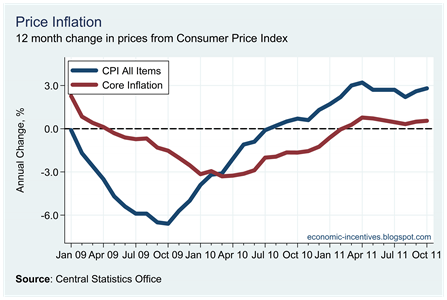

The headline rate of inflation from today’s Consumer Price Index release is 2.8%. However 2.33 percentage points of that are accounted for by just two categories: energy products and mortgage interest. These make up about 15% of the index. Mortgage interest is up 18.1% on the year and energy products are up 13.4% on the year.

The remaining 85% of the index, which we are using as a measure of ‘core’ inflation, contributes just 0.47 percentage points to the overall inflation rate and is showing annual inflation of 0.55%.

The headline rate is inflation is nearly 3% but outside of mortgage interest (and it is only standard variable rates that are picked up in the index) and energy products inflation remains low.

Am I correct in saying that the ECB inflation rate calculation ignores the effects of rate increases on mortgage repayments?

ReplyDelete