The issue of further capital for the banks has attracted some attention in recent days. Prof. Brian Lucey had a piece in Saturday’s Irish Examiner and yesterday’s Sunday Business Post led with the headline ‘IMF warns of new €16bn black hole in Irish banks’.

The issue in the SBP piece is actually about the contingent liabilities of the State rather than the banks and the IMF have actually been making the same point for at least a year. Here is a quote from the IMF’s fifth review issued this time last year with the same 10% of GDP (€16 billion) contingency.

Recognition of contingent liabilities would constitute a one-off increase in the level of debt. Ireland’s contingent fiscal liabilities relate to the covered banks, the IBRC, and NAMA. There is no expectation of losses from these entities as the covered banks have been recapitalized under PCAR 2011, the IBRC meets capital adequacy requirements, and NAMA received assets at heavy discounts—averaging 58 percent—to protect its viability. Under the standard scenario, the assumption of 10 percent of GDP in contingent liabilities by the Irish government would raise the debt-to-GDP ratio to 124 percent in 2012 and cause it to peak at 129 percent in the following year, but starting from 2014 debt would start to decline steadily, reaching 123 percent by 2016. However, the debt trajectory would be higher if the higher debt level resulted in higher interest rates on new market funding.

Although the level and composition of the contingent liabilities have changed over the year (NAMA Bonds, ELG guarantees, ELA Guarantees), and are subject to further change because of the IBRC liquidation, the IMF have not adjusted the 10% of GDP contingency in their scenario analysis. It is not clear that they have given this issue much consideration recently.

In fact if we go all the way back to the IMF’s first review (May 2011) we find this graph in the annex on public debt sustainability (page 41).

And even before November 2010, the IMF included a ‘one-time 10% of GDP contingent liabilities shock’ in their debt sustainability analysis. Check out page 37 of the Article IV Report on Ireland published in June 2009.

So the IMF is not warning of a ‘new €16 billion black hole in the Irish banks’ but the broader question still stands: will the Irish banks need more capital? Maybe or maybe not. When Craig Beaumont, the IMF Mission Chief to Ireland was asked as part of the conference call on the publication of their latest report on Ireland (the ninth review) he was non-committal as can be seen below the fold.

SPEAKER: Great. Do you think the Irish banks will need more capital, leaving aside the Basel standards in terms of the --

MR. BEAUMONT: Well, like I said before, the analysis hasn’t been done and we can’t prejudge it.

The analysis is the latest PCAR (Prudential Capital Assessment Review) due to be completed over the next few months and published in the autumn. Of course we have been here before. There was the inadequate 2010 PCAR but this was followed by the much more granular analysis in the 2011 PCAR.

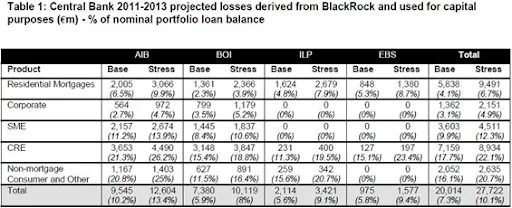

In the 2011 PCAR exercise the banks were recapitalised for expected losses in the adverse or stress scenario which, along with the baseline scenario, is summarised in the following table. Click to enlarge.

The projected losses used were those in the adverse scenario. A quick comparison to what has happened subsequently shows that the outturn has been worse than the baseline scenario but in most cases is slightly better than those in the adverse scenario.

The first estimates from the CSO are that, in 2012, GDP grew by 0.9% and GNP by 3.4%, Consumption declined by 0.9%, Investment grew by 1.2% and Government Consumption fell by 3.7%. All of these are better than the adverse scenario, though in some cases not by much, as were the outturns for 2011. The Balance of Payments current account recorded a surplus of close to 5% of GDP in 2012.

According to the QNHS, employment grew 0.1% in 2012 and the like-for-like unemployment rate with the above table finished the year at 14.2%. The CSO’s residential house price index shows that prices fell 16.7% in 2011 (close to the adverse scenario projection of 17.4%) but the 2012 fall of 4.5% was significantly better than even the baseline scenario projection of 14.4%. We don’t yet have full year data for personal disposable income but the data to Q3 (source) show a 4.1% increase on the first three quarters of 2011, while an annual decline of 1.2% was used in the adverse scenario.

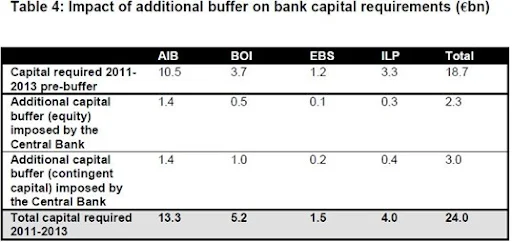

It is notable that the level of mortgage arrears are not included in the projections and it would be interesting to see what level, if any, was included in the analysis. The projections gave rise to the following capital requirements in AIB (now merged with EBS), BOI and PTSB (now separated from Irish Life).

Some €18.7 billion of capital was required to cover the projected loan losses under the adverse scenario that were expected to arise by the end of 2013. Additional capital buffers (equity and contingent capital) brought the total requirement to €24 billion.

The following shows how the €24 billion was reached in aggregate across the banks (click to enlarge).

The expected operating profit over the three years of close to €4 billion is unlikely to be achieved. In the stress case BlackRock Consultants projected that there would be €40.1 billion of lifetime loan losses in the banks. The Central Bank estimated that €27.7 billion of these would occur within the three-year timeframe of the exercise and these were deducted from the opening capital stock and balance-sheet provisions from the end of 2010.

A further €13.2 billion of losses were allowed for from the deleveraging of non-core loans. Although specific details of the deleveraging have not been provided it has been stated on a number of occasions that the “overall cumulative discounts incurred have been within PCAR assumed discounts.” The lower losses here, such that they are, may cover the shortfall on the €3.9 billion of expected operating profits.

Much of the focus will be on whether the €27.7 billion of three-year losses allowed for up to the end of 2013 will be enough and whether lifetime losses after 2013 will continue to erode the capital base. Last week’s IMF report has a useful summary of the position of the PCAR banks. Click to enlarge.

The banks’ core-tier one (CT1) capital has increased to €22.3 billion (from €13.3 billion at the end of 2010). The stock of loan loss provisions on their balance sheets has increased to €26.8 billion (from €9.9 billion at the end of 2010). When summed to €49 billion these are large relative to the €223.8 billion of gross loans that the banks have.

Finally, here is a breakdown of the €27.7 billion of three-year losses from the lifetime total of €40.1 billion used in the exercise. Again click to enlarge.

The banks have recognised some loan losses since the PCAR but if the banks were to fully recognise the losses shown above and write-off the projections as loan losses it could be almost fully covered by their current stock of provisions. Having no provisions would not leave the banks in a particularly sound state but given their existing capital they can set aside a further €6 billion for provisions (assuming no operating losses) and still remain above the 10.5% CT1 ratio.

It remains to be seen if this is enough but there is considerably capacity in the covered banks to deal with loan losses.

Seamus,

ReplyDeleteI'm wondering if you could assist me. You had a previous post where I seem to recall you hyperlinked to a PQ regarding the breakdown of the recapitalisation of Irish banks. I've been searching for that PQ and am unable to source it; would you be able to direct me to it?

Greg

Greg,

ReplyDeleteThis is the latest one I can find from October 2012.

http://oireachtasdebates.oireachtas.ie/debates%20authoring/debateswebpack.nsf/takes/dail2012100400051?opendocument

It won't include the sale of Irish Life or the BoI CoCos though.

ReplyDeleteБыли ли у вас случаи, когда вы теряли выгодных клиентов из-за отсутствия возможности выхода на международный уровень, либо отсутствия представительства в отдельно взятой стране?

UA-OFFSHORE является - профессиональным агентством, специализирующееся в регистрации предприятий более чем в 25 странах Европы. Мы способны предложить весь спектр услуг по регистрации юридических лиц, полного пакета услуг по регистрации ООО или ЗАО, необходимые для успешной деятельности: открытие счета в иностранном банке, арендная плата за офис, бухгалтерские услуги, весь комплекс юридических услуг. У нас есть свои свои представительства во Франции, Германии, Латвии, Ирландии и США. Пожалуйста, просмотрите наш сайт для уточнения деталей, либо его русскую версию.

Используя возможности нашей программы, Вы и Ваши клиенты можете заявить о себе не только в Европе, но также и в США, Японии и Китае.

Мы стремимся сделать нашу работу более прибыльной для Вас. Мы можем обсудить любые другие предложения о сотрудничестве с Вашей стороны.

Мы предлагаем гибкие формы сотрудничества: можем работать либо в области информационной поддержки Вашего бизнеса, а можем с клиентом непосредственно – по Вашему выбору.

Регистрация офшорных компаний

Оффшорный счет