Friday, May 18, 2012

Will a ‘Yes’ Vote Cost €6 billion?

The last week or so have seem the claims move to faux outrage to the impact of the structural deficit rule. As per the Treaty, this will require Ireland to move to a structural deficit of no more than 0.5% of GDP over a timeframe to be agreed with the European Council.

The largest party of the ‘No’ campaign regularly claim:

Tweet

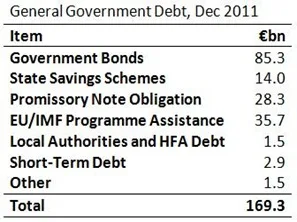

The General Government Debt

At the end of 2007, the gross general government debt was €47.2 billion. The recent Eurostat debt and deficit release showed that this has increased to €169.3 billion at the end of 2011. That is an increase of an incredible €122 billion in just four years. We can use the previous post on the general government accounts to see how that has come about.

There we saw that from 2008 to 2011 Ireland ran underlying primary deficits summing to €48.5 billion. Interest expenditure over the four years was €15.4 billion. At the same time temporary or once-off measures totalled €41.4 billion, with bank-bailout payments making up the bulk of this.

These three items sum to €105.3 billion. To get to the full €122 billion increase we must account for some stock/flow adjustments. In the main this is an increase in borrowings to build up a cash buffer. Details from the NTMA show that balances of €17.8 billion “were held

in Departmental Funds + other Accounts, including the Exchequer A/c.” at the end of 2011. At the end of 2007 these cash balances were just €4.4 billion.

Here is a summary table of the changes in the debt since 2007.

The largest single item is the €48.5 billion of primary deficits run since 2008. This is the excess of government expenditure on public sector pay, social welfare, services and investment over government revenue.

The next largest item is the €47.2 billion of debt we carried into the crisis in 2007. This debt is largely the residual of the last great crisis in the public finances from the 1980s. Data from the NTMA show that in 1994 (commonly taken as the start of Celtic Tiger Mark 1) the general government debt was €41.7 billion. It hardly changed over the next 13 years.

Temporary and once-off measures account for €41.4 billion of the increase in the general government debt. The vast majority of this is the bank payments and of that the bulk is the €30.85 billion of Promissory Notes used to recapitalisation Anglo, INBS and to a lesser extent EBS in 2010. Once-off measures (though they seem to be happening a lot) account for 34% of the increase in the debt over the past four years and 25% of the stock of debt at the end of 2011.

There is a big drop them to the final two items. Over the four years interest expenditure was €15.4 billion. In 2007, interest expenditure was €1.8 billion so if the 2007 debt and interest rates had been maintained interest would still have consumed €7.2 billion over the four years. The extra debt added about €8.2 billion of additional interest costs over the four years and the bulk of that is due to the primary deficits rather than the once-off measures. From the last post we saw that social transfers-in-cash totalled €96.7 billion over the four years.

The final item is the stock/flow adjustment that is mainly an increase in borrowing by the NTMA in 2008 and 2009 to build up cash balances. The NTMA borrowed far more than was needed to fund the deficits and a cash buffer was built up that has been maintained as part of the EU/IMF programme. The general government debt is a gross measure so no allowance is made for assets even though this cash could be used almost immediately to reduce the debt by that amount.

The composition of the general government debt was provided in this recent PQ to Michael Noonan.

TweetThe General Government Accounts

There are a number of measures of government revenue and expenditure. The Exchequer Accounts tend to get a lot of attention as they are released on a monthly basis but they only give a partial picture of the government sector. The general government accounts give a far better overview of the impact of the government sector on the economy.

These are not produced on a regular basis but the requirements of the Stability and Growth Pact means a useful table is included in the Stability Programme Updates which are now published each April. The general government accounts are not perfect but they are far more useful than the Exchequer Accounts.

The general government sector includes central government, local government and the Social Insurance Fund. It does not include semi-state companies, state-owned banks or NAMA.

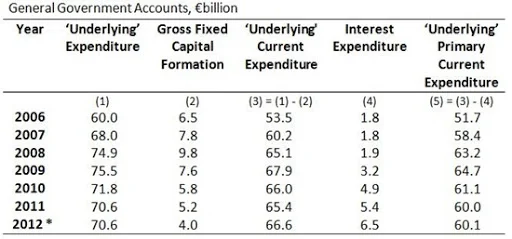

The ‘underlying’ general government balance, which is the overall balance net of temporary measures, is the benchmark used in the Excessive Deficit Procedure and it is this that must be reduced to under 3% of GDP by 2015. The following table gives the overall and underlying general government balances from 2006 to 2012, and by subtracting interest expenditure from the latter the underlying primary balance.

As a result of the effect of the bank-bailout payments, which form the bulk of the temporary measures that occurred between 2009 and 2011, it is difficult to determine what direction the public finances are going. The underlying deficit peaked at 12.2% of GDP in 2009, fell in the next two years and is projected to continue falling in 2012.

The primary deficit measures the excess over revenue that the government is spending on providing goods, services and transfers to Irish people. The underlying primary deficit also peaked in 2009 and when it hit 10.2% of GDP. Since then it has declined and it is expected to be 4.5% of GDP in 2012.

The improvement in the primary balance is greater because of the impact of our increased interest expenditure on the underlying balance. Interest expenditure was 4.1% of GDP in 2012. More than one-quarter of this was carried into the crisis and in excess of a half of it was due to the underlying deficits that ballooned in 2008 and 2009. Interest on the bank bailout forms a very small part of the 2012 interest expenditure.

The trend is clear. Since 2009, both the underlying balance and the underlying primary balance have been declining, though both still remain excessively high.

The following table gives the euro-equivalent of the GDP proportions in the above table.

The underlying balance has improved from €19.6 billion in 2009 to €13.7 billion in 2012. By applying the temporary measures (the largest of which are the bank-bailout payments) to total expenditure we can get a crude measure of ‘underlying expenditure.

The excess money we are spending on ourselves as measured by the underlying primary balance has fallen from €16.4 billion to 2009 to a projected €7.2 billion this year. In 2007 the general government ran a surplus of almost €2 billion. Of the deterioration of more than €18 billion that occurred over the following two years, one-third was due to the an increase in expenditure and two-thirds was due to a drop in revenue.

It can also be seen that interest expenditure is projected to be €6.5 billion this year and that it was almost €2 billion in the run-up to the crisis. Finally, we will look at the breakdown of revenue and expenditure provided in the general government accounts. Click to enlarge.

The reason for the drop in revenue can be easily noted in the main revenue columns of ‘taxes on production and imports’ and ‘current taxes on income and wealth’. After bottoming out in 2010 revenue has risen slightly in the past two years.

In the expenditure table the figures for compensation of employees and intermediate consumption were not provided separately until 2010. Since then the combined figures have been €27.7bn, €26.5bn, and €26.6bn. Cash transfers peaked at €25 billion in 2009 and are expected to be €24 billion this year.

The named column that shows the largest reduction is gross fixed capital formation or investment. Investment from the general government sector (central and local government) was almost €10 billion in 2008 but this has been cut to just €4 billion for 2012. It is the cuts in capital expenditure that have brought expenditure down.

Current expenditure has remained largely unchanged over the past five years. It is up about €1.5 billion since 2008 but the composition of the total has changed. There has been an increase of around €4.5 billion in interest expenditure since 2008 which has been partially offset by a €3 billion reduction in primary current expenditure.

Looking at the gross expenditure figures can be slightly misleading and there are some important reasons why they should not be considered in isolation. One such caveat is the Public Sector Pension Levy which raises around €1 billion a year. When this was introduced government gross expenditure was unchanged and the impact of the “pay cut” was seen as an increase in revenue.

Even taking into account this it is still the clear that only a relatively small portion of the improvement in the public finances has taken place via current expenditure/revenue which is by far the largest area of expense. A greater amount of ‘improvement’ has come from the huge reductions in capital expenditure. In 2012, out of primary expenditure of €64 billion, just €4 billion or 6% will be on capital investment. Around 94% of expenditure will be current.

TweetThursday, May 17, 2012

Cork Independent 17/05/12

A short article I wrote on the Treaty on Stability, Coordination and Governance for The Cork Independent can be read here.

TweetWednesday, May 16, 2012

Bond Yields

After three months with barely a budge the Irish government 9-year bond yield as calculated by Bloomberg jumped back over 7% in the last few days.

The yield did rise as high as 7.7% earlier but is now back to around the 7.4% level it began the day at. There have be no domestic changes to explain the move in recent days and the driver is uncertainty in Greece. On this day last year the equivalent yield was 11.2%.

TweetThursday, May 10, 2012

The impact of the Fiscal Compact on a ‘Good’ Country

It may be useful to consider the impact of the rules in the fiscal compact in a country that is currently in adherence of both the 3% of GDP deficit limit and the 60% of GDP debt limit from the Maastricht Treaty. What will the impact of the rules be on such a country? At present examples of such countries are scarce as 14 of the eurozone 17 are in an Excessive Deficit Procedure due to breaching the 3% of GDP deficit limit. One example we can use is Finland.

According to the recent Maastricht Returns, Finland finished 2011 with a debt equal to 48.6% of its GDP and had a budget deficit equal to 0.5% of GDP. Finnish GDP was around €191.5 billion in 2011. According the Finland’s Apil 2012 Stability Programme Update, Finland had a structural budget balance of +0.9% in 2011 and an output gap of –3.5% of GDP. Finland has a medium term budgetary objective (MTO) of +0.5% of GDP and was the only eurozone country to meet its MTO in 2011.

So let’s create a hypothetical country (but based loosely around the example of Finland).

- Initial general government debt: 50% of GDP

- Medium term budgetary objective: –0.5% of GDP

- Output gap: –4% of GDP to +2% of GDP over the cycle

- Elasticity of budget balance to output gap: 0.5

- Average nominal GDP growth: 4% per annum

As this country has a debt ratio below the 60% reference value we do not need to consider the impact of the ‘1/20th’ debt brake rule as it does not apply. Thus we can focus on the structural deficit rule which was introduced in Council Regulation 1055/2005 in June 2005.

What happens to the debt and deficits in the hypothetical country described above if it adheres to the fiscal rules? As the example is highly stylized it is relatively easy to see what will happen to the overall deficits.

Wednesday, May 9, 2012

Debt and Deficits in EU Fiscal Rules

The focus on deficits has been evident since the original entry criteria laid out in the Maastricht Treaty. The 1992 Maastricht Treaty provided the reference values for the annual deficit (3% of GDP) and the stock of debt (60% of GDP). However, greater emphasis was placed on the deficit rule.

To gain entry to the euro is was necessary that a country’s deficit was “close to the reference value”, but for the level of debt all that was necessary was that the debt ratio was “sufficiently diminishing and approaching the reference value at a satisfactory pace”.

No numerical benchmark was provided to define satisfactory pace. Even though they had debt ratios in excess of 100% of GDP both Belgium and Italy were cleared for entry into the euro in 1999 as the rate of reduction in the debt ratio was deemed ‘satisfactory’. Greece was admitted in 2001 with a debt ratio that was also above 100% of GDP, but it was actually increasing rather than falling.

The performance of annual deficits relative to the Maastricht criteria was much better and all the original 11 members had deficits of less than 3% of GDP in 1999. The ‘close to’ requirement under the deficit rule was much less accommodating than the ‘sufficiently diminishing’ flexibility allowed under the debt rule. Of course, in 2001 Greece was allowed into the single currency with a deficit of 4.5% of GDP and it had been 1980 since it last had a deficit below the 3% of GDP reference value.

As the launch of the euro approached in the mid-nineties the EU put together the framework that would oversee fiscal outcomes in the EU. This saw the introduction of the Stability and Growth Pact. This took the reference values from the Maastricht Treaty and incorporation them into two EU Council Regulations; the ‘preventative’ arm and the ‘corrective’ arm.

It was in the preventative arm that countries agreed to “the objective of sound budgetary positions close to balance or in surplus”. It is 15 years since Ireland first committed to a balanced-budget rule.

The corrective arm of the Stability and Growth Pact set out what was to happen if a country exceeded the reference values, but the emphasis was entirely on the annual deficit. If a country’s annual deficit exceeded the 3% of GDP threshold, that country would be put in an Excessive Deficit Procedure (EDP) and be required to try and bring its deficit until the 3% of GDP benchmark. If the country failed to introduce measures to try and curb the deficit it would face fines of up to 0.1% of GDP.

Although a reference value was set for the level of debt there were no fines or sanctions for countries that exceeded the 60% of GDP threshold. The emphasis of the corrective arm was entirely on the annual deficit. The view was that if deficits were sufficiently curtailed that low deficits in conjunction with economic growth would bring the ratio down.

The Maastricht criteria was internally consistent with a world in which nominal GDP growth was 5%. In such a world average deficits of 3% of GDP would see the debt-t0-GDP ratio converge on 60% regardless of the initial starting position. The view was that the emphasis on deficits was sufficient as the debt ratio would improve with reductions in deficits.

The reality did not fit with the view. From 2000 to 2008, Italy had an average nominal growth rate of 3.2%, while at the same time it ran average deficits of 2.9% of GDP. In such an environment the debt ratio will not change by much and Italy’s 2008 debt ratio of 106% was not much different from the debt level it carried into the euro in 1999.

Under the rules of the Stability and Growth Pact there was little that could be done against such a continued exceeding of the reference value for government debt as the corrective arm was framed entirely in terms of the annual deficit. Italy needed nominal growth to close to 5% to bring the debt ratio down but this did not materialise.

Greece actually exceeded the assumed nominal growth rate and between 2000 and 2008, nominal GDP growth in Greece averaged around 7% per annum. The problem was that Greece has average deficits of just over 6% of GDP. Although Greece had the nominal growth to allow the debt ratio to fall, this space was filled by additional borrowing required because of the large deficits.

So why didn’t the Excessive Deficit Procedure (EDP) as outlined in the 1997 Stability and Growth Pact and require Greece to bring the deficit below the 3% of GDP reference value and create the fiscal space for the debt ratio to fall? Greece was put into an EDP in 2004 but was allowed to exit the EDP in 2007 when the Council ruled that the Greek deficit would fall below the 3% of GDP reference value. This was not true as Greece was hiding the true extent of the deficits. The excessive deficit was not corrected and the 2007 deficit was actually more the twice the allowable level at 6.5% of GDP.

As part of the ‘six pack’ agreed last year a numerical reduction was agreed to provide a benchmark for the required falls in the debt ratio. As John McHale has shown that ‘1/20th’ rule is actually the equivalent of the 3% deficit rule in a situation where nominal growth is 5%. The debt brake rule takes the expectation of the Maastricht Treaty and formalises it. Here is a graph that illustrates this point.

This shows what happens to the debt ratio in a country that rules deficits of 3% of GDP and experiences different nominal growth rates. The starting point is a country with a debt ratio equal to 100% of GDP.

With 3% nominal growth, the debt ratio will not change as the growth in the numerator (debt) is the same as the growth in the denominator (GDP). With deficits of 3% of GDP it takes nominal growth of greater than 3% to bring the ratio down. With 4% growth the ratio falls, albeit very slowly and with 5% growth the ratio can be seen to converge on the 60% of GDP reference value. If growth is 6% the ratio will decline more rapidly and converge on 50% of GDP. At higher growth rates the rate of decline increases and the level the debt converges on gets lower (provided the country continues to run deficits of 3% of GDP).

The graph also includes the debt reduction requirement of the 1/20th rule. This sets a numerical benchmark for the reduction in the debt ratio, and in the strictest sense is independent of the debt ratio. The line for the 1/20th rule can hardly be seen. This is because it is almost completely covered by the line represented 3% deficits and 5% nominal GDP growth (the assumptions of the Maastricht Treaty). What is being required in the debt brake of 2011 is no more than was expected under the Maastricht criteria in 1992.

The rules are virtually equivalent in the case of 5% nominal GDP growth. With 6% growth the debt-brake will be non-binding as the requirements of the 3% deficit rule will exceed it. At growth rates lower than 5% the debt brake will be binding and will force reductions in the debt ratio that are larger than those that can be achieved by running 3% deficits.

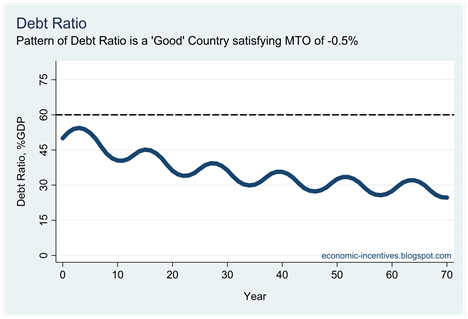

Of course, it is important to note that 3% of GDP is the limit for deficits and not the target. Since 1997, EU countries have committed to running budgets “close to balance or in surplus”. In 2005, the balanced-budget rule was restated in terms of the structural deficit and a limit of –0.5% of GDP was placed in the structural balance via country’s Medium Term Budgetary Objective. This will be more restrictive than the debt brake rule.

Here is a graph that shows the changes in the debt ratio with 4% nominal growth under the 3% of GDP deficit limit, the ‘1/20th’ debt brake and the 0.5% of GDP structural deficit limit. For the latter I have assumed that the cyclical element of the budget balance as a percent of GDP follows the pattern –2%, –1%, 0%, +1%, 2%, +1%, 0%, –1% and so on, and allowed a structural deficit of 1.0% of GDP once the debt ratio falls below the 60% threshold.

It can be seen that the structural deficit rule is far more restrictive and, in the example here with 4% nominal growth, will force the debt ratio to converge on a level equal to 25% of GDP. This is well below the 60% of GDP reference value but that appears to be the intention. Tweet

Friday, May 4, 2012

Complying with the Debt Reduction Rule

The debt reduction benchmark is calculated as an average over a three-year period. One of two averages can be used to satisfy the rule. There is a backward-looking average covering the years t-1, t-2 and t-3 with a benchmark calculated for year t, and there is also a partially-forward-looking average for the years t-1, t and t+1 with a benchmark calculated for year t+2.

The formula for the benchmark is in the Code of Conduct for the Stability and Growth Pact and for the retrospective average it can be seen on page 8 to be:

where bb is the benchmark or target debt ratio and b is the debt-to-GDP ratio in other years. Although there is a bit to the formula all that is needed is the debt ratios for three years in order to calculate the benchmark for the next year.

If the debt ratio for the current year is expected to be below the benchmark level given by the formula then the conditions of the debt reduction rule are satisfied.

To simulate the impact of the rule on Ireland we can use the IMF’s forecasts of the general government gross debt from the recent update of the World Economic Outlook as these extend out to 2017. We will use these to gauge Ireland’s performance to the rule beginning in 2012.

The debt ratio column are actual data up to 2010 and are the IMF’s projections from 2011 to 2017. The benchmark column are the targets for each year and is calculated by putting the debt ratios for the preceding three years into the formula shown above. Compliance is true if the debt ratio for any year is less than the benchmark calculated for that year. Under current assumptions and IMF projections Ireland will satisfy the retrospective version of the debt reduction rule in 2017.

One of the assumptions the IMF makes is that we undertake the €8.6 billion of fiscal adjustment planned for 2013-15. Projections after that are based on a “no policy change” scenario. Under IMF projections we will satisfy the debt brake rule in 2017 with no additional fiscal effort above what has already been provided for up to 2015 with neutral budgets after that.

The debt reduction rule can be satisfied while running deficits and does not require any debt repayments. The IMF project that there will be an overall budget deficit of 1.9% of GDP in 2017.

The gross debt continues to rise and in the years from 2014 to 2017 (the years used in the 2017 comparison) the gross debt increases from €201.0 billion in 2014 to €213.5 billion in 2017.

If the alternative forward-looking version of the rule was applied it would actually show that we would be in compliance with the rule from 2015, as the benchmark calculation is based on the debt ratios in the same three years, 2014, 2015 and 2016 and again compared to the ratio in 2017. Using the forward looking version of the rule in 2015 will also give a benchmark of 109.6% of GDP for 2017 which is, of course, above the projected debt ratio for 2017.

Although this is only a simulation it does show that we would not need additional fiscal adjustment to satisfy the debt brake rule. In fact, using IMF projections it can be shown that we will be able to satisfy the rule before we even leave the Excessive Deficit Procedure (EDP). The debt brake rule doesn’t actually become effective until three years after a country leaves the EDP. We have until 2018 to become compliant with the debt reduction rule but we may actually be compliant by as early as 2015.

One reason for this is that the “1/20th” rule is actually relatively benign and according to Karl Whelan in section 2.1 of this paper the “rate of progress that is deemed satisfactory is still very slow.” We have plenty to be worrying about but satisfying the conditions of the debt brake is not one of them. In fact, it is likely that we will want to reduce the debt ratio at a rate faster than that required by the rule. Tweet

Thursday, May 3, 2012

Additional Fiscal Effort: Scaremongering?

We are looking at a further €8.6 billion of “consolidation” over the next three budgets. The table shows the proposed spilt between expenditure cuts (€5.55 billion) and tax increases (€3.05 billion). As we are in an Excessive Deficit Procedure there is nothing in the Treaty on Stability, Coordination and Governance that will change the targets.

The period after this has received some attention and there have been a number of claims that either or both of the 0.5% of GDP structural deficit limit and the “1/20th” debt reduction target will require further €X billions of fiscal adjustment in the post-2015 period. Over the past few days I have heard a number of these claims in various debates. Here are a few unearthed from a very quick search.

(1) “The Austerity Treaty would turn this recession into an economic depression. It would bring at least €5.7 billion additional cuts and taxes from 2015, on top of the €8.6 billion austerity up til then.”I’m not sure where the figures have come from but a figure of around €6 billion is attributed to the structural deficit rule and one of around €5 billion is attributed to the debt reduction requirement.

(2) “This treaty will mean an extra €6 billion in tax increases and spending cuts post 2015. This will further depress consumer demand, pushing the domestic economy further into recession.”

(3) “On May 31, we are being asked to support an austerity treaty that will result in €6bn of extra spending cuts and tax increases being imposed on people post 2015. This is on top of the €8bn the Government intends to cut in the coming four years. If you are against austerity, you must vote against the austerity treaty.”

(4) “Debt should be 60 per cent of GDP. If debt is greater than 60 per cent, it will be reduced by 1/20 per year over the next 20 years. This would start in 2018, when the bailout terms expire, and could require up to €5 billion a year in savings to 2038.”

(5) “Ireland's debt to GDP ratio is likely to be around 120% in 2015 when we exit the bailout. Reducing the debt to GDP ratio by one twentieth of the excess per year will therefore mean reducing it by 3% of GDP per year. Without significant economic growth, that means paying back €4.5 billion per year in principal”

Over on irisheconomy.ie, Prof. John McHale has an excellent post on some budgetary arithmetic for fiscal rules that teases out some of the implications for Ireland after we leave the Excessive Deficit Procedure in 2015. The conclusion is that there will actually be very little additional effort required to meet the requirements of the fiscal rules post-2015.

This is the straightforward one and it is one we have looked at before. For a start it is important to note that Ireland will not be subject to the debt reduction rule until three years after we leave the excessive deficit procedure. The rule will begin to apply from 2018.1. The Debt Reduction Rule

Here is a table that shows the IMF projections for Ireland for 2017 and shows the overall budget balances that would be allowed if nominal growth was 3.5% per annum.

The starting nominal GDP from 2017 is the IMF projection. The figures for 2018 to 2021 are based on a nominal growth rate of 3.5% per annum. This is lower than the 4.5% per annum that the IMF are projecting for 2015, 2016 and 2017.

The 2017 gross debt is also the IMF projection which gives the starting debt ratio of 109.2% of GDP. The debt ratio from 2018 onwards are those that would be required to satisfy the “1/20th” debt reduction benchmark.

The change in gross debt is the annual change in debt that is allowed. It can be seen that this is always positive. The level of debt can increase in each year. There is no requirement to repay debt and definitely no requirement for annual payments of €5 billion per annum.

The final column is the key one. This gives the allowable budget balance to satisfy the debt brake rule. The €8.6 billion of adjustments is designed to bring the deficit below 3% of GDP by 2015. The IMF projections for 2016 and 2017 are based on a “no-policy change” scenario. By 2017 they project that the deficit will be down to 1.9% of GDP.

Continuing the IMF scenario into 2018 it is likely that the deficit would be around 1.4% of GDP in 2018. This is only 0.3% of GDP (€0.6 billion) away from the deficit required to satisfy the debt brake rule. As the debt reduction requirement is calculated over a three-year average it is likely that the expected outcomes for 2019 and 2020 would allow us to satisfy the debt reduction requirement.

Using the IMF’s projections and assuming 3.5% nominal GDP growth from 2018, Ireland can satisfy the debt reduction rule with no additional fiscal effort. There is no guarantee that this scenario will come to pass but it is difficult to see how the kind of assumptions that would give arise to annual repayments of around €5 billion per annum could come to pass. It is far more likely that we will be allowed to borrow small amounts rather than have to make the repayments suggested.

The balanced-budget rule is a little more involved. This is the rule that requires a cyclically-adjusted or structural budget balance of no more than –0.5% of GDP. Last week’s Stability Programme Update says that using the European Commission methodology it is forecast that Ireland will have a structural deficit of 3.5% of GDP in 2015.2. The Balanced-Budget Rule

There is no transition period when a country leaves an EDP so the balanced budget rule becomes applicable in 2016. What matters here is the pace of reduction and as we pointed out previously the requirement is an improvement of 0.5% of GDP towards the budget objective. What will happen in Ireland post-2015? Will be have to undertake €6 billion of additional fiscal adjustment to satisfy the balanced-budget rule?

The starting point here is the structural deficit of 3.5% of GDP given in the SPU. Next it is assumed that nominal GDP will go by 3.5% per annum (this is lower than the IMF projections of 4.5% per annum).

The coefficient of elasticity is the impact of the growth rate on the structural balance. There is no way of knowing what this is but we will follow the figure of 0.2 used by Prof. McHale. Using this figure a nominal growth rate of 3.5% is expected to improve the structural balance by 0.7 percentage points of GDP per annum under the assumption of “no policy change”, i.e. no additional adjustment. This is in excess of the 0.5% of GDP improvement required under the Stability and Growth Pact.

By 2019 it can be seen that the structural deficit would be down to –0.7% of GDP. Using the projections here this is achieved with no additional fiscal effort and is in line with Council Regulation 1055/2005 which says that countries should aim “to gradually reach the medium-term budgetary objective”.

There is no guarantee that this is what will happen. The IMF’s debt projections for 2017 and the DoF’s structural deficit projection for 2015 are only estimates. They are very unlikely to be wholly accurate. The assumed 3.5% nominal growth rate in the subsequent four year period is only a conjecture. For what it’s worth Ireland’s nominal GDP growth rate from 1971 to 2010 averaged 11.5% per annum. However, the scenarios do show what could happen and, in my opinion, are based are fairly prudent assumptions.

It is possible that Ireland could satisfy the conditions of the debt-reduction rule and the balanced-budget rule without any additional fiscal adjustment after 2015. There are plenty of accusations of scaremongering in relation to official funding floating around. Are claims of €5 billion and €6 billion of additional fiscal adjustment after 2015 more of the same?

Of course, it should also be pointed out the the result of the referendum will not change the necessity to satisfy the fiscal rules. These rules are all elsewhere in EU regulations and the Fiscal Compact element of the Treaty just restates them. We have already committed to adhere to them. In fact, even if the referendum is defeated we could still introduce a Fiscal Responsibility Bill that incorporates these fiscal rules. The referendum is to allow us to ratify (become a signatory of) the Treaty. Tweet

Wednesday, May 2, 2012

Hitting the structural deficit target

The original balanced budget rule was introduced as part of the Stability and Growth Pact in 1997 when member countries committed “themselves to respect the medium-term budgetary objective of positions close to balance or in surplus”. This was revised in 2005 and the rule was restated in terms of the structural balance rather than the overall balance.

At present this is not an issue for Ireland. As our overall deficit is above 3% of GDP we are in an Excessive Deficit Procedure (EDP). We will remain in the EDP as long as the deficit is above 3% of GDP. This year it is forecast that the deficit will be around 8.3% of GDP and it is estimated that it will be 2015 before we leave the EDP. On leaving the EDP we will then become subject to the balanced budget rule.

Ireland first set a Medium-Term Budgetary Objective (MTO) in terms of the cyclically-adjusted or structural budget balance in December 2005 when we set as “close to balance” (discussed here). The current MTBO is a structural deficit of –0.5% as stated on page 31 in last week’s Stability Programme Update.

As discussed in last year’s SPU, Ireland’s ‘medium-term budgetary objective’ (MTO) currently stands at -0.5% of GDP. This objective was set well in advance of the Inter-Governmental Treaty on Stability, Coordination and Governance in the Economic and Monetary Union (the ‘Stability Treaty’). Ireland is making progress towards the achievement of its MTO, with further progress to be made in the post-2015 period on a phased basis, in accordance with a timeline to be agreed.Up until 2015, or whenever it is achieved, the fiscal target will be to bring the overall deficit below the 3% of GDP limit. In the post-2015 period we will be subject to the balanced budget rule and must move towards meeting the MTO (which is subject to revision).

Firstly, it is very impossible to know what the structural balance actually will be in 2015. Tables A5 and A6 on page 53 of the SPU provide some estimates from the Department of Finance. Using the European Commissions methodology they estimate a structural balance of –3.5% of GDP and using the approach of the IMF the figure is –2.5% of GDP. Taking the midpoint (though the EC’s approach will take precedence for the EU’s fiscal rules) it seems we are set to have a structural deficit of around 3% of GDP in 2015. At this remove these estimates can only be considered to be tentative.

So if the structural deficit is 3.0% of GDP how quickly does it have to be reduced to the 0.5% of GDP limit? The SPU says it will be done “on a phased basis, in accordance with a timeline to be agreed.” This is true and it is likely to be much more moderate than the current timeline to bring the overall deficit under the 3% of GDP limit.

The answer was actually provided in June 2005 in Council Regulation 1055/2005 which forms part of the Stability and Growth Pact.

The Council, when assessing the adjustment path toward the medium-term budgetary objective, shall examine if the Member State concerned pursues the annual improvement of its cyclically-adjusted balance, net of one-off and other temporary measures, required to meet its medium-term budgetary objective, with 0,5 % of GDP as a benchmark. The Council shall take into account whether a higher adjustment effort is made in economic good times, whereas the effort may be more limited in economic bad times.This is confirmed in the revised Code of Conduct for the Stability and Growth Pact which was published in January of this year. A slightly abridged version of the section on reaching the MTO is below the fold and, as can be seen, it is not lacking in get-out clauses.

Tweet

What’s on the table?

Today Irish Times carries an opinion piece from Prof. Terence McDonough of NUIG on the Treaty on Stability, Cooperation and Governance. It is headed ‘Treaty not a safe option but a perilous experiment’.

I agree with some the article says in relation to the funding options available to Ireland in the event of a ‘No’ vote. Towards the end of the article there is a summary of “what’s on the table” in four points. There are a number of parts in this list that I disagree with.

1. Structural deficits for Ireland should be about half of 1 per cent of GDP, with a 3 per cent top limit on the headline deficit even in the worst years. This requirement seriously compromises government ability to end recessions.

The implementation of the 0.5 per cent structural deficit rule in the new treaty is considerably more stringent than any of the existing “six-pack” regulations, which are themselves unwise. Eventually, a shortage of government bonds will emerge, forcing conservative investors such as pension funds into less safe investments, risking the reappearance of dangerous asset bubbles.

The 0.5% of GDP target for the structural deficit is not ‘new’ and is not more stringent than the existing ‘six pack’. The balanced-budget rule in terms of the structural deficit has been in place since June 2005 as we discussed here. In fact the current rule is actually less stringent than that proposed in 2005.

In the March 2005 document approved by the Commission as the template to revise the Stability and Growth Pact, the rule required high-debt countries to have structural balances that were “in balance or surplus”. This is slightly relaxed in the 2012 Fiscal Compact with high debt countries allowed a structural deficit of up to 0.5% of GDP.

The balanced-budget rule is restrictive and will bring government debt levels down to low levels as previously discussed but it is not so because of the Fiscal Compact.

2. Debt should be 60 per cent of GDP. If debt is greater than 60 per cent, it will be reduced by 1/20 per year over the next 20 years. This would start in 2018, when the bailout terms expire, and could require up to €5 billion a year in savings to 2038.

This is utterly wrong. The debt brake rule, which on this occasion is part of the “six pack” and was introduced as part of Council Regulation 1177/2011 last November. The regulation makes no reference to 20 years. What it does specify is that if a country’s debt ratio exceeds the 60% of GDP threshold, then the country must close one-twentieth of the gap between the current level and the 60% threshold (and doing so on average over a three-year period is sufficient).

Consider a country with a debt equal to 100% of GDP. This is 40 percentage points above the threshold. In order to satisfy the rule one-twentieth of this gap must be reduced. One-twentieth of 40 is 2, thus the following year the indicative target for the debt ratio is 98% of GDP.

This can be easily achieved with growth and inflation. With 2% growth and 2% inflation this country could satisfy the conditions of the debt brake with a deficit of close to 1.9% of GDP. In the second year GDP would be around 104 and the nominal debt 101.9 giving a debt ratio of 101.9/104 = .98.

Here are some indicative nominal debt levels at different nominal growth rates for a country that starts with a debt ratio of 120% of GDP.

In the extreme case of no nominal growth for 20 years the debt must be reduced from 120 to 81.5 over the 20 years with very moderate debt reductions in the second 10 years. With just 2% nominal growth (the ECB’s inflation target plus zero real growth) the debt stays relatively constant and is up slightly to 121.1 after 20 years. In this scenario the debt must fall marginally for the first 10 years and then can increase gradually after that.

In a more typical scenario of 4% nominal growth (say 2% inflation and 2% real growth) then the actual debt must never be reduced. Deficits are around 2% of GDP are allowed right from the start and over the 20 year period shown above the nominal debt can increase from 120 to 178.6. The level of debt increase allowed is even greater with 6% nominal growth.

Today’s article says that the debt brake rule “could require up to €5 billion a year in savings to 2038”. I am not sure what this means. By using the word savings I assume this is money put on deposit or, in this case, money used to pay down debt. There is no plausible scenario in which Ireland will have to reduce the debt by €5 billion per annum.

Even with zero nominal growth such repayments would not be required. Any nominal growth close to 2% will mean the debt level has just to be maintained and if nominal growth is above 2% the amount of debt can actually be increased. From 1971 to 2010 average annual nominal GDP growth in Ireland was 11.5%.

3. Even after we reach this target, Ireland will be forced to run primary surpluses, that is excluding interest payments on the national debt, for many years, taking steam out of the economy.

Ireland will have to run primary surpluses for the foreseeable future but this will probably not be the case if we can reach the target of the 60% of GDP threshold. If we ever get the debt back to 60% of GDP then we will only be required to run primary surpluses if the interest rate exceeds the nominal growth rate. This might not happen and small primary surpluses might be required to keep the debt ratio at 60% but there nothing to suggest that “Ireland will be forced to run primary surpluses”.

If will take decades for the debt to approach the 60% threshold and, of course, this limit does not come from the Stability Treaty. It was first introduced as part of the Maastricht Treaty in 1992.

4. If these conditions are violated, control over fiscal policy is ceded to Europe and the European Court of Justice.

This is just plain wrong.

Tweet