The last post went a bit heavy on the detail in the household sector accounts. Here we try and pull out a few snapshots from the accounts that give visual pointers to the aggregate improvements over the past few years. All the data here is nominal and is for the household sector combined with non-profit institutions serving household but the impact of these on the aggregates is relatively minor and they have almost no impact on the trends.

We’ll start with income and consumption and we have series for these that are showing steady growth for the past few years (with the series also having been extended back to 1995).

Which combined give the following gross savings rate:

Since 1995 this has averaged 8 per cent so the 2016 level is about a percentage point below that.

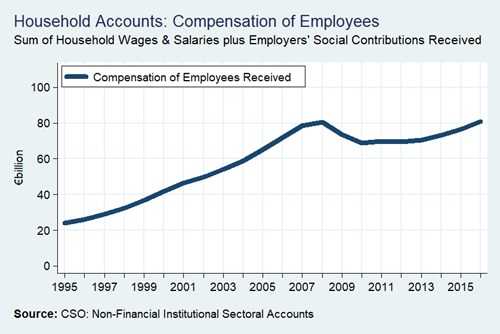

The increase in income has largely been driven by a rise in the compensation of employees received by the household sector which, in nominal aggregate terms, is back to the pre-crisis peak.

Though tax and social contributions are now higher than they were pre-crisis:

And, of course, rents are increasing. The aggregate amount of actual rentals paid for housing exceeded €4 billion for the first time in 2016.

It is from a very low base (compared to pre-crisis levels at any rate) but household sector capital formation is beginning to pick up:

After a number of years where household spending (consumption plus capital formation) was less than total household income, the household sector has returned to being a net borrower in the past few years though no where near the levels that were seen pre-crisis.

This pattern is reflected in household financial transactions with household transactions increasing both assets and liabilities up to 2008 and reducing them since.

By and large net financial transactions from the financial transactions account and net (borrowing)/lending from the capital account track each other:

Here is the impact of these transactions on household deposits and loan liabilities:

After peaking at €203 billion in 2008, household loan liabilities have been steadily declining since then and had reduced to €143 billion by the end of 2016. Household deposits have been relatively stable for the past decade but what is noticeable is that the level of household deposits almost matches the level of household loans for the fist time since 2002 – though these aggregate data tell is nothing about the distribution of these assets and liabilities.

Add in the impact of other financial assets and liabilities and we get the overall balance sheet position:

The divergence of financial assets (rising) and financial liabilities (falling) since 2008 is clear. This has meant that the household net financial asset position has been increasing and stood at €210 billion at the end of 2016. This compares to €130 billion at the end of 2006.

Finally, here is a measure of debt to income:

This ratio of total financial liabilities to total disposable income has fallen from 220 per cent in 2011 to 160 per cent in 2016 and is now back near levels last seen in 2004. The progress is understandably slow but we’re getting there.

Tweet

No comments:

Post a Comment