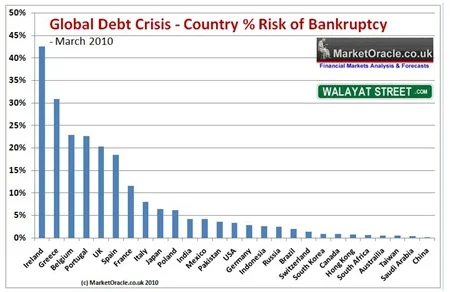

Nadeem Walayat writing on www.marketoracle.co.uk is definitely one commentator who does not believe in us. In fact he thinks we are worse than Greece. Here’s an extract from the piece and the graph he uses to highlight his point.

The following graph attempts to paint an accurate picture of the current relative state of the trend towards bankruptcy of the worlds major economies which takes into account public and private debt, unfunded liabilities, budget deficits, and debt denominated in foreign currencies, as well as taking into account the historic track record of the countries in dealing with past debt crisis. The results are shown as a % of the countries risk of going bankrupt where Iceland would be at 100% following its defacto debt default.

Whilst the mainstream press these past two months has been obsessed with the Greek debt crisis, the above graph clearly illustrates that a far larger debt crisis looms in Ireland that could soon transplant Greece in the debt crisis headlines over the coming months, similarly a number of other Euro Zone countries head the risk towards bankruptcy league table with Belgium and Portugal not far behind Greece. The price that these countries pay for being stuck in the Euro single currency is that they cannot devalue to try and gain some competitive advantage for their economies and therefore try and grow and inflate their way out of a high debt burden that stifles economic activity.

I am a little unsure as to what the vertical axis of the graph actually means. He seems to have created a bankruptcy measure based on a number of factors (public and private debt, budget deficits, etc.) and then indexed it so that Iceland represents 100%, as they have defaulted, and all other countries are scored relative to that.

Whatever the methodology, and it appears questionable, we have the worst score. It is likely we will see more analysis like this produced on Ireland.

Tweet

No comments:

Post a Comment