The release yesterday by Eurostat of some tax revenue statistics rekindles the debate of whether Ireland is/is not a “low-tax economy”. With receipts of 28.9% of GDP (35.4% of GNP) Ireland is below both the EU27 (38.8% of GDP) and EA17 (39.5% of GDP) weighted averages. One tax that attracts attention is the Corporate Income Tax.

At 12.5%, Ireland has the third-lowest headline rate of Corporate Income Tax in the EU. Only Bulgaria and Cyprus are lower (and as part of the recently negotiated “rescue” programme Cyprus has committed to raising its rate to 12.5% leaving only Bulgaria at 10%).

This clearly supports the “low-tax” hypothesis. But looking at Corporate Tax revenues as a percent of GDP paints a somewhat different picture.

The presence of countries with large financial sectors relative to the GDP is notable. But the fourth member of that group is not at the top with them.

Using this approach Ireland is pretty much an average taxer of corporate income. So which is it? Both sides in the “low-tax” debate can provide support for their position.

One determinant of the latter ranking is obviously the amount of corporate income in the country. A graph from an earlier post gave the Gross Operating Surplus of the Corporate Sector as a proportion of GDP.

Relative to GDP there is more corporate income to tax in Ireland than in all but one EU country. Even with a low rate this alone could push Ireland into mid-table in the previous chart.

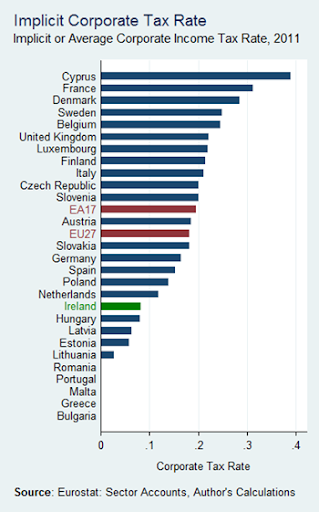

With this in mind we can calculate a crude ‘implicit tax rate’. This is akin to an average effective tax rate. In the chart below it is simply Corporate Income Tax Paid divided by the sum of Net Operating Surplus and Net Mixed Income. The 2011 figures are missing for five countries (Bulgaria, Greece, Malta, Portugal and Romania ) but the remaining data produces the following chart, where the EU27 and EA17 are simply the unweighted arithmetic averages.

The missing countries are unlikely to alter the result. Here it can be seen that Ireland is a “low-tax” country on corporate income. The implicit rate in France is almost four times greater, which may go some way to explaining the pressure applied to have the Irish headline rate changed as part of the rescheduling of Ireland’s loans from the EU in the summer of 2011. The other half of the “Double Irish” – the Dutch Sandwich – shows up with the Netherlands also being a low-tax country for corporate income.

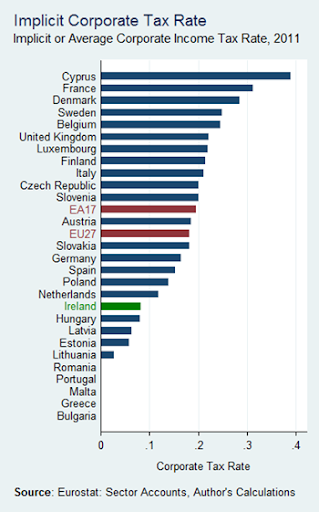

The position of Cyprus seems incongruous. It has (for the time being) the joint-lowest headline rate of corporation tax in the EU but has the highest implicit rate. This is confirmed by the implicit rate calculated by Eurostat (see Table 86 on page 257 (pdf page 259) which is reproduced below).

The above implicit rates are different to Eurostat’s because missing data mean Ireland is excluded from the Eurostat table but the relative ranking is generally the same for the countries included in both. The difference is mainly due to the treatment of dividends with dividends paid excluded from the calculation of corporate income (dividends are included in the tax base for the corporate income tax but it is done on a withholding basis). The methodology used by Eurostat and their results for the implicit corporate income tax rate are below the fold.