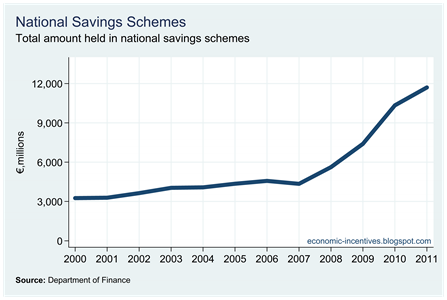

Although have we been “shut out” of bond markets, the EU/IMF is not the only remaining source of funding for the State. The National Treasury Management Agency (NTMA) run a series of State Savings Schemes and they have seen a substantial inflow of funds in the last few years.

After seeing annual increases of no more than a couple of hundred million between 2001 and 2006 and even a reduction in 2007 the annual change in the amount held in various State Savings Schemes soared from 2008 on. In 2010 almost €3 billion was put into this schemes and this dropped to under €1.5 billion in 2011.

The total amount in the schemes is almost €12 billion.

We don’t have details for 2011 yet, but the NTMA’s 2010 Annual Report gives some insight into the breakdown of the total amounts and annual changes for the different schemes in 2010 when inflows peaked at about €3 billion.

There was also close to €2.5 billion is various Post Office Savings Bank Deposit Accounts (including savings stamps) which took in almost €500 million in 2010.

Although small in the greater scheme of things this source of funding makes a useful contribution. An added advantage is that is cheap, the average interest rate is likely to be less than 3%. The average rate of the EU/IMF funds we had drawn down by the middle of November 2011 was 3.55%. At the end of 2011 the €12 billion in the State Savings Schemes will make up around 7.5% of Ireland’s General Government Debt.

No comments:

Post a Comment