As part of its response to the 2008 crisis the EU has set up the Macroeconomic Imbalance Procedure which “aims to identify, prevent and address the emergence of potentially harmful macroeconomic imbalances”. The identification is done via a scoreboard of indicators with various thresholds.

Our concern here isn’t on the choice of indicators, the thresholds chosen or the one-sided nature of the adjustments but on the work done by the CSO to make some of the indicators logical from an Irish perspective. We know that lots of macro aggregates in Ireland are distorted and unless this is identified a scorecard with arbitrary thresholds could lead misleading conclusions and adjustment requirements.

The CSO first published its version of the Macroeconomic Scorecard for 2013. As we considered at the time this provided a very useful breakdown of private sector debt with debts of the NFC sector broken down by Irish-owned and foreign-owned parents. There were lots of wild claims that debt in Ireland was four, five or more times national income. The CSO’s work via the macroeconomic scoreboard was important in helping to get the actual position set out.

The work has continued with scorecards produced for 2014 and 2015 with the latest one for 2016 published last week. The graphics have got flashier and the insights into things like the current account and net international investment position have got better.

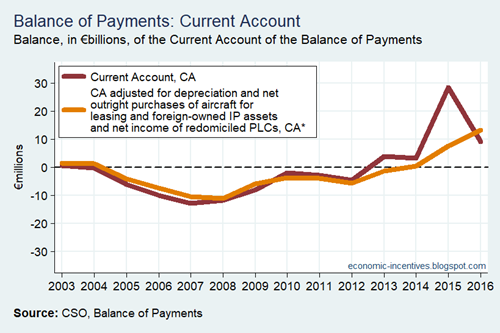

The work on the Balance of Payments current account is particularly useful given the importance of this measure. A distorted current account offers few insights. Here is Ireland’s headline current account from the Balance of Payments.

Over the past few years the breakdowns provided by the CSO focused on the impact of redomiciled PLCs and the changing treatment of aircraft for leasing. However, the extraordinary recent jumps in the balance are due to the impact of intangible assets and it was clear that this would have to be addressed.

This started with the publication of the modified national income measures back in June which included a modified current account, CA*. As the CSO explained:

CA* is the current account balance (CA) adjusted for the depreciation of capital assets sometimes held outside Ireland owned by Irish resident foreign-owned firms, e.g. Intellectual Property (IP) and Aircraft Leasing, alongside the repatriated global income of companies that moved their headquarters to Ireland (e.g. redomiciled firms or corporate inversions).

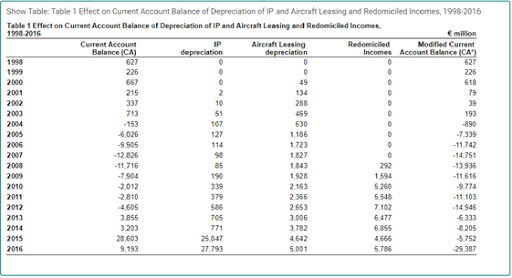

The size of these adjustments was shown in this table (click to enlarge).

So if we subtract the depreciation of foreign-owned IP and aircraft for leasing as well as the net income of redomiciled PLCs the outcome is:

The 2016 figure shows that all is not well with this approach and as we discussed here the issue was likely related to the acquisition of aircraft and intangible assets. These were being bought by Irish-resident entities but being funded by intra-company loans so any deficits arising from these acquisitions are of little concern to the rest of us.

The CSO have included an updated approach to the modified current account in their 2016 macroeconomic scoreboard that takes this into account. As they say in a revised version of their note on the modified current account:

Since the original publication the CSO has made a further change to CA* to exclude the cost of investment in aircraft related to Leasing and the cost of R&D related IP from the current account balance. Some firms borrow money abroad to finance their investment by purchasing IP from their parent company. In the long term this debt is repaid from the profit on the IP or the aircraft being leased. It means that this borrowing is not a liability of residents of Ireland and the purchase of this IP needs to be excluded when deriving CA*.

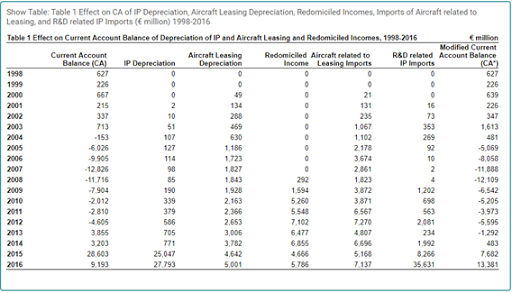

A couple of extra columns have been added to the table showing the adjustments (again click to enlarge).

As before the adjustments for depreciation and redomiciled income are subtracted while now adjustments for imports are added back in to give the updated version of the modified current account. The headline and modified current account balances are:

This is much better and there is no doubt that this modified current account gives a much more informed view of the underlying position of the economy relative to the headline current account. This is further evidence of the work being undertaken by the CSO to provide meaningful indicators of the underlying conditions of the Irish economy.

As discussed here there may still be some concerns that the figures for recent years are a little high. The modified balance is a surplus of €13 billion for 2016. This may be related to the treatment of expenditure on R&D services as intermediate consumption for Balance of Payments purposes and gross fixed capital formation in the National Accounts.

If this is an issue it may be remedied in due course and it does not require any changes to the adjustments now proposed to get the modified current account, CA*, as any revisions to the headline balance will automatically apply to the modified balance. It may have taken a while but there’s no doubt that we’re now getting somewhere with the modified current account and as with other indicators of the Irish economy this is showing that we’re in pretty good shape.

No comments:

Post a Comment