government who are borrowing these funds to provide this capital. Apparently it has to do with a fair value accounting adjustment and ESA accounting rules. Am I right in saying that were we to attach a 0% rate the €31 billion would not be enough for the capital adequacy purposes as required by the financial regulator? Basically the fair value is derived by referencing the notes to identical transactions in the market or in this case government bond yields. Why can't a marginally lower rate be attached to the promissory notes? Brian Lenihan RIP explained it here but it is not entirely clear to me

http://www.kildarestreet.com/debates/?id=2010-11-10.531.0

Second, the DOF technical note on the Promissory note used a weighted average cost of funds raised in 2010 of 4.7% for years after 2011. The rate used for 2011 was 6.5%. Since we now know the rates will be in excess of that or 8.2% even. Brian Lenihan in the PQ you referenced spoke about 20 years and the total interest cost of €17 billion. Is this now a more accurate figure and timeline, and does this imply that the DOF note is out of date given the assumptions they made?

Hi Patrick,

ReplyDeleteExcellent comment. Your analysis of the workings of the Promissory Notes is generally correct.

I'm not sure why the yield on Irish government bonds was choosen as the appropriate benchmark rate. It does make the Tranche 4 Notes very expensive.

The point you raise in the final paragraph is one that bothered me earlier as well. However the interest rates quoted are the cost of the money used to make the annual repayment, not the interest rate on the actual Promissory.

The DoF assume that the cost of the €3.1 billion annual payment will be met with money borrowed at 4.7%. Given the recent changes at the EU summit this seems a fairly reasonable assumption.

They don't give the rates they use to calculate the accrued interest on the Promissory Notes but my back of the envelope calculations suggest that they were not far from the actual rates. The €17 billion interest bill is still a good ball park figure.

The information note assumes that the Promissory Notes will be paid linearly, i.e. €3.1 billion each year until the capital plus interest has been paid off. This may not be the case for a number of reasons. It could be that Anglo/INBS need the capital quicker or, as I point out above, we could decide to pay them off quicker. The final interest cost is still unknown.

There might be the view that paying €600 million of accrued interest in ten years is better than paying €300 million of cash interest now because of cash considerations but we have to take a long term view of the cost of this debt.

We can see that in 2013 of the €3.1 billion nearly two-thirds of that will be consumed by the accrued interest; the principle only falls by one-third of the payment. It is a universal law of household finance - pay off your most expensive debt first. I cannot see why we are doing the same here.

Thanks Seamus,those promissory notes are a maze. No wonder Joan Burton wanted a powerpoint presenation!

ReplyDeleteHello friend

ReplyDeleteHow are you Today Visit your Web Blog Page Got more Information you share Best Information my pray with you and Your Business get more success and Blessings in The name of LORD.

saving prize bond

prize bond sale

national savingss bonds

national savings

What A blog sir nice article plus good information

ReplyDelete