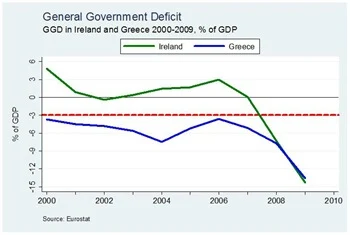

In a post back in March we looked for differences between the Greek and Irish budgetary situations. We came to two conclusions in terms of the size of the debt problems relative to each country’s GDP.

- The annual government deficits in Ireland (-11.7%) and Greece (-12.5%) were similar.

- Ireland was in a getter position as it was coming from a relatively low overall debt position (64% versus 115%).

It turns the first of these was wrong! Today Eurostat released a revision of the 2009 government deficits. The updated figures show that Ireland had the worst government deficit in 2009 running at 14.3% of GDP. The Greek figure was also revised upwards to 13.6%. The primary reason for the revision of the Irish numbers was the inclusion of the €4 billion capital injection in Anglo Irish Bank made last made to the general government deficit. The reaction of the Minister for Finance is here.

Our spot the difference graph now looks like this.

The international reaction to the figures has focused on Greece. See here, here and here. These reports give no attention to the Irish figures. Domestic media loudly (proudly?) declare that Irish 2009 deficit biggest in the EU.

The revision hasn’t been ignored on bond markets if we look at the daily changes in the yield on the 10-year Irish government bonds – graph here. Not as bad as has been happening to Greece today but going in the wrong direction nonetheless. The ‘others believe in us’ mantra may be losing its shine.

No comments:

Post a Comment