Today the CSO have released the Q4 2015 update of the Non-Financial Institutional Sector Accounts. By summing the quarterly data we can get provisional annual figures though these remain subject to revision when the full-year figures are finalised.

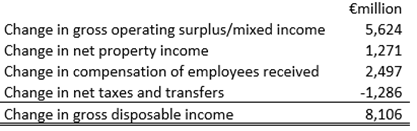

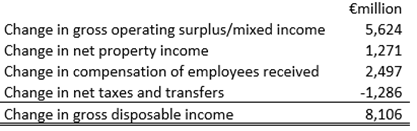

The annualised figures show that gross household disposable income increased by nearly 10 per cent to €94 billion in 2015. The €8.1 billion increase can be broken down as:

Clearly the biggest factor underlying the increase was the increase in gross operating surplus/mixed income. Gross operating surplus for the household sector is mainly imputed rent for home-owners and mixed income is earning from self-employment (and is also the balancing item in the accounts).

The output produced by the household sector surged in early 2015 and is now back (in nominal terms) to the level briefly seen in mid-2007.

We have previously looked at the employee compensation received by the household sector and the pattern of this series in the sectoral accounts now seems to better reflect what would be expected (previously is was not exhibiting an increase).

The increase in 2015 comes in at €2.5 billion but remains below those levels seen in 2007 and 2008. Around 45 per cent of the increase last year came from payments by the household sector itself (the self-employed paying staff). Compensation of employees from the government sector rose by close to €1 billion while payments from companies rose by less than half a billion (falling €200 million for financial and rising €600 million for non-financial companies).

Of course, a near 10 per cent increase in household disposable income hasn’t converted into an increase of consumption expenditure of anything near the same amount. We now have a growing gap between the two series (shown here in seasonally adjusted terms).

The effect of this is that the household savings rate increased from 5.0 per cent in 2014 to 9.5 per cent in 2015.

Here is a modified table showing the household sector in the non-financial accounts for the last three years. Click to enlarge.