Both the Irish Independent and The Irish Times cover a teleconference given yesterday by Fitch on the Irish economy and the Irish banks. The Irish Times report summarises their conclusions on mortgages as:

The agency expects loan arrears to peak in 2014, and that 40 per cent of loans that are more than 90 days in arrears will begin to “reperform”. Another 40 per cent will be the subject of some type of writedown, with 50 per cent of the debt in this category being written off. The final 20 per cent of loans will see the associated properties being repossessed.

Overall, the agency believes 4.8 per cent of outstanding mortgage balances (ie, €2.2 billion) could be lost by the banks.

If these are applied to the entire market (the Fitch-rated banks in Ireland are AIB, BOI, PTSB and UB as can be seen in this report on Irish banks released earlier in the week) it would mean around 16,000 repossessions in the owner-occupier market.

The most recent mortgage arrears statistics show that there are 99,189 PDH mortgage accounts in arrears of 90 days or more. With an average of 1.25 accounts per household with a mortgage that means that around 80,000 households are in 90 day arrears. A 20 percent repossession rate would be 16,000 homes.

I have suggested similarly before: September 2013 and December 2012 and even back to November 2011. Any resolution of the mortgage crisis is going to involve a dramatic step-up in repossessions which as we saw in the previous post have remained incredibly low.

The relation between the number of accounts and the number of properties in the buy-to-let sector is not known. Unlike PDHs it is possible that one BTL mortgage account could encompass several properties.

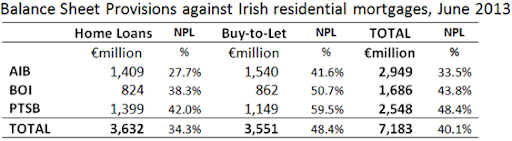

If we just focus on the ‘covered’ banks in which the State has varying equity stakes we see that they had €90.2 billion of Irish mortgages at the end of June 2013 as shown in this table.

Taking the 4.8 percent estimate of the outstanding mortgage balances that “could be lost by the banks” implies a loss of €4.3 billion if applied to the €90.2 billion of Irish mortgages that AIB, BOI and PTSB have.

It is not clear where the €2.2 billion figure in the reporting comes from. Using the figures above the closest fit is that it relates to PDH mortgages in the ‘state-owned banks’, AIB and PTSB: €31.1 billion plus €17.7 billion equals €48.8 billion which multiplied by .048 equals €2.3 billion.

Looking across all three banks the stress scenario three-year loss rate on Irish mortgages used in the 2011 PCAR exercise to calculate the capital needs of the banks was 9.2 percent (7.6 percent for PDH mortgages and 14.3 percent for BTL mortgages). Both are in excess of the 4.8 percent loss rate now projected by Fitch.

The nominal loss on Irish mortgages allowed for under the 2011 recapitalisation was €9.0 billion. Although substantial mortgage losses have been provisioned for very little has actually been crystallised since the 2011 PCAR exercise. As it stands the banks have €7.2 billion of provisions against their Irish mortgages.

Applying the 4.8 percent rate, Fitch estimate that the banks could lose €4.3 billion of outstanding mortgage balances (assuming it applies equally to PDH and BTL accounts). The banks have 66% more provisions than the projected losses estimated by Fitch.

However, the banks are going to have to continue to roll-out restructuring arrangements for the 40 percent of those in 90 day arrears who can get back on track but need a long-term restructuring. Many of these will involve a cost for the banks: permanent interest rate reductions, split mortgages and possibly capital forgiveness (though there seems little willingness on the part of the banks to allow this while the borrowers retains ownership of the property).

These loans may not appears in provisions or crystallised losses but this will involve a cost for the banks and, along with the continuing problem of ‘tracker rate’ mortgages, will hinder the banks’ ability to generate operating profits and bolster their capital base.

In advance of next year’s ECB stress tests Fitch say:

While this (the recent Balance Sheet Assessment undertaken by the Central Bank of Ireland) may reduce the banks‟ end-2013 capital adequacy positions, Fitch believes that once the CBoI’s observations have been considered the banks should be in a better position to withstand EBA scrutiny and tail risks should be reduced as a result of more conservative provisioning against NPLs.

While the banks will likely pass the ECB stress test in 2014 the impact of new capital requirements rules to be introduced over the medium term will be much greater. Fitch conclude:

Applying 2019 Basel III rules, Fitch estimates that Common Equity Tier 1 (CET1) would reduce to 5% in BOI and 4% in AIB which is weak in view of the high levels of net impaired loans/equity and underscores the need for these banks to be capital generative through profitability before their credit profiles can stabilise on a sustainable basis.

The banks are going to need more capital over the medium term. A return to profitability is one way to achieve this. Last week’s preference share sale and equity rights issue has shown that BOI can raise some capital from private market sources. The ability of AIB and PTSB do to so remains untested. AIB may begin in 2014 but a long-term restructuring plan is needed before PTSB will be able to do so.

Mario Draghi is right that the Irish banks remain a source of “some concern” but the key concern is not necessarily stress tests or capital ratios in the future (though they are important); the main concern remains the lack of resolution to the distressed loans the banks have now.

I was at the same meeting. I am not sure where the 2.2billion figure came from. It was not in Fitch's presentation and I do not recall it being mentioned.

ReplyDeleteGreat article Seamus. From the data it appears we're some way off a resolution & well behind our neighbours. No Central Bank data yet for Q4 2013 but for Q4 2012, there were 14,140 claims for repossession made in British courts whereas during the same period in Ireland, only 238 claims for repossession were made.

ReplyDelete