There is lots of talk of soaring tax revenues at the moment. If we go back to the previous turning point in 2007 we have this statement from the then Minister for Finance, Brian Cowen, in October of that year which included the following:

However it is now expected that there will be some shortfall in overall tax revenues reflecting developments in some taxes such as stamp duty. While this will be somewhat compensated for by positive developments on other elements of the Exchequer account, an Exchequer deficit of up to €1 billion now seems likely.

The Exchequer Returns for the first nine months of the year underline the need to continue to implement prudent, sensible fiscal policies while at the same time giving spending priority to those areas which enhance our productive potential.”

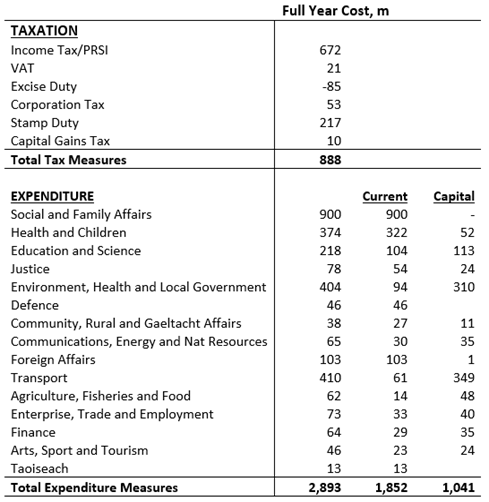

A little over two months later Budget 2008 was announced. Even with the predicted headwinds the Budget contained almost €900 million of tax reducing measures and €1.8 billion of current expenditure increases. This table is compiled from the Summary of Budget Measures:

Of course, many of these measures were (painfully) reversed over the following years. Here is an exchange from Brian Cowen’s testimony to the Oireachtas Banking Inquiry:

Deputy Kieran O’Donnell: Can I go back to the last budget you put through, which was the 2008 budget, which you would have put through in December 2007? Do you believe in line with the fact that, we’ll say, stamp duty from property tax was … had gone down in ‘07 by 20% and it collapsed heavily in ‘08 went down by nearly over 50%, should you have adopted a less expansionary budget for 2008 where you increased current expenditure by nearly 9%?

Mr Brian Cowen: Yes, I think I probably should have been less expansionary in that budget. It was the first year after an election and certainly there was … we did budget in lower housing output and all the rest of it. But looking back now I’d be, rather than defensive about it, I think I’d rather have done … spent a bit less then. But it was a new Government and issues arose there, but I accept that … it’s not the one I’m proudest of.

Deputy Kieran O’Donnell: What would you have done differently with it, if you had the chance?

Mr Brian Cowen: Spent a bit less.

Deputy Kieran O’Donnell: In what areas?

Mr Brian Cowen: Well, I mean, you’re asking me to redraw the budget now. I’m saying to you, you know, genuinely speaking, that looking back on it, I think the ‘08 budget, whilst it did account for the change in the situation and all the rest of it, I think probably there needed to be a … we needed to start a tighter position that year rather than allowing for the new Government to settle in, etc. Sometimes that can happen.

Budget 2016 was framed around a different turning point. One where tax revenues are far exceeding, rather than falling short, of expectations. It is very unlikely that Budget 2016 will lead to anything like the regrets expressed about Budget 2008 but hopefully we have learned to not leave it until after the next turning point to act. The point of a counter-cyclical policy is to be ahead of the curve.

No comments:

Post a Comment