Back in April the Department of Finance published the 2013 Stability Programme Update. In it the projected general government deficit for 2014 was 4.4% of GDP. This assumed a package of adjustments of €3.1 billion in the Budget.

Yesterday a package of €2.5 billion of expenditure cuts and tax increases was announced but because of measures put in place earlier in the year (mainly the Haddington Road Agreement) the amount of adjustment for 2014 remains at €3.1 billion. The Economic and Fiscal Outlook (bottom of page 13) says:

Tax and expenditure consolidation measures of €2.5 billion are complemented with additional resources and savings of some €600 million, giving a total adjustment package of €3.1 billion.

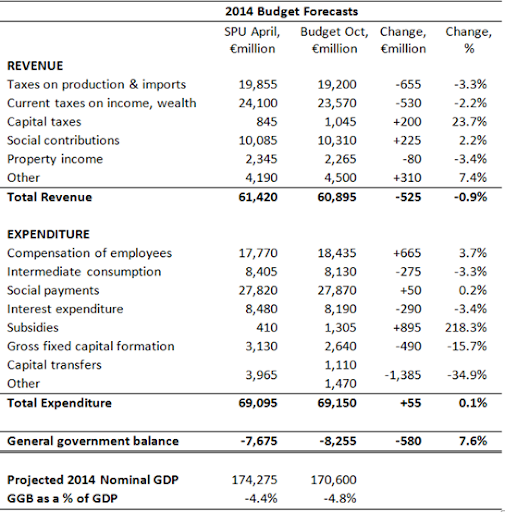

So if the level of adjustment is the same why is it that the projections issued with yesterday’s budget are for a 2014 deficit of 4.8% of GDP. A comparison of the April and October figures may provide some insight into where the deterioration comes from.

It is pretty clear why the projected deficit is higher: revenue for 2014 is now expected to be around 1% lower compared to what was set out in April. Total expenditure is virtually unchanged.

Why is the revenue figure down? It is mainly because of lower than expected receipts from Income Tax, VAT and Excise Duty. As described in the notes to the table on page 33 of the Economic and Fiscal Outlook the 2013 outturn for these is set to be around €650 million than was projected even as recently as April. These lower receipts in 2013 then have knock-on implications for the 2014 projections.

The composition of expenditure appears to have changed since the publication of the April figures but that is largely down to reclassification issues on about €1 billion of expenditure on third-level education. Free fees (€250 million) and the block grant (€350 million) have been shifted from Other Expenditure to Social Payments and Subsidies respectively, while another €300 million to universities previously under Capital Transfers has also been reclassified to Subsidies.

A notable change in the expenditure list is the increase in Compensation of Employees of €665 million. There doesn’t appear to be a reclassification item that is responsible for this. There is also a €490 million fall in the figure for GFCF, though the Exchequer Account figures actually shows a slight rise in 2014 estimate for Gross Voted Capital Expenditure (€3,230 million in the SPU to €3,335 million in the Budget). Again we may be looking at a reclassification issue but it does not appear to specified.

The Exchequer Account projections in April’s SPU and the Budget’s EFO also show that the deterioration is mainly due to a reduction in revenue forecasts. In April, Exchequer Tax Revenue for 2014 was put at €40,975 million. Yesterday a figure of €40,040 million was provided which represents a decrease of nearly €1 billion.

Why is revenue lower than expected? Mainly lower growth, and also lower inflation, than expected. A recent post covered this and the figures for nominal GDP at the bottom of the table above illustrate the problem. Back in April, NGDP for 2014 was expected to be €174.3 billion. Just six months later and the figure has been revised down to €170.6 billion.

Ireland collects the equivalent of 30% of GDP in tax revenue. It’s a bit crude, but 30% of a €3.7 billion reduction in NGDP is roughly €1 billion. And that is pretty much the reduction that has been applied to the forecast of tax revenue.

If it wasn’t for the accounting chicanery from the Promissory Note swap yesterday’s budget would have meant a 2014 deficit of around 5.4% of GDP. As the previous post concluded, excluding the largely notional Promissory Note gains (see here) “the numbers [.] suggest that more should be done if the fiscal consolidation plan is to remain “on track” not less.”

Yesterday’s Budget had the full €3.1 billion of adjustments (as confirmed by the Economic and Fiscal Outlook) and the deficit is not falling as fast as planned. Even if the 4.8% of GDP deficit targeted for 2014 is achieved there is still a significant step to be made to get it under the 3% of GDP limit in 2015 as required under the Excessive Deficit Procedure. The gamble being taken (again!) is that nominal growth will have resumed by then and will carry most of the burden. Who wants that bet?

Tweet

No comments:

Post a Comment