Today’s International Investment Position and External Debt release from the CSO shows that Ireland’s net external debt (excluding the impact of the IFSC) has fallen to just €23 billion from €180 billion at the start of 2012.

This would be a remarkable improvement if it was true but as with lots of aggregate statistics on the Irish economy it is true, sort of.

The first issue that needs a second glance is our gross external debt. This actually rose €60 billion in the year to Q2 2015 before falling back slightly in Q3. Here is the sectoral breakdown of our gross external debt (again excluding the impact of the IFSC as all the charts here will).

Some components of our gross external debt are coming down in particular through the monetary authority (central bank) and, to a lesser exent, monetary financial institutions. Both of these are functions of the deleveraging of the domestic banking system.

The sector going in the other direction is direct investment debt, the vast majority of which is likely originating from multinationals – both MNCs which have subsidiaries here and MNCs which have re-domiciled here.

This FDI effect is equally seen if we look at external assets in debt instruments with those associated with direct investment increasing very rapidly over the past two and half years.

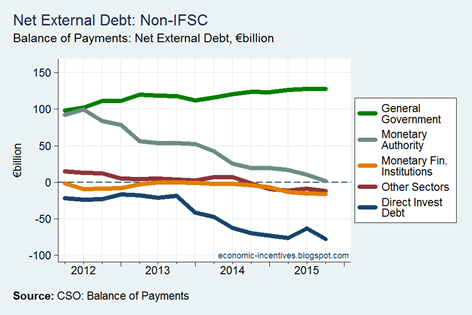

If we subtract the external assets in debt instruments from the gross external debt we can get the net external debt to see to contribution of each sector to the aggregate totals in the first chart above.

This shows that three of the five sectors have net external debt positions of around zero. The central bank has rapidly moved there while the banks and other sectors (financial intermediaries, pension funds etc.) have moved into small creditor positions (they are owed more debt from the rest of the world than they owe).

The two diverging sectors are the government sector (which borrowed hugely from abroad between 2009 and 2012) and the debt associated with direct investment. We can see that there are far more external assets in debt instruments than there are gross external debt liabilities linked to direct investment. This means companies here are owed much more from abroad than they owe externally themselves. Again this is likely to be an MNC effect.

The impact of this is that our gross external debt is likely to be overstated (because many of the debt liabilities owed from Ireland originate from MNCs) and our net external debt is likely to be understated (because there is an even greater amount of external debt owed to MNC subsidiaries or headquarters in Ireland).

So if we strip out FDI from the first chart we get the following:

This probably better reflects our position. There still is improvement with both the gross and net external debt figures falling over the past four years. Excluding direct investment (and the IFSC, of course) Ireland’s net external debt is €101 billion – with by far the largest contributor (only?) to that being the government sector.

Yes, this is a higher figure than the €23 billion figure we started with above but it probably isn’t too bad all things considering. As a percentage of GDP it comes in at under 50 per cent – not exactly a headline grabbing number.

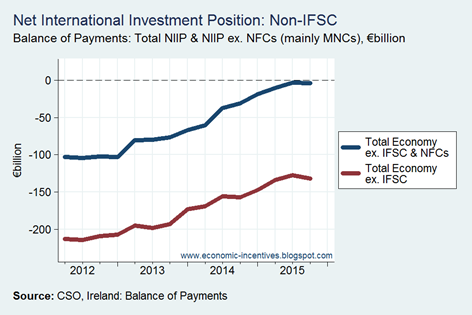

And if we look at the broader net international investment position of all financial assets we can see where this improvement has gotten us (with a negative figure indicating a net liability position).

It won’t be long before the explanation will be that a positive figure indicates a net asset position. In fact, if we look at the sectoral positions we can see the components of the overall net position.

So if our pension funds (a large part of financial intermediaries) can earn more on their investments abroad than the government pays out in external interest costs we may even be able to turn a bob or bob from all this.

Tweet

No comments:

Post a Comment