We are all aware that the decision of September 30th 2008 resulted in a the creation of a contingent liability of around €440 billion for the State but details about this total have been scant.

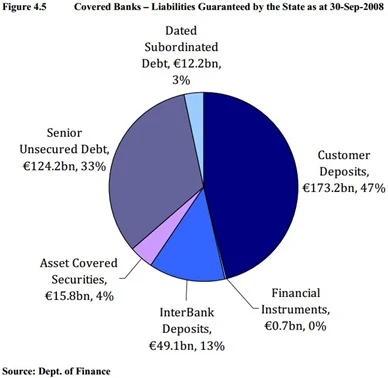

We know that €75 billion was a result of the Deposit Guarantee Scheme, the limits of which has been substantially increased just over a week previously and this chart from page 77 of the Nyberg Report provided an overall breakdown of the €375 billion of liabilities covered by the near-blanket guarantee.

Via an FOI request by TD Stephen Donnelly, new figures (well new to me anyway) giving the breakdown of these liabilities by institution have now been released. This may be raking over old ground but here are the figures. Click to enlarge.

There are no hot embers and the figures are much as would be expected from looking at the annual reports of the banks issued for this period (though only Anglo had a year-end at the time that coincided with end-September 2008).

The figures of central interest are undoubtedly those for Anglo and INBS. These are the institutions which, in retrospect, should not have been saved. All told, the State provided €34.7 billion of capital injections to shore up these delinquent institutions. Most of this money went to depositors.

Between them Anglo and INBS had €77.4 billion covered by the guarantee. Of this, €2.4 billion was date subordinated debt none of which matured during the two years of the guarantee and was subsequently subject to haircuts of between 50 and 70 per cent. That leaves €75.0 billion of liabilities to meet the €34.7 billion of losses covered by the State’s capital injections. For simplicity we will combine the two banks as one, which of course did subsequently happen.

If this could have been known at the time, or some immediate way was found to freeze these liabilities until the total loss was known then a haircut of 39 per cent would have been required. If a fixed 39 per cent haircut was applied across the board then the following losses would have resulted.

If put into resolution, the customer deposits up to €100,000 protected by the Deposit Guarantee Scheme (DGS) would need to be made good and the DGS would then take the place of the depositors but as an unsecured creditor of the bank. That is why the DGS appears in the above table of estimated losses and means the €34.7 billion would be spread across most of the banks’ creditors. [If the DGS deposits were paid from the assets of the bank the required haircut on the other creditors would rise to 46 per cent to give the €34.7 billion of savings. But that is not how it would work.]

Even if the bank was put into immediate resolution the DGS scheme would have had to meet a loss of around €5.2 billion and presumably this would have come from public resources. Of course there is also the question of where €13.2 billion would have come from to make good the covered deposits up front. It was going to be the “cheapest bailout in the world”.

After the losses that have remained to be absorbed by the State (via the DGS) we can see that depositors outside the DGS were sheltered from around €20 billion of losses through the guarantee and senior unsecured bonds from around €9 billion. This assumes that the same fixed haircut is applied to all creditors and that the resolution wasn’t botched to the same extent that the Cypriot case was four years later.

Haircuts to depositors would have been a very remote possibility in September 2008. If the resolution option was taken it is likely that all deposits would have been made good in the manner of the DGS-backed deposits with the State taking their place as an unsecured creditor.

To cover all the deposits in Anglo and INBS this would have required finding €63.8 billion up front with the State only getting €38.7 billion of this back if the resolution resulted in the same level of losses that have been provided for to date. A deposit rescue of Anglo and INBS would have cost the State €25.1 billion.

Simplifying assumptions aside this shows that, by amount, the big winners from the decision to guarantee Anglo and INBS were depositors, not bondholders. Bondholders did dodge something around €9 billion of losses through the failure to put Anglo and INBS into resolution around the time it became known they were insolvent. €9 billion is a massive amount of money.

No comments:

Post a Comment