The graph of total deposits in all banks operating in Ireland paints an alarming picture.

At first glance this would give rise to notions of a bank run. We examined this in detail using last month’s figures and concluded that it was mainly due to a reduction in deposits from non-resident monetary financial institutions and about half of the decline could be attributed to non-domestic banks with operations in Ireland.

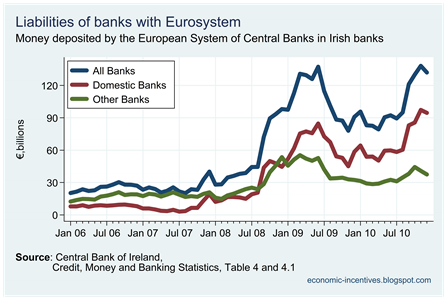

It could be because these depositors have withdrawn their money from Irish banks or because Irish banks have not aggressively sought to extend these deposits, and instead have turned to the cheaper funding available from the ECB. Most banks would prefer not be extensive and prolonged users of the ECB lending facilities because of the reputational damage this would cause, but the Irish banks have no reputation to lose.

Anyway, this month’s release from the Central Bank allows us to monitor the trends in deposits in the six covered institutions (AIB, BOI, Anglo, INBS, PTSB and EBS).

When looking at the drop in deposits that has occurred in domestic banks over the past six months we see that, by and large, this is a phenomenon that has affected the covered banks. Almost three-quarters of deposits in domestic Irish banks are held in the six covered banks. These banks had deposits of €414 billion last July. By January, this had fallen to €319 billion, a drop of €95 billion.

By contrast deposits in the non-covered banks (ACC, Barclays Ireland, Danske Bank A/S, Investec Bank (Ireland), KBC Bank Ireland, Northern Rock, Rabobank, Ulster Bank, Credit Unions) fell from €114 billion to €90 billion, a drop of €24 billion. The proportionate drop in deposits in the covered institutions was 23%, with a 21% drop in deposits in the non-covered institutions. Who has taken their money out of the banks?

Deposits from all sources have declined since August 2010, but the drop in deposits from non-eurozone residents (€59 billion or 40%) is greater than withdrawals by Irish residents (€25 billion or 10%) and other eurozone residents (€12 billion or 68%).

For total deposits in the Irish banking system the Central Bank provide a breakdown by depositor category for the above three groups. These categories are monetary financial institutions, private sector and general government. Here we update the graph for the deposits of non-eurozone residents in Irish banks. (Note that this relates to all banks operating in Ireland.)

It is pretty clear that it is other financial institutions who have undertaken the greatest reduction in their deposit holdings in Irish banks and that this has accelerated since the first guarantee expired last August. What we do have is a breakdown of deposits by category for Irish residents.

General government deposits have been largely unchanged and hovered between €2 and €3 billion. The €25 billion drop in Irish resident deposits in the covered banks can be split as €9 billion from financial institutions and €16 billion from the private sector. For total deposits we get a breakdown of private sector deposits by household and business but this is not available for the private sector deposits in the covered banks. Anyway, there has been some drop in Irish resident deposits in the covered banks it is not (yet?) at a rate to suggest a domestic bank run is underway.

It is non-eurozone deposits that have left the domestic banks and this €95 billion is the second reason that the covered banks have been turning to the ECB and Central Bank of Ireland for funding. They needed the money to pay the bondholders and depositors back.