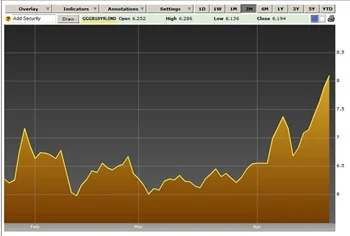

Bond yields on 10-year Greek government bonds have soared above 8%. Here is a 3 month graph from Bloomberg to yesterday’s close. Click to enlarge.

The drop seen after the announcement of the EU/IMF support package has been wiped out and yields are at new record levels. The yield went over 8.3% for a time yesterday but dropped by the market close to 8.1%.

The reason for this is an increased perception in the risk of Greek bonds, which is driving the price down. As the price goes down the yield goes higher. More graphs here.

When Greece comes to borrow money from bond markets (and they will have to borrow a lot) the interest rate they have to offer to get lenders will be determined by the yield investors can get from buying existing bonds on bond markets.

Greece now faces the choice of going to the markets to refinance their debts and rates of 9% or higher or calling in the support of the EU/IMF who have offered money at 5%. Which one would you go for?

No comments:

Post a Comment