The previous post looked at the 3 per cent rise recorded for GNP in 2013 and attributed it to three factors.

- GDP remained unchanged;

- Retained earnings owed by companies fell by €3.4 billion; and

- Dividends received by domestic sectors increased by €1.3 billion.

The question that remained was why did GDP remain largely unchanged when the retained earnings owed by Irish-resident companies fell by €3.4 billion (with most of this likely owing to non-residents). The following table looks at Gross Value Added by sector of origin. Data back to 2007 are shown but it is the 2013 changes that initially interest. Click to enlarge.

As would probably be expected GVA from Industry fell by €1.6 billion (most of which is likely in Chemicals and Pharmaceuticals) and there was also a €0.9 billion drop in GVA from Distribution, Transport, Software and Communications (likely due to increased outbound royalty payments made by IT companies).

This €2.7 billion reduction was offset by small increases in GVA from the Agriculture, Forestry and Fishing sector and the Building and Construction sector. These increases were large in relative terms though at 6.6 per cent and 10.7 per cent.

Most notable though was the 3.1 per cent increase in GVA from the Other Services (including Rent) sector. This is:

The total of estimated earnings (cash and kind) and profits in the case of all professions, financial and insurance concerns, health services, personal services (private domestic service, hairdressing, undertaking, etc.), entertainment and sport etc. as well as net rent (actual and imputed).

Essentially this is NACE Rev. 2 sectors K-U excluding O. A breakdown of GVA by these sub-sectors is yet only available to 2012 and is shown below.

The notable changes are a 4.2 per cent in the GVA from Financial and Insurance Activities (K) and a 20.1 per cent rise in GVA from Administrative and Support Service Activities (N). It is not clear if the growth in these sectors continued in 2013. The growth in sector K is likely linked to the increased balance of services from the IFSC. Here are the sub-categories that comprise sector N.

7735 looks a likely candidate but not for €1.3 billion of additional GVA in 2012 surely. But what else could be expanding at that rate and magnitude? Call centre activities in 822 maybe but that doesn’t seen like a high value-added activity. Whatever is going on we’re doing a lot more of it and it likely explains a good deal of the offset that was necessary to counter the impact of the ‘patent cliff’ in the 2013 GDP outturn.

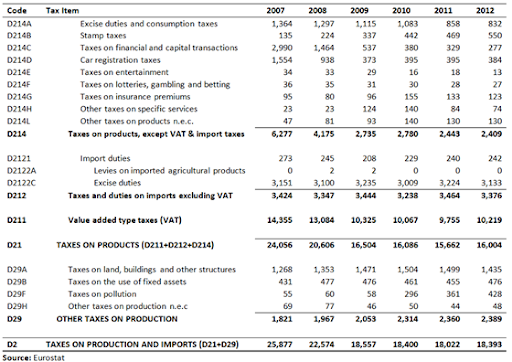

The other item in the first table that explains the stability of GDP is the 2.8 per cent increase in ‘Taxes less Subsidies’ which was equal to €413 million. The subsidies element of this is relatively stable most years (mainly from the EU) so most of the changes happen on the tax side.

To conclude it is probably worth noting the seemingly small drop that has been recorded for real Gross Value Added in the Irish economy. In 2011 prices, this peaked in 2007 at €153.3 billion. The provisional figure for 2013 is €148.0 billion, giving a drop of 4 per cent from the peak. Over the same period the impact of Taxes less Subsidies on GDP has fallen from €22.3 billion to €15.2 billion, a drop of 32 per cent.

In 2011 prices, GDP has fallen €13.3 billion (equal to 7.6 per cent) over the past six years. This can be broken down as:

- Reduction in Gross Value Added: €6.2 billion

- Reduction in Taxes less Subsidies: €7.1 billion

Changes in taxes have had a greater impact on GDP than changes in output. There have been some compositional changes in the sector of origin of GVA in the economy. Between 2007 and 2012 GVA from Chemical and Pharmaceuticals rose from €11.4 billion to €17.6 billion (in 2011 prices). This was not accompanied by an associated increase in employment. Over the same period there were significant reductions in GVA from Computers and Instruments and from Building and Construction. These did lead to significant losses in employment.

On the changes in taxes it can be seen that most of the reduction can be attributed to D214C: Taxes on financial and capital transactions, D214D: Car registration taxes and D211: Value added type taxes. And as we know large amounts of the activity that gave rise to these taxes was funded with borrowed money.

So why did GDP remain stable even if the patent cliff and increased royalty imports were negative factors (and reflected in the external income flows used in GNP)?

- Output in the Agriculture, Forestry and Fishing sector and in Building and Construction rose by modest amounts, €0.2 billion.

- Taxes on products rose by around €0.4 billion.

- Output in Other Services rose by close to €2.0 billion and is likely related to IFSC activities and aircraft leasing.

No comments:

Post a Comment