A restructuring of the €31 billion of Promissory Notes given to Anglo Irish Bank and Irish Nationwide (now merged in the Irish Bank Resolution Corporation) has been getting a good deal of attention recently. Much of the focus has been on reducing the interest rate coupon on the Notes but as we have said a number of times it is not clear that this would actually save the State money.

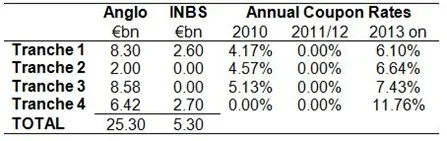

Here is a table of the issued Promissory Notes from a previous post.

When we account for the “interest holiday” taken in 2011 and 2012 the equivalent annual coupon for Tranche 4 is 8.6%. This means that the average annual coupon rate across the €31 billion was about 5.8%.

The interest rate on each tranche was based on the yield Irish government bonds of the same maturity on the day the tranche was provided to Anglo/INBS. This increased from 4.17% to 8.60% as the tranches were issued beginning on the 31st March 2010, though the second and third tranches on the 31st of May and 28th of June 2010, and finishing with the final tranche on the 31st December 2010.

For the first six months of 2011, Anglo reported it had Interest Income of €644 million on the €25.3 billion of Promissory Notes that it had received. The amount of the Promissory Note outstanding was reduced to €23.8 billion when the first annual payment was made on the 31st of March.

The “bank” also paid €519 million of interest to the Central Bank of Ireland for use of Emergency Liquidity Assistance (ELA). The total amount of ELA the bank was drawing down stood at €45.0 billion on the 31st December 2010 and had reduced to €40.8 billion by June 30th 2011. With an haircut of around 20% applied to the use of the Promissory Note as collateral it is clear that the Promissory Notes were supporting about half of the ELA that Anglo was drawing down.

Therefore we could allot around €260 million of interest expense to the ELA backed by the Promissory Notes. In the first six months of 2011 Anglo made an interest profit of around €380 million on its Promissory Notes transactions. As Anglo is 100% state-owned this profit is not lost. Any reduction of the interest rate on the Promissory Notes will simply reduce this profit and no money will be saved.

What about the €519 million of interest Anglo paid to the Central Bank of which around €260 million is due to the Promisory Notes-backed ELA? We don’t have the 2011 Annual Report for the Central Bank of Ireland yet but we we can track the flow of the interest that was paid to the Central Bank over the past few years. This is given under the heading 'Other' in the Income Received total in the Central Bank Annual Reports

2008: n/a

2009: €240.5 million

2010: €510.2 million

Given the level of ELA that was issued during these years it is possible that the interest rate charged was around 2.5%. In 2010, Anglo paid €435 million in interest to the CBoI for ELA so it is clear that the bulk of the ELA was issued to Anglo.

The full extent of the ELA (up to €50 billion) only arose in late 2010 so it will be interesting to track the 'Other' Income Received when the Central Bank publishes the 2011 Annual Report later in the year.

It is hard to see if this interest is paid on to anyone else by the Central Bank, with anyone else of course being the ECB. Earlier this week John McManus in a very good piece on the Promissory Notes in the Irish Times said:

"The Central Bank is in turn getting the money it lends to Anglo from the ECB at a much lower and not disclosed rate which is reported to be 2 per cent or less. It keeps the difference. The real cost to the State is the rate at which the ECB provides cash and it is far from penal."

In a piece from last February on the ELA, Laura Noonan of the Irish Independent wrote:

“While money that comes directly from the ECB is issued for terms ranging from seven days to 90 days, the money given out through ELA is typically granted for seven days.”

I’m not so sure the Central Bank needs to get the money. This might be the case but it is also possible that the Central Bank of Ireland just created the money as only central banks can do.

This little note on the ELA mentions nothing about a payment to the ECB and, says:

The little known ELA facility allows national central banks (NCB) to provide funds to domestic financial institutions in financial difficulty over and above the liquidity provided by the ECB's regular refinancing operations. These operations are separate from the Eurosystem, but the ECB's Governing Council can with a ⅔ majority oppose the granting of further ELA, if, for instance, it considers the emergency assistance provided constitutes monetary financing.

The assistance provided is supposed to be temporary and to an illiquid but solvent financial institution. The lending is not subject to ECB collateral requirements. Thus a bank can present its NCB collateral which would not be acceptable by the ECB (but which would be acceptable by the NCB).

If you really want to get into ELA you can read this five-page note from Citigroup’s Willem Buiter. On the first page it states:

Any profits or losses made from the collateralised lending of NCBs under their ELA facilities are for the account of the NCB alone and are not shared/pooled with the rest of the Eurosystem.

There is lots of technical sounding stuff here but it really throws little light on the subject. To try and track these profits we can look at the Central Bank surplus that is payable to the Exchequer each year. Here it is for the past six years.

2005: €109.2 million

2006: €98.5 million

2007: €183.4 million

2008: €290.1 million

2009: €745.9 million

2010: €671.0 million

There could be other reasons for this but the Central Bank surplus has increased in the period in which the ELA has been provided. The interest received from the ELA doubled to €500 million in 2010 but the Central Bank surplus fell. Again it will be the 2011 Annual Report that will give a more telling indication of the impact of the ELA in the surplus that is transferred to the Exchequer.

We know for definite that the interest profit that Anglo makes on the Promissory Notes is not initially lost as Anglo is 100% state-owned. It remains to be seen what Anglo will do with these profits. It appears that the chunk of the interest that the Central Bank takes for providing the ELA also stays within the State.

Hi Seamus,

ReplyDeleteWhile there may be profit coming from the ICB. I have my doubts about whether the “interest profit” from Anglo will ultimately accrue to the state. It was always my understanding that this capital, the P notes, must bear interest just as if was €31 bn of cash sitting in the banks account.

Dept of Finance already said if the government attached a zero rate to the €31 bn of promissory notes this would not have been sufficient to meet the regulatory capital requirements as set down by the Financial Regulator and an increase in the face value of €31 bn would have been required to satisfy these requirements.

As such if you reduce the interest rate the nominal face value has to increase. So if the interest rate wasn’t really an issue then we could simply charge 0 and just pay off the capital over ten years but because this would result in the banks needing additional capital we can't.

I think reducing the interest rate is irrelevant not necessarily because it is going around in circles and we will get it back but because we would need to increase the face value of the notes if we did reduce it.

Hi Patrick,

DeleteIf the interest rate was set equal to some value I think there might be someone to your point, but the rate was set equal to an Irish government bond of equal maturity on the date the Promissory Note was issued.

The interest rate was not set to provide a fixed amount of capital plus interest to Anglo. The interest rate was applied so that the Promissory Notes could be value "at par" on the Anglo balance sheet.

At the time this rate was chosen yields on Irish government bonds were around 4%. If the intention was to pour more money into Anglo surely a higher rate would have been chosen. By the time the final tranche was provided on the 31st December 2010 we had entered an EU/IMF programme and yields had ballooned to nearly 9%.

It was not a deliberate choice to set the interest rate so high, it was a function of the base rate that was chosen. If a different base had been chosen the interest rates could have been different.

The issue is to ensure that the notes can be valued at par by Anglo. This could be possible with a different (lower) interest rate but it won't save us money. Nor will reducing the interest rate require us to increase the nominal amount of the Promissory Notes. The Anglo debacle is going to cost us €30 billion. Interest rates on Promissory Notes is not going to change that.