The previous post looked at some developments in the household sector in the Q3 release of the Institutional Sector Accounts. There we concluded that the pattern of employee compensation received by the household sector was now more plausible but there seem to be unusally large increases in mixed income (+22%) and net property income (+55%).

Here we will look briefly at the corporate sector which is divided into Financial and Non-Financial. First the table. Click to enlarge.

What are the take-out points? First we can see in line 7 that the increase in Corporation Tax receipts is reflected in the account. In line with the Exchequer Statements there is an increase of more than 40 per cent in the first three quarters of 2015 compared to 2014.

There has been a lot of debate about this increase with the Department of Finance attributing it to “improved trading conditions”. We see some evidence of that here. Gross Operating Surplus (line 4) is up 19 per cent year-on-year. Gross Operating Surplus is akin to earnings before income, tax, depreciation and amortisation (EBITDA) which in turn is a relation of taxable income.

But how do we reconcile a near 45 per cent increase in tax payments with a 19 per cent rise in operating surplus? What profits are the companies paying extra taxes on?

The increased taxes could be due to non-trading factors such as the exhaustion of previous losses carried forward or the taxation of capital gains rather than trading profits. Based on a letter from the Chairman of the Revenue Commissioners to the Minister for Finance we can rule out capital gains (as almost all of the surplus is expected to be repeated this year) but the increase in Corporation Tax seems too large to be explained by the exhaustion of previous losses (even with a 20 per cent rise in operating surplus).

A second issue is one that is in the detail behind the above table. Line 5 gives net property income. For the non-financial sector this is dominated by the outflow of profits earned by foreign-owned MNCs with operations in Ireland. But the figure above is net and the constituent elements are worth looking at. Again click to enlarge.

It can be seen that the net figure results when property income received is offset with property income paid. In the first three quarters of 2014 the NFC sector in Ireland received €10 billion of property income and in the first three quarters of 2015 this increased to €11.5 billion. Almost all of this is re-invested earnings on direct foreign investment, i.e. it is profits earned abroad by “Irish” companies.

This is counted as an outflow from the countries where the profits are earned (just as MNC profits are usually counted as an outflow here) and is counted as an inflow to Ireland. As the money remains reinvested abroad it will be counted as an outflow in the financial account so the net overall effect is nil. This money never comes to Ireland but for ownership purposes is counted as an inflow of profits (income) and an outflow of investment (FDI).

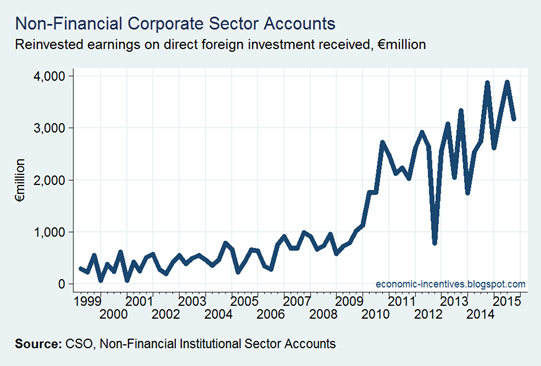

The pattern of these reinvested earnings paid to the Irish NFC sector are worth recalling.

We know what has caused this – redomiciled PLCs with inversions from the US likely to play an even greater role in furture time periods.

What do we get from this “inflow” to Ireland? Very little. It is unlikely that the companies are paying any additional Corporation Tax to Ireland on these profits. As stated above the money never passes through Ireland. It is retained profits earned abroad that stays abroad. If the companies ever decide to distribute these profits as a dividend then it will count as an outflow from Ireland (assuming the shareholders are non-resident) but that is unlikely to happen as companies do retain substantial profits for reinvestment.

Is there a cost to Ireland of this? Yes, there is. These “inflows” are counted as part of our Gross National Income. In a sense because of these redomciled PLCs the GDP-GNP gap is smaller than it otherswise would be. [This income also makes the current account of the Balance of Payments appear better.] Is there anything set based on GNI? Yes, contributions to the EU. We are paying more because of these profits.

Tweet

"If the companies ever decide to distribute these profits as a dividend then it will count as an outflow from Ireland (assuming the shareholders are non-resident) but that is unlikely to happen as companies do retain substantial profits for reinvestment."

ReplyDeleteI am not sure that this is the case. The (flow) transaction is recorded in the relevant quarter according to the classification of the entity at that point in time.

Any repatriation of profits would be a (stock) reclassification and would not appear in the BoP (although may appear in NIIP).

You could be right. The intricacies of the sector accounts are many. But maybe I didn't make a clear enough distinction between the Irish HQs of these re-domiciled PLCs and their foreign subsidiaries.

DeleteDividends paid to shareholders is a separate transaction to retained earnings received from subsidiaries. It is true that if the foreign subsidiaries of these companies repatriate the profits to their Irish parent it will not feature in the non-financial accounts as it has already been accounted for through retained earnings. But if the Irish parents were to pay increased dividends at some stage based on these profits it will count as an outflow from the Irish NFC sector and income for some other sector in the accounts (more than likely the Rest of the World sector).

Thus the over-statement of GNI now could be offset in the future if these companies were to distribute these profits to their shareholders. Though that is almost certainly not going to happen.