An earlier post went into the gory details of the household sector. Here we do something similar for the non-financial corporate sector and assess what can be learned from a new breakdown of this sector provided by the CSO.

There is lots going on in the current account of the non-financial corporate (NFC) sector but it is hard to tell what the underlying patterns are. Here is the NFC current account since for the past five years from the 2016 institutional sector accounts.

The big changes happened in 2015 when gross value added jumped by more than 50 per cent to reach €180 billion with an increase of a near similar scale showing for gross operating surplus. We know this was the result of activities of foreign-owned MNCs and it probably wouldn’t be much of any issue if the pollution was limited to the estimates of GDP but we can see that after profit and interest distributions that gross national income in 2015 still jumped by almost €30 billion.

So more than half of the increase in gross profits of the NFC sector in 2015 was attributed to Irish residents. There was a bit of fumbling around when the figures first came out but now we have a fairly good handle on what happened.

Now the CSO are giving a further useful breakdown that allows us to see what happened by trying to isolate some of the distortions. Figures have been provided for two sub-components of the NFC sector:

- large foreign-owned NFCs

- other NFCs

As the CSO say in the background notes:

Non-financial corporations are sub-divided into Large foreign-owned MNEs (S.11a) and the Other (S.11b) in these accounts. Large foreign-owned MNEs are those companies surveyed by the CSO's Large Cases Unit. This division is not prescribed in ESA2010 but is an additional level of detail provided because of the nature of the Irish economy. This sub-division is a step towards a full separation of domestic and foreign-owned corporations, and allows a more informed perspective on the purely domestic economy.

In the release they further say:

These 50 largest foreign MNEs (out of approximately 114,000 enterprises in S.11) are presented as a proxy for all the MNEs in this release. A more comprehensive account of foreign-owned enterprises is currently under development.

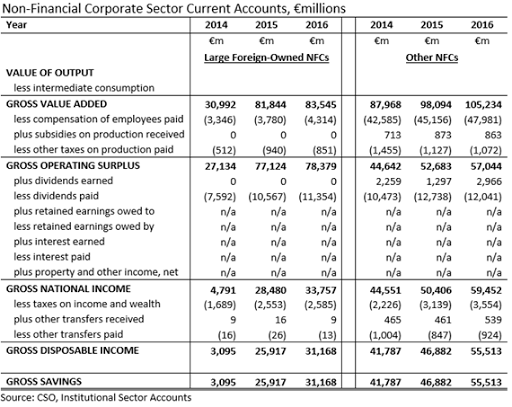

So what do we see if we split the current account into these 50 foreign-owned MNCs and the rest? Lots. Here are their current accounts for the last three years.

A wider table that also includes the overall totals is available here. Breakdowns aren’t provided for all of the constituent parts of the current account but most of the important ones are included. The panel on the right hand side is a huge step in giving us a view of the underlying trends in Ireland’s business sector. Over the past three years we see that gross value added has been increasing (+7.3% in 2016), compensation of employees is growing (+6.3%) and gross operating surplus is rising (+8.3%).

There may be a little bit of an issue with redomiciled PLCs or some other issue in the distribution of income account as gross national income recorded an increase of 17.9% in 2016 but all in all the new breakdown is very useful. Corporation Tax payments from these companies rose a further 13.2% in 2016 to reach €3.55 billion (and up €1.3 billion on 2014). Thus, the right panel presents a story of a business sector growing strongly.

And that means that most, but not all, of the problems are corralled in the large, foreign-owned NFC subsector. This is a small group of companies but ones which have a disproportionate, and distortionary, effect on Ireland’s national accounts.

The €50 billion jumps in gross value added and gross operating surplus that occurred in 2015 are obvious. As stated above the problems really kick in after the distribution of income.

As these are foreign-owned companies we would expect their direct contribution to Irish gross national income to be minimal. Their contribution would have been paid out to other sectors: buying goods and services in their intermediate consumption from domestic suppliers and wages paid to the household sector. In fact by the time we get to gross national income all we would expect to be left is whatever is needed to cover their Irish Corporation Tax bill. We would expect any remaining profits to be either distributed or attributed to the foreign shareholders.

But that is not the case. The gross national income of the large, foreign-owned NFCs far exceeds their Corporation Tax payments and at the bottom we would expect their gross disposable income to be close to nil. We can see that it was €3.1 billion in 2014, jumped hugely in 2015 and rose again in 2016 to stand at €31.2 billion. This is counted as our income. It is not.

As an quick aside here are the Corporation Tax payments attributed to the subcategories of NFC and also to Financial Corporates over the past four years.

Compared to 2014, Corporation Tax payments for 2016 are shown to be €2.9 billion or 57.6 per cent higher. All the categories shown paid more but the small relative growth was for these large, foreign-owned NFCs which paid 53 per cent more Corporation Tax in 2016 compared to 2014. For other NFCs the increase was 59.7 per cent and it was 60.4 per cent for financial corporations. It should be noted though that these tax amounts are inclusive of the R&D tax credit (which as a payable tax credit related to capital spending (as research and development is now treated) is counted as an investment grant received).

Anyway, back to this huge level shift in GNI from foreign-owned NFCs in 2015. The reason is because nearly €25 billion of profits of foreign-owned companies weren’t counted as a factor outflow. There are two possible reasons:

- The first is different treatment of certain items in the national accounts (where gross operating profit is estimated) and in the balance of payments (where factor outflows are derived). We previously considered some issues around the treatment of spending on R&D service imports.

- The second, and most significant, is that profit outflows are based on net operating surplus and there is now a huge amount of gross operating surplus that is consumed by depreciation.

We can see some things that point to the second issue in the capital account.

Unfortunately, both the capital accounts of both sub-groups are bit of a mess. For the large, foreign-owned group the acquisition and depreciation of intangibles is throwing the numbers awry while for other NFCs it is likely that the acquisition and depreciation of aircraft are muddying the waters (not forgetting that gross savings is inflated by the net income of redomiciled PLCs).

For the group of large foreign-owned NFCs we can see the large changes that occurred in the depreciation charge. Consumption of fixed capital for these 50 companies was €5.5 billion in 2014 and this surged to €29.4 billion in 2015 with a further increase to €32.8 billion in 2016.

In the National Income and Expenditure Accounts the CSO provided details of a modified measure of national income, GNI* and one of the adjustments made is for the depreciation on certain foreign-owned intellectual property assets. This depreciation went from €0.8 billion in 2014, to €25.0 billion in 2015 to €27.8 billion in 2016. This is what has driven the changes in the consumption of fixed capital for the large, foreign-owned NFCs shown in the table above.

Although these companies have large amounts of gross savings their expenditure on gross capital formation is volatile and can exceed the level of gross savings. The financial transactions account for the subcategories might throw some additional light in the thing but although great strides forward have been made we haven’t got that far – yet. For the large, foreign-owned NFCs we can surmise that some of these are running large surpluses to repay loans they assumed in the process of acquiring large amounts of intangible assets.

At the same time other companies are borrowing to acquire intangibles so it is hard to tell what is happening. So, in 2015 there was net lending available to repay debt (net lending of €10.7 billion) while in 2016 additional borrowing for intangibles swamped the repayments that some companies were making (resulting in net borrowing of €16.5 billion).

While we don’t have the financial transactions account we do, though, have the financial balance sheets of the two sub-groups.

Plenty of big numbers there. Unfortunately the loans liability category is suppressed. However, we do have total financial liabilities. We can see that for the group of 50 large, foreign-owned NFCs this jumped from €198 billion at the end of 2014 to €516 billion at the end of 2015. A year later and it was €519 billion. This is vaguely supportive of the idea of some large loans being repaid while other, relatively smaller, loans are being taken out as part of the onshoring of intangibles.

The balance sheet of the Other NFCs category tells us nothing about the domestic business sector. The numbers are huge. By the end of 2016 these companies has €1.2 trillion of financial assets and €1.5 trillion of financial liabilities. There’s still a bit of stripping out to do here.

None of this is straightforward but this latest release is another step along the way. GNI* is a promising measure that will likely improve in subsequent rounds. The current account of the balance of payments is still a bit of a mystery but maybe we know where we’d like to end up. For the sector accounts we’d definitely like a foreign/domestic split for the NFCs. The split provided here gives some reasonable growth measures for output in the current account but there’s still room for improvement on the income, capital and balance sheet side of things.

No comments:

Post a Comment