The issue of effective rates for corporate income tax is getting some attention at the moment. Suggestions that the effective rate for Ireland is around 11 per cent are generating the expected responses.

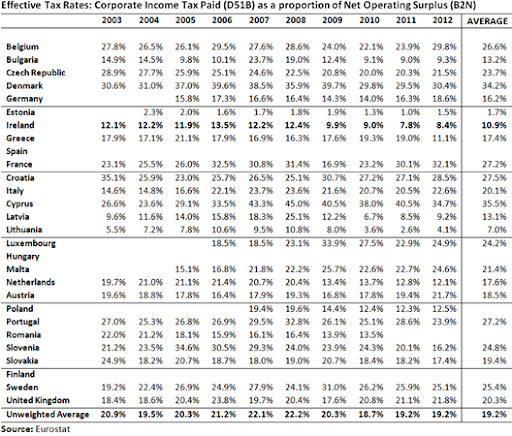

One of the measures of the effective tax rate proposed is corporate income tax paid (D51B) as a proportion of the Net Operating Surplus (B2N) of non-financial corporations (S11) and financial corporations (S12).

A further question is how this compares relative to the equivalent rate for other EU countries. Here are the answers, where available, for the EU28. Click to enlarge.

The Irish figure is again 10.9 per cent, which can clearly seen to be ‘low’ relative to the un-weighted EU28 average of 19.2 per cent. And this of course is deliberately and transparently so. At 12.5 per cent Ireland has one of the lowest headline rates for corporation tax in the EU. There is nothing hidden or secret about that.

Only two countries have an average annual rate lower than Ireland: Estonia (1.7 per cent) and Lithuania (7.0 per cent). Latvia (13.1 per cent) and Bulgaria (13.2 per cent) have the next lowest rates above Ireland’s.

There are probably lots of important details that need to be understood when interpreting the above table (the rate for Germany seems unexpectedly low) and people can make of it what they wish. From an Irish perspective it can simply be noted that the Eurostat data show a figure of 10.9 per cent.

Tweet

No comments:

Post a Comment