The understanding we have of Ireland’s massive mortgage arrears problem remains scant. Many reasons have been put forward for the continued growth in arrears: unemployment, income decreases, negative equity, regulatory response, lack of repossessions and something called “strategic default”.

Up to recently actual evidence on any of these was absent but this is slowly improving. In some recent speeches Governor of the Central Bank, Prof. Patrick Honohan has focussed on the role of income in explaining the very high level of mortgage default. Recently he has said:

“Examination of the Standard Financial Statement (SFS) returns of defaulting borrowers in Ireland has shown that, indeed, monthly amounts due on the original monthly schedule represent a remarkably small portion of current monthly income, for a relatively high fraction of borrowers.”

And back in May he stated:

“The decline in after tax incomes for most employees has been significant, but aggregate data suggest that in the bulk of cases this decline is not so large as to make the continued servicing of debts impossible. Unless the household was already over-borrowed, a relatively moderate adjustment of spending patterns in response to lower income would allow the average household to remain on track.”

The Central Bank will be formally publishing the results from this research over the coming months. Here is a table extracted from Eurostat’s results from the Survey of Income and Living Conditions. It is a measure of housing cost overburden for owners with a mortgage and tenants renting at the market rate:

Around one-fifth of tenants renting at the market rate face a housing cost that is greater then 40% of their disposable income. For occupiers with a mortgage that rate is 3.3%.

The rate for mortgagors is, in proportionate terms, a large increase on the rates of 1.5% and lower that were the case from 2005 to 2007. However, the increase does not seem sufficiently large to explain why 12.7% of mortgage accounts are now 90 days or more in arrears.

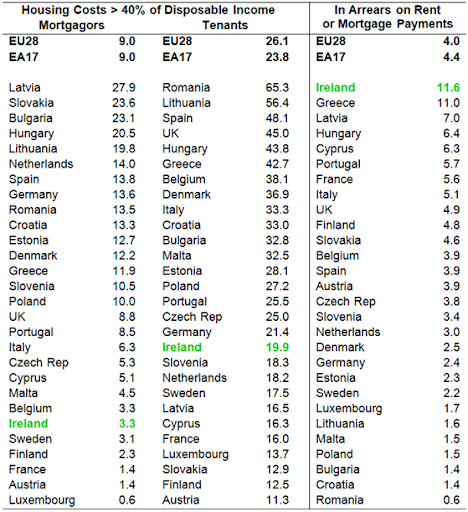

Here is a table that compares gives the comparable housing cost overburdens in EU member states and also provides the proportion of households in each country who are in arrears for either rent or mortgage payments. Again the data are taken from the EU-SILC. The numbers in the first two columns represent the percentage of households within each category; the final column is the percentage of all households.

The first two columns seem to indicate that it is something other than payment to income that explains Ireland’s position at the top of the third column. The proportion of households in Ireland in arrears on rent or mortgage payments is almost three times the EU average and is more than twice the rate it is in all EU countries bar four.

The position of Ireland so low down the first column seems unusual. How can so few mortgaged households face a housing cost of more than 40% of disposable income? This is down to the definition of housing costs used in the survey. From this Eurostat publication we can see that it is:

Housing costs include mortgage or housing loans interest payments for owners and rent payments for tenants. Utilities (water, electricity, gas and heating) and any costs related to regular maintenance and structural insurance are likewise included.

Capital repayments on mortgages are excluded as these are considered a form of saving. Lots of Irish mortgagors may have what appear to be low housing costs because of cheap ‘tracker’ mortgages but they face huge capital payments on an asset that has lost around 50% of its value. It might be saving in the strictest sense of the word but it would not feel like it to households in deep negative equity.

The proportion of households by country in each category is given in a table below the fold. This explains why Romania is at the top of the second column and can then end up at the bottom of the third (96% of households are owner-occupiers with no mortgage).

Tweet

No comments:

Post a Comment