The publication last week of the Q4 Institutional Sector Non-Financial Accounts gives us a preliminary view of the various sectors of the economy in 2016. The figures are subject to revision but can still offer some useful insights. We’ll start here with a look at the current, capital and financial account of the household sector. First the current account. Click to enlarge.

The headline is towards the bottom and shows that (nominal) gross disposable income is estimated to have grown by 4.5 per cent in 2016. With consumption expenditure growing at a slower 3.5 per cent this means the saving rate increased in 2016 – which it did from 11.0 per cent in 2015 to 11.8 per cent in 2016.

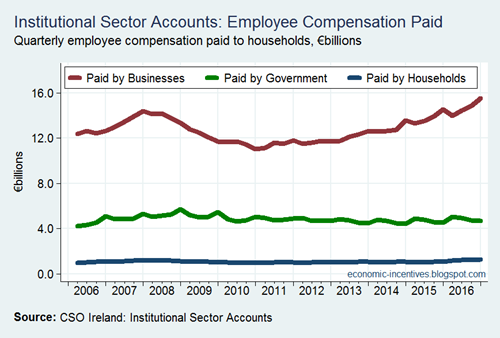

The path to this 4.5 per cent increase in gross disposable income shows a few interesting developments. Compensation of employees from the non-financial corporate sector continued its strong recent performance in 2016 growing by 7.5 per cent and is now up a remarkable 31 per cent from the level recorded in 2011. Although it is the smallest source of compensation of employees the fastest growth in COE was actually from the household sector itself (through unincorporated entities).

Compensation of employees from the corporate sector (financial plus non-financial) is now eight per cent greater, in nominal terms, than the local maximum recorded at the end of 2007. Most of this is due to the NFC sector as shown in the first table from which COE paid in Q4 2016 was up ten per cent on it end-2007 peak. Here is compensation of employees received by the household sector since the series began in 1999.

This increase in COE is reflected in higher taxes on income and social contributions paid by the household sector. Taxes on income paid by the household sector rose 3.4 per cent and social contributions paid to the government sector rose 7.8 per cent. So working through these gives the 4.5 per cent increase in gross disposable income.

Another notable feature of the data, as pointed out above, is that disposable income is rising faster than consumption expenditure. Here are the seasonally adjusted series provided by the CSO.

The widening gap between income and consumption in 2016 is evident. A couple of asides on the chart:

- Looking at the chart would appear to suggest as though the growth of consumption in 2016 was close to nil. In fact the Q4 number is actually slightly below the Q1 number. However, that does not mean the annual growth figure for consumption was close to zero. We have already seen that consumption expenditure grew by 3.5 per cent in 2016 and the seasonally adjusted figures in the chart above correspond with that. The growth is as a result of the “carryover effect”. Consumption might have been flat in 2016 but because there was growth in 2015, the quarterly levels in 2016 were above those from 2015. The fact that consumption ended 2015 higher than it began the year causes a “carryover effect” for growth in 2016 which will give an annual growth rate even if there is little quarter-on-quarter growth from that level in 2016.

- The measure of income in the chart is Total Disposable Income. This is Gross Disposable Income plus the adjustment for pension funds. This adjustment adds back in a deduction which is counted as a social contribution but is actually a form of savings, i.e. contributions to pension funds. This money is being put aside to fund consumption in the future. The adjustment for pension funds is the difference between social contributions paid to the financial sector and social benefits received from the household sector. For example, in 2016 the household sector paid €5,538 million of social contributions to the financial sector. The household sector received €2,980 million of social benefits from the financial sector. The adjustment for pension funds at the bottom of the table of €2,558 million is the difference between these two numbers.

The widening gap between income and consumption means the savings rate has increased. The savings rate is the gap as a percentage of Total Disposable Income.

What are people doing with these savings? To answer that we need to look at the capital and financial accounts.

First, it could be that people are using the savings to fund investment expenditure. We can look for evidence of this in the capital account. As would be expected the 2016 capital account for the household sector is hugely different to its 2007 equivalent.

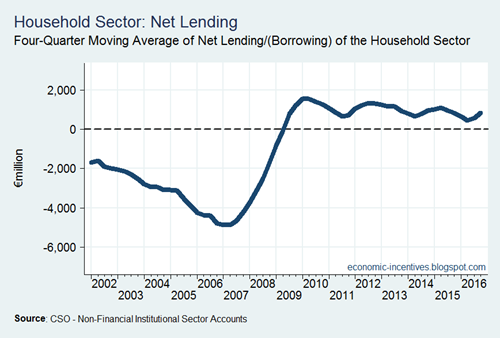

In 2007, the household sector has gross savings of €6.3 billion and undertook €23.2 billion of gross capital formation. Thus to fund consumption and investment expenditure the household sector was a net borrower in 2007 to the tune of €16.9 billion (overall borrowing was growing much faster but that was due to transactions – buying existing houses off each other).

A decade later and the household sector has gross savings of €11.7 billion but only undertakes €8.6 billion of gross capital formation. Capital spending by the household sector is rising (and grew 16.5 per cent in 2016) but remains below the level of gross savings. Thus the household sector is a net lender, and this was at a level of €3.4 billion in 2016.

We can see how this borrowing in 2007 was funded and get some insight into where the lending of recent years is going by looking at the financial account – and in particular the transactions of the financial account. The 2016 update won’t be published until later in the year but we can see the general trends in the changes to 2015. Of course, these are net figures with lots of underlying movements. The household sector isn’t a homogenous group. Some people are borrowing to fund expenditure now, others are saving to fund expenditure in the future and others are saving to repay previous while others may be buying or selling financial assets.

The most significant change is predictably enough for transactions relating to loan liabilities. Back in 2007 loan transactions increased household indebtedness by nearly €25 billion (drawdowns far exceeded repayments) while for the past few years loan transactions have reduced household indebtedness by between €5 billion and €9 billion (repayments have exceeded drawdowns). We can expect this to have continued in 2016.

On the asset side there has generally been an increase in deposits while transactions with insurance and pension reserves have seen a steady inflow of funds. The pension component of these transactions corresponds to the “adjustment for pension funds” seen in the current account, i.e. the difference between contributions to, and drawdowns from, certain private pensions. The transactions account also shows that the household sector is generally a seller of equity with the bulk of this made up of unlisted shares (private companies).

Here is the turnaround in financial transactions over the full period for which data is available. Net financial transactions was negative up to 2008 and has been positive since then.

Transactions are only one factor that affects the balance sheet which will also reflect the impact of reclassifications and revaluations. These are unlikely to significantly effect items like currency and deposits but can be a big factor behind changes in equity and pension reserves.

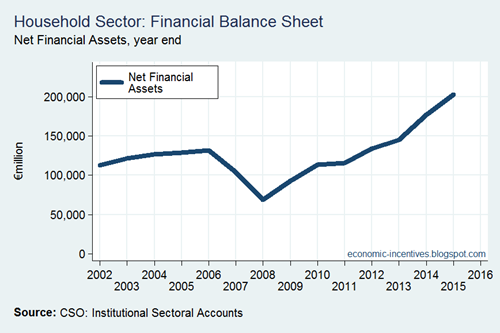

The net financial wealth of the household sector almost doubled between 2007 and 2015. This was due to three factors:

- €18.3 billion increase in Currency/Deposits (€18.2 billion of transactions)

- €37.9 billion increase in Insurance/Pension Reserves (€22.9 billion of transactions)

- €44.7 billion reduction in Loan Liabilities (€35.7 billion of transactions)

Of the €101 billion improvement in these items €77 billion was due to transactions. Reclassifications and revaluations had little impact on the change in Currency and Deposits. The increase in Insurance and Pension Reserves was €15 billion more than that explained by transactions while the reduction in loans was €9 billion greater than the reduction due to the transactions. Pensions funds have benefitted from rising asset values and there has been some write-offs of household debt.

The household sector’s financial balance sheet has been improving but around three-quarters of it has been the result of ongoing saving and debt reduction rather than revaluations. The overall balance sheet will include real assets (such as property, land, valuables etc.) but they are not part of this data.

Here are the aggregate financial assets and liabilities of the household sector since 2002.

The gap between the two lines above represents household net financial wealth. This passed €200 billion for the first time in 2015 and there is little doubt that this improvement is ongoing.

If housing assets were included net wealth would still be below the level seen in 2007. To conclude here is a measure of debt-to-income for the household sector.

No comments:

Post a Comment