The Department of Finance have released the exchequer figures for May. We were

upbeat about the April figures, but that optimism has been quickly quelled. The relevant documents are

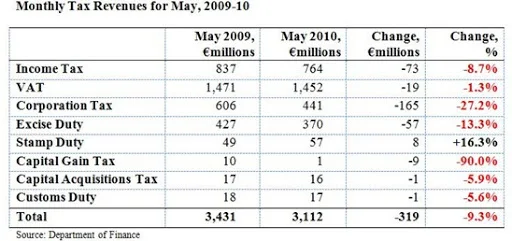

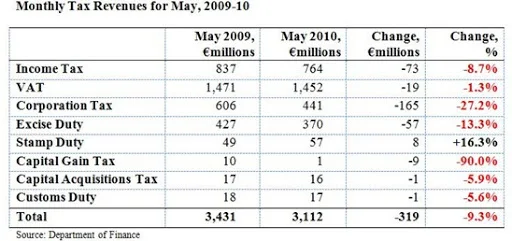

While tax revenues in January and February were almost 18% behind the previous year, the annual drop eased in both March and April. This improvement stopped in May. Tax revenue is now 10.4% behind the tax collected to May last year.

All taxes except CAT are behind last year’s revenues. Excise duties had been performing well up to April, but Excise revenues in May were 13.3% below the same month last year, and now Excise Duty for the year is almost 3% below the amount collected by the same time last year.

In April we noted that the monthly tax take was up 11.5% on the same month in 2009. This positive sign has proven to be a once off. May’s tax revenue of €3.1 billion was over €300 million or nearly 10% below the equivalent from last year. The good news seen in April has quickly been reversed.

Of the eight tax headings the year-on-year comparison to May of last year is negative for seven of the eight headings. The only tax head showing any improvement is, the now relatively unimportant, Stamp Duty. This is the reverse of April, when seven of the tax heads were ahead of the April 2009 outturn. The poor performance of Income Tax, in spite of higher Income Levy rates, is worrying.

Performance relative to Department forecasts for May was also poor and revenue for the month was 4.3% below target. The Department’s forecasts for individual taxes can be seen

here. Tax revenue is now 1.2% behind the Budget forecast as can be seen

here.

For those who prefer a visual representation of the figures here are some graphs that show the pattern to tax revenues for the past three years. First, here’s total tax revenue. The red line showing 2010 tax revenues continues to slip below the green line showing 2009’s dismal tax revenue.

Here are the same graphs for the individual tax headings.

Finally, here is a table that looks at the relative importance of the individual tax headings to total tax revenue.

We can see that Income Tax and VAT are becoming an ever greater proportion of total tax revenue making up 75% of 2010 revenue to date. At the same time in 2006 Income Tax and VAT comprised 63% of total tax revenue. The importance of Excise Duty has remained relatively constant at around 14% of tax revenues.

Corporation Tax shows a slight decline but the biggest drops can be seen in the property related taxes. The contribution of Stamp Duty and CGT has fallen from 13% in 2006 to only 3% this year.

Tweet

Tweet