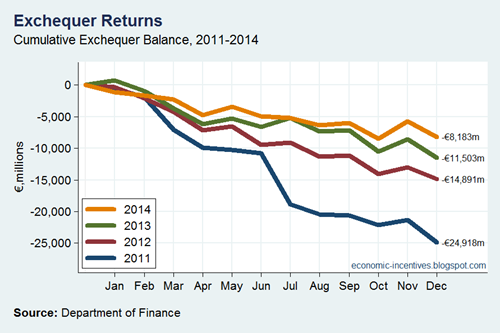

Figures from the Exchequer Statements show that the Exchequer Balance has improved in each of the past four years.

However, for the years to 2013 this was because of improvements in “one-off” items in the capital account: large recapitalisation payments in 2011 moving to some (much smaller) asset sale receipts in 2013.

Last year, however, marked the first year where there was a clear improvement in the current account. These are the regular and ongoing receipts and expenditures from the Exchequer Account.

We will have to move to a current account surplus but there was little or no progress on that until 2014. And most of this was achieved through higher tax revenues.

Since 2011, tax revenues have increased by around €7 billion. Over the same period the Exchequer Current Deficit has improved by €6 billion. There is still a bit to go (and early indications that the improvement has continued in 2015).

It should be noted that the Exchequer Account has become much more dependent on Non-Tax Revenue in the Current Account.

The composition of non-tax revenue is looked at here but it can be seen that it is now more than €2 billion greater than the pre-crisis levels seen in 2007. A lot of this is down to banking support measures (central bank surplus, contingent notes interest, guarantee fees) and cannot be expected to last indefinitely. These revenues will have to be replaced.

On the expenditure side, here’s a chart of net voted current expenditure.

On aggregate there doesn’t appear to be a lot happening there but voted current expenditure has been reduced from €41.4 billion in 2011 to €39.0 billion in 2014.

Offsetting this there have been increase in non-voted current expenditure – the main component of which is servicing the national debt.

Debt interest expenditure rose rapidly in the years to 2013. There was only a small rise in 2014 and the continuing low-interest environment allowing the refinancing of some debt at lower rates (such as the IMF loans) means that it is likely that debt interest expenditure will fall (but not by much) over the next few years.

By far the greatest change in the Exchequer Account during the crisis has been the huge scaling back of voted capital expenditure. Since its peak in 2008 voted capital expenditure has been cut by more than 60 per cent.

Tweet

No comments:

Post a Comment