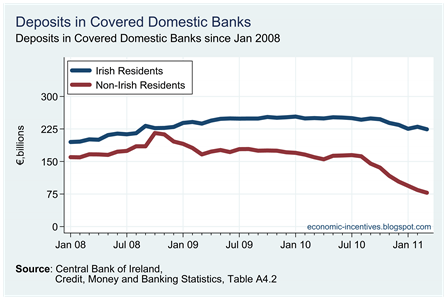

Here is a pretty startling graph. It shows the liabilities of the six covered banks broken into three groups.

- Irish residents

- Non-Irish residents

- The ECB

The patterns are pretty self evident. The liabilities for the Irish and non-Irish residents are made up of four categories. The numbers in this table give the change in each liability since the month of the blanket guarantee (September 2008)

Since the guarantee was introduced Irish resident exposure to the covered banks has increased by almost €110 billion. Most of this has been through the ELA offered by the Central Bank of Ireland. At the same time non-Irish resident exposure to the banks has fallen by almost €170 billion which huge drops in deposits and bondholdings by non-residents in the bank.

The other player in all this, the ECB, has seen it exposure increase €14 billion in August 2008 to almost €80 billion now. The drop in deposits and bonds from non-residents is the reason the banks have needed almost €150 billion of central bank funding.

In the immediate aftermath of the guarantee non-resident lending to Irish banks surged and rose by over €25 billion to €310 billion in November 2008. This enthusiasm was short-lived and over the next few months non-resident lending to Irish banks dropped around €60 billion by March 2009. It then remained steady at around €250 billion until August 2010 when the original blanket guarantee expired.

Since then it has dropped at a remarkable rate and is now down to €117 billion. The total drop since November 2008 is almost €200 billion. It does appear that this is being isolated as very much an Irish problem.

Here are graphs for the above liabilities. Every non-resident apart from the ECB is getting out.

Tweet

No comments:

Post a Comment