With the domestic economy in continued freefall, the positive growth recorded for Q3 2010 in the Quarterly National Accounts published before Christmas was entirely due to the performance of the trade sector. We are now following an “export-led growth strategy” and our exports are being described as ‘strong’, ‘robust’ or ‘resilient’.

Indeed, the balance of trade in the Q3 National Accounts reached a record level.

However, the increase in the Balance of Trade seen in 2008 and 2009 was not down to a surge in exports, but rather a collapse in imports. It is only in 2010 that exports resumed an upward trajectory.

As we can see even though exports were falling in 2008 and 2009 the net export position was improving because imports were falling even faster. It is the poorer performance of imports relative to exports, rather than a standalone increase in exports that has given the slight positive sheen to our growth figures. So as with our export performance, it is worth looking at our import performance in a little more detail.

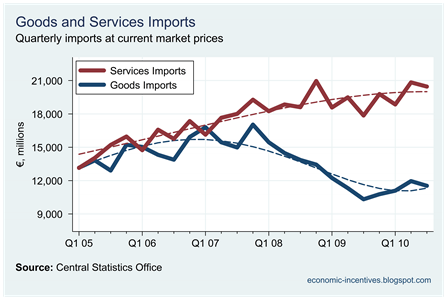

In the National Accounts Quarterly the CSO provide a breakdown of imports by goods and services.

Quite clearly the drop in Irish imports has been on the goods side rather than in services. This pattern of service imports is confirmed if we look at the equivalent figures from the Balance of Payments from which the National Accounts draw (graph here), with Royalty/License imports the fastest growing category.

But this doesn’t tell us why imports are falling. To get a deeper understanding of the reasons for the fall in goods imports we can turn to the monthly External Trade statistics also provided by the CSO. Here are the seasonally adjusted monthly merchandise imports since 2005.

What is of more interest, though is the type of goods we have stopped importing. Imports can be generally divided into imports of goods for consumption and imports of intermediate or capital goods for production. The patterns of these are rather revealing.

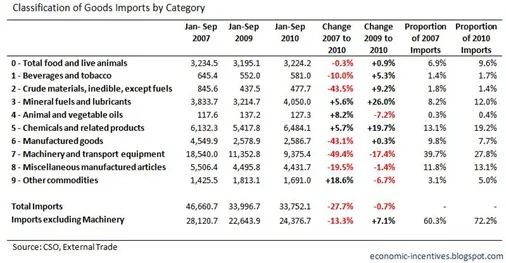

It is clear that the category showing the biggest drop is the imports of production materials. The decline in the import of consumption goods has been far less pronounced. Here same data in tabular form. Click table to enlarge.

Imports of production materials are nearly one-third on their 2007 levels. Although the monthly series of production capital goods is a little more erratic we can see from the table that these imports are down a similar amount. These are not good trends and although production material imports have risen very slightly in 2010, production capital goods imports have continued to fall.

The Quarterly National Accounts reveal that consumption expenditure for the first three quarters of 2010 is about 12% below the equivalent figure from 2007. This ties in with the 14% drop seen in the imports of consumption goods. It is noteworthy that imports of consumption goods in 2010 to September are running 6.7% ahead of the 2009 level. Consumption goods now make up close to 32% of Ireland’s merchandise imports.

With the above External Trade figures revealing that consumption imports have risen in 2010 and Retail Sales figures showing the retail expenditure is lower than last year, it appears that the bite of the continuing falls in consumption expenditure is hurting domestic producers more.

It is not a good sign when an economy’s “growth” figure is driven by a drop in this category. The following table provides details of the ten main NACE categories provided by the CSO for the January to September period for the years 2007, 2009 and 2010. Click table to enlarge.

From the peak in 2007, goods imports for the first nine months of the year, have fallen by nearly €13 billion or 27.7%. Of this fall, more than €9 billion is accounted for by the near 50% drop in machinery and transport equipment imports. No category has shown a larger percentage decrease. This category made up 39.7% of total merchandise imports in 2007 but by 2010 this proportion was down to 27.8%.

Here are the sub-categories that make up the Machinery and Transport Equipment group.

Since 2007 there have been substantial drops in specialised machinery (-61%), general machinery (-45%), office machines and computers (-71%) and electrical machinery (-35%). All of these categories have continued to fall in 2010.

It is possible that the huge drop in the import of Office Machines and Computers is linked to the comparable drop of exports in the same category. We may have been importing intermediate materials and exporting the finished products. There may be an associated drop in employment (Dell?) with this drop in imports. Remember this the next time someone tells you imports are ‘bad’ for the economy.

Imports of road vehicles are down more than two-thirds of the 2007 peak but in line with the new car sales figures they did exhibit a rebound in 2010. This is the only significant sub-category in this group to show growth in 2010.

Outside of the substantial drops in the sub-categories of Machinery and Transport Equipment shown above the sub-category with the next largest drop since 2007 is NACE 67 – Iron and Steel which has fallen 60% ( from imports of €819 million in the first nine months of 2008 to only €325 million in 2010). This is likely linked to the collapse of the construction sector.

The sub-category with the best growth since 2007 is NACE 54 – Pharmaceutical and Medical Products, which is up 40% (from imports of €1,830 million in 2007 to €2,559 million in 2010). This is also our best export category but there is a huge disjoint between imports and exports. See graph here. There is no merchandise imports category that can account for the huge increase in medical and pharmaceutical exports since 2007 but it may be linked to increase in service imports payments on patent royalties shown above as the biggest cost of a pharmaceutical product is the research (which is not undertaken in Ireland).

The poor import performance, and in particular the very poor merchandise import performance, since 2007 might be having a positive effect on Ireland’s growth arithmetic, but the outlook for the economy cannot be positive as long as production materials are the main cause of the fall in imports. An “export-led growth strategy” might provide the numbers that give the appearance of growth but unless this is converted in job growth there will be no real improvement in the economy. The spin-doctors might be crowing about our export performance but is equally as likely (maybe more so) that increases in our imports are what we actually need.

Tweet

Seamus, this is a very interesting post. There are just a couple of comments I would make.

ReplyDelete1) There has been a substantial increase in the level of customs duties paid this year to the Irish Exchequer. While there has been no increase in the consumption of products here (the opposite is true), this would seem to suggest that some of the imports are just being washed through Ireland through as the first point of entry into the EU.

2)In relation to R & D, there is a basis on which reasonably accurate analysis could be made in relation to the level of say pharma R & D actually done in Ireland and that is from the Revenue Commissioners. Have the Commissioners ever published an analysis of R & D claims and costs? As the Revenue uses the NACE codes it should be in a position to provide figures up to 2009.

Again a very interesting post and analysis.

ReplyDeletere Consumption goods now make up close to 32% of Ireland’s merchandise imports.

I estimate from the graph that is about €11 billion. It seems that there is still a lot of scope for home production based on import substitution.

Hi Niall,

ReplyDelete1) I don't think the increase in Customs Duty is that substantial. It went from €208 million in 2009 to €228 million in 2010 - an increase of just 9.6%. This extra €20 million could just reflect a different mix of imports in 2010 rather any "washing through" effect.

2) I don't know the answer to this, but it would be interesting ti find out. I would guess that our so-called 'smart economy' does not engage in much R&D.

Royalties/License Imports to Q3 2010: €21,119mln

Royalties/License Exports to Q3 2010: €958mln

Hi Tumbrel,

ReplyDeleteThe import of goods for consumption in the first nine months of 2010 was €10,735 million (see the first table in the post). It is hard to know how much of could be substituted by domestic production.

Imports of fuel and oil were close to €4 billion (though obviously not all of this was not private consumption). Road vehicle imports were just over €1 billion. We do import about €3 billion of food but it is unlikely that all of that could be produced here.

Imports of clothing and footwear came to another €1.5 billion and our indigenous clothing industry has all but vanished.

Imports of consumption goods for the first nine months of the year peaked at €12.5 billion in 2007. For 2010 they were down about 15% to €10.7 billion. Some of this could be due to subsitution to domestic products but I would guess that a large part of it was simply consumption delayed or cancelled.