The March Exchequer Returns have just been

published and allow us to update our analysis of tax revenue from

February. In a

statement released with the return, the Minister for Finance has indicated his satisfaction with the figures.

“At end-March, €7¼ billion in tax receipts has been collected, some 3½ per cent behind profile for the period and 15 per cent below what was collected in the first quarter of 2009. However, a substantial year-on-year decline had been anticipated in the early stages of 2010 and for the year as a whole, the Budget day forecast of €31 billion, which represents a 6 per cent year-on-year decline, is still a valid target. The widely held view is that the economy will return to growth in the second half of the year and this should improve tax performance.”

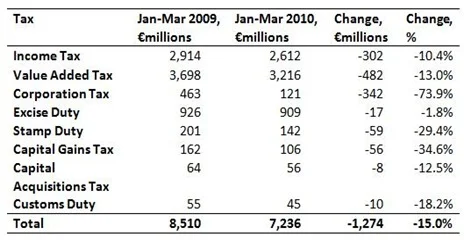

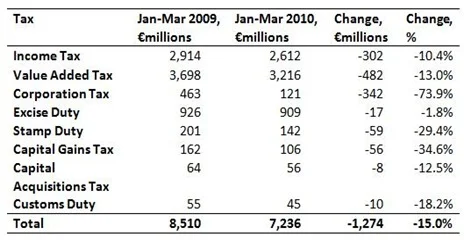

In looking at the March tax figures we can see that the 15% drop for the first three months of the year represents a fall in revenue of €1,274 million below the amount collected in the same period last year.

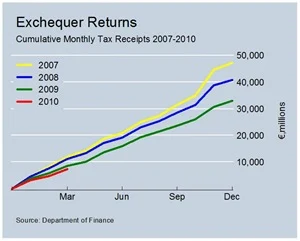

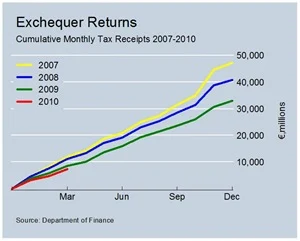

We can examine the pattern of tax receipts since 2007 with a graph that tracks cumulative tax receipts by month. Click the graph to enlarge.

There is now a gap emerging between the 2009 (green) line and the 2010 (red) line. See close-up

here. Similar graphs are also available for the main tax heads. Click to view.

The graphs show that corporation tax revenue is very low and is down 73% on last year, with very little preliminary tax paid. Relative to last year the best performing tax is Excise Duty (-1.8%). The complete collapse in stamp duty and capital gains tax revenues relative to 2007 and 2008 is also evident.

Returning to the total tax take for 2010, the annual rate of decline eased somewhat in March. After rates of 17.6% and 17.9% in January and February, the March 2010 was ‘only’ 9.2% below the corresponding figure for March 2009. Here are the monthly tax revenues in millions with the associated annual changes.

We can also look at the

forecasts made by the Department of Finance back in February. No monthly forecast of January tax revenue was made.

We see that the outturn has fallen below the Department’s forecast for each of the last two months and that the forecast error increased from 3.7% in February to 7.5% in March.

Looking at the individual tax heads we see how the overall drop of 15% varies across the different headings. The double-digit drops in both income tax and VAT give rise for concern.

The monthly equivalents for March 2010 and March 2009 are available

here. There even are some positive signs used in the table! The performance of the individual taxes relative to the

Department’s forecasts can be seen

here.

The strongest performing tax is Excise Duties – up 12.1% on the same month last year and only down 1.8% for the year. We don’t have the breakdown of revenue by excise duty. Excise duties on oil (38.8%), tobacco (20.9%), alcohol (19.1%) and Vehicle Registration Tax (20.0%) are the main sources of revenue (using

2008 figures).

The relatively good performance of Excise Duties in 2010 is probably down to changes in the rates applied rather than any improvement in activity. Revenue will have increased because of the introduction of the carbon tax in last December’s Budget, though this will have been offset somewhat by the reduction in duties on beer and cider. The effect of the €1,500 VRT rebate is also unknown.

For 2010 as a whole the Department predict that tax revenue will fall by €1,993 million. In the first three months of the year there is already a drop of €1,274 million or 15% below the amount collected in the first three months of last year. Tax revenue for the next nine months can only be €719 million or 3% below the amount collected in the last nine months of last year.

There will have to be a substantial improvement from the 15% drop we have seen so far this year if this target is to be met. The monthly rate of decline has eased to 9.2% and the Department are

forecasting that this will continue with a 4.9% drop forecast for April.

How will

our forecast of a 7.2% lower tax revenue for the rest of the year fare out?