This is a companion to the previous post which looked at changes in the homeownership rates in the 1991 and 2022 censuses. Here we look at more recent changes in the tenure status for households headed by an Irish or UK national using figures kindly provided by the CSO.

From Census 2016 to Census 2022 the number of households enumerated headed by an Irish or UK national increased by 83,293, or 5.5 percent. In 2022, these were 87 percent of the total households enumerated (and 89 percent of households where the citizenship of the reference person was provided, i.e. excluding “not stated”).

Here is the tenure status of households headed by an Irish or UK national in the last two censuses.

When looking at the changes, by far the largest absolute increase was for owner-occupiers, whose number increased by 48,522 over the period. There was a rise in the number of outright owners without a loan or mortgage and a decline in the number of owner-occupiers with a loan or mortgage.

In relative terms, the number of owner-occupiers rose by 4.4 per cent. With the total increasing by 5.5 percent, this results in a decline in the home-ownership rate for this group from 75.3 percent in 2016 to 74.8 percent in 2022. Households whose tenure status is “not stated” are excluded from the determination of the tenure rates shown in the table.

The next largest absolute increase was for social housing tenants. The number of households who are tenants of local authorities or approved housing bodies shows a rise of 20,741 over the period. This is a 14.5 percent increase and resulted in the the share of households headed by an Irish or UK national who were local authority or AHB tenants increasing from 9.6 percent to 10.5 percent.

The next largest increase was for households who occupied a dwelling free of rent. There were a further 3,643 such households in 2022, though these remained less than two percent of all households headed by an Irish or UK national. These are likely to arise due to intra-familial arrangements where the owner and occupier of the dwelling differ.

Of the possible occupancy statuses, the smallest absolute increase for households headed by an Irish or UK national was for those renting from a private landlord. There were just an additional 360 such households in Census 2022, an increase of 0.2 per cent. The share of these households declined from 13.4 percent in 2016 to 12.8 percent in 2022.

This does not tally with a property-owning democracy being replaced by a rent-paying one.

Indeed, related findings from the census indicate that we need more rental dwellings not fewer. On Census night 2022, 33 percent of 25 to 29 year-olds were enumerated at their parents’ house. The equivalent figure from 2011 was 24 percent.

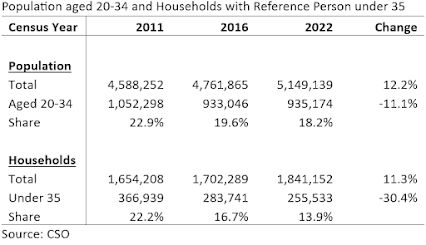

If the share of 18 to 35 year-olds living with their parents had stayed at the level it was in 2011, then almost 100,000 more young adults would have left the family home. The number of households with a reference person aged under 35 declined from 367,000 in 2011 to 255,000 in 2022.

Part of this is demographics and aging, but a lot of it is due to the shortage of housing. The share of the population aged 20 to 34 has declined from 23 percent to 18 percent. However, the share of households with a reference person under 35 has declined from 22 percent to 14 percent. If the share of households had just tracked population change there would be 70,000 more households with a reference person aged under 35.

If we were to crudely apply the actual tenure status rates from Census 2011 for the under 35s, then these additional 70,000 households would be split as 35,000 private rentals, 25,000 owner-occupiers and 10,000 social rentals or occupied free of rent. However, the extra 100,000 still living at home are not the same as those living independently.

Most people when they leave the family home go initially to rental accommodation. Some of those still in the family home may be looking to buy, but most would choose to rent if reasonable options were available. Ireland needs more of all types of housing but options for renters are far more restrictive then they are for buyers.

The very large increase in the number of young adults still living at home can be addressed by providing more rental accommodation for these people to move out to. At a point in time, private renting is a legitimate form of tenure status and is no less deserving of being provided for. However, almost all commentary and pretty much all policy is aimed at owner-occupiers. Units provided for renters are considered a "home lost".

As the opening table of the post shows, since 2016 there has been an 48,500 increase in the number of households headed by an Irish or UK national who are owner-occupiers. Over the same period the number of such households who are renting privately increased by 360.

For every one additional household headed by an Irish or UK national who became a private renter, 135 became owner-occupiers.

In the inter-censal period, April 2016 to March 2022, separate CSO figures show that there were 79,500 market transactions by first-time buyers. On an annual basis these are currently running at 17,500 per 12-month period.

If we look at the homeownership rates derived from the census we can see the decline in recent decades. However, most of this decline took place in the first decade of this century.

From Census 2002 to Census 2011 the homeownership rate declined from 80 percent to 71 percent. From Census 2011 to Census 2022 the decline levelled out considerably with a further fall to 69 percent.

Part of the reason the decline is moderating is because people are staying in owner-occupied houses for longer – their parents’ houses. With more options, people could get out of the family home and set up their own one-person or two-person households – in suitable rental accommodation. They could then look to join the buying brigade down the line.

Just how upside down things have got can be see by these two recent postings on Daft.ie:

- https://www.daft.ie/for-sale/apartment-apartment-12-the-mall-maryborough-woods-douglas-co-cork/5664846

- https://www.daft.ie/for-rent/apartment-apartment-10-millbrook-carrigaline-road-douglas-co-cork/5644412

These two 2-bed apartments are a short distance from each other in the Douglas area of Cork city. The property for sale is listed at €275,000. The property for rent is listed at €2,200 per month.

At an interest rate of five percent, over 20 years, the monthly repayment on a mortgage of €240,000 would be €1,600 per month. That’s €600 a month to help cover the additional costs of being an owner-occupier, though obviously without the flexibility of being able to move easier.

If the sale and letting were to happen at the advertised prices it would give a price-to-rent ratio of just over ten. By international and recent historical standards in Ireland this is low. Remember this?

Again, something does not feel right. Then it was prices that were far too high; now it is rents.

There is lots of evidence that the squeeze is most acute in the private rental sector. As shown in an earlier post here are the housing-cost overburden rates for renters and mortgagors across the OECD.

And this only reflects those who are actually in rented accommodation.

To repeat what we saw at the start. Since Census 2016, there are an extra 83,300 households headed by an Irish or UK national. Of these, the increase can be split as:

- 48,500 owner-occupiers

- 20,700 social housing tenants

- 3,600 occupied free of rent, and

- 360 private renting

with a 10,000 increase in the number of “not stated”. If a ratio of 135:1 is the natural order of things, then fine, but it seems more than a little extreme and is just going to result in more young adults having to stay at home for longer.

Tweet

No comments:

Post a Comment