The video below is from the EU Council press conference last night at which Commission President José Manuel Barroso had some interesting things to say about Ireland. The question from RTE’s Paul Cunningham that sparked Barosso’s comments begins at 04:45. The question lasts for about one minute. The response continues for nearly five!

Friday, December 20, 2013

Tuesday, December 17, 2013

Fitch on Mortgages

Both the Irish Independent and The Irish Times cover a teleconference given yesterday by Fitch on the Irish economy and the Irish banks. The Irish Times report summarises their conclusions on mortgages as:

The agency expects loan arrears to peak in 2014, and that 40 per cent of loans that are more than 90 days in arrears will begin to “reperform”. Another 40 per cent will be the subject of some type of writedown, with 50 per cent of the debt in this category being written off. The final 20 per cent of loans will see the associated properties being repossessed.

Overall, the agency believes 4.8 per cent of outstanding mortgage balances (ie, €2.2 billion) could be lost by the banks.

If these are applied to the entire market (the Fitch-rated banks in Ireland are AIB, BOI, PTSB and UB as can be seen in this report on Irish banks released earlier in the week) it would mean around 16,000 repossessions in the owner-occupier market.

The most recent mortgage arrears statistics show that there are 99,189 PDH mortgage accounts in arrears of 90 days or more. With an average of 1.25 accounts per household with a mortgage that means that around 80,000 households are in 90 day arrears. A 20 percent repossession rate would be 16,000 homes.

I have suggested similarly before: September 2013 and December 2012 and even back to November 2011. Any resolution of the mortgage crisis is going to involve a dramatic step-up in repossessions which as we saw in the previous post have remained incredibly low.

The relation between the number of accounts and the number of properties in the buy-to-let sector is not known. Unlike PDHs it is possible that one BTL mortgage account could encompass several properties.

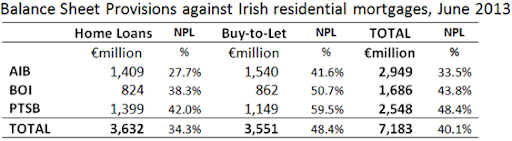

If we just focus on the ‘covered’ banks in which the State has varying equity stakes we see that they had €90.2 billion of Irish mortgages at the end of June 2013 as shown in this table.

Taking the 4.8 percent estimate of the outstanding mortgage balances that “could be lost by the banks” implies a loss of €4.3 billion if applied to the €90.2 billion of Irish mortgages that AIB, BOI and PTSB have.

It is not clear where the €2.2 billion figure in the reporting comes from. Using the figures above the closest fit is that it relates to PDH mortgages in the ‘state-owned banks’, AIB and PTSB: €31.1 billion plus €17.7 billion equals €48.8 billion which multiplied by .048 equals €2.3 billion.

Looking across all three banks the stress scenario three-year loss rate on Irish mortgages used in the 2011 PCAR exercise to calculate the capital needs of the banks was 9.2 percent (7.6 percent for PDH mortgages and 14.3 percent for BTL mortgages). Both are in excess of the 4.8 percent loss rate now projected by Fitch.

The nominal loss on Irish mortgages allowed for under the 2011 recapitalisation was €9.0 billion. Although substantial mortgage losses have been provisioned for very little has actually been crystallised since the 2011 PCAR exercise. As it stands the banks have €7.2 billion of provisions against their Irish mortgages.

Applying the 4.8 percent rate, Fitch estimate that the banks could lose €4.3 billion of outstanding mortgage balances (assuming it applies equally to PDH and BTL accounts). The banks have 66% more provisions than the projected losses estimated by Fitch.

However, the banks are going to have to continue to roll-out restructuring arrangements for the 40 percent of those in 90 day arrears who can get back on track but need a long-term restructuring. Many of these will involve a cost for the banks: permanent interest rate reductions, split mortgages and possibly capital forgiveness (though there seems little willingness on the part of the banks to allow this while the borrowers retains ownership of the property).

These loans may not appears in provisions or crystallised losses but this will involve a cost for the banks and, along with the continuing problem of ‘tracker rate’ mortgages, will hinder the banks’ ability to generate operating profits and bolster their capital base.

In advance of next year’s ECB stress tests Fitch say:

While this (the recent Balance Sheet Assessment undertaken by the Central Bank of Ireland) may reduce the banks‟ end-2013 capital adequacy positions, Fitch believes that once the CBoI’s observations have been considered the banks should be in a better position to withstand EBA scrutiny and tail risks should be reduced as a result of more conservative provisioning against NPLs.

While the banks will likely pass the ECB stress test in 2014 the impact of new capital requirements rules to be introduced over the medium term will be much greater. Fitch conclude:

Applying 2019 Basel III rules, Fitch estimates that Common Equity Tier 1 (CET1) would reduce to 5% in BOI and 4% in AIB which is weak in view of the high levels of net impaired loans/equity and underscores the need for these banks to be capital generative through profitability before their credit profiles can stabilise on a sustainable basis.

The banks are going to need more capital over the medium term. A return to profitability is one way to achieve this. Last week’s preference share sale and equity rights issue has shown that BOI can raise some capital from private market sources. The ability of AIB and PTSB do to so remains untested. AIB may begin in 2014 but a long-term restructuring plan is needed before PTSB will be able to do so.

Mario Draghi is right that the Irish banks remain a source of “some concern” but the key concern is not necessarily stress tests or capital ratios in the future (though they are important); the main concern remains the lack of resolution to the distressed loans the banks have now.

Monday, December 16, 2013

Repossession Statistics

The mortgage arrears statistics published each quarter rightfully get a lot of attention but included within the releases are figures which get little attention. These are the repossessions and court proceedings statistics that are also published. The focus here is only on the figures that relate to primary dwelling houses; buy-to-lets are not covered.

One reason they are not covered is that a useful time series of the data is not provided and the relevant numbers are only included in the text accompanying the statistics rather than in tabular form. The following table collate the figures from the quarterly releases to date.

First, is the number of repossessions.

In the last four years 2,386 houses repossessed. Of these, 70% have been repossessed through a voluntary surrender by the borrower. There have been just 738 court-ordered repossessions, less than 200 a year. Given the scale of the mortgage debt crisis we are in this is an incredibly small number.

Of the court-ordered repossessions it has been indicated that close to half are at the behest of sub-prime lenders who make up about 2% of the outstanding mortgage debt.

One important outcome that is missing is where a borrower is pushed into a forced sale of the house by the bank. This does not appear in the repossession figures as the bank does not take ownership of the property but the loss of possession for the borrower is the same. A related issue is what happens to any shortfall that might remain on the mortgage after the forced sale is concluded.

Next, we have the number of court proceedings issued and concluded each quarter.

There was a massive jump in the number of court proceedings issued in the last quarter. This is likely related to the lacuna in the law identified through ‘The Dunne Judgement’. This was recently resolved.

It can be seen that of the court proceedings concluded roughly half end with the granting of an order for repossession (though some are merely to formalise a voluntary surrender) and half are concluded by other means. Most of these see the borrower and lender enter a new arrangement through a restructuring of the original loan agreement with others ending by way of voluntary surrender/abandonment. Again no detail of forced sales is provided.

There have been 1,957 court-orders for repossession granted. There have been 738 court-ordered repossessions over the same period. Some of the repossessions orders are granted to formalise a voluntary surrender/abandonment that has already occurred and even though a court-order is granted the lender and borrower may enter a restructuring arrangement to try and avoid an actual repossession. Although the six-fold jump in the number of court proceedings issued this quarter may change it, there does not appear to be a significant back-log of court orders for repossessions waiting to be enforced.

The third element available is the number of properties that are in the possession of the lenders. This increases with the repossessions of the first table and is reduce by the properties sold shown here.

Over the past four years the lenders have sold just over 1,500 properties which were repossessed as PDHs and continue to have another 1,050 in their possession.

Finally, the figures previously includes the aggregate number of active court proceedings which had been issued and the number of formal demands which were outstanding. These aggregate figures have not been published since the second quarter of 2012.

It is not clear why these figures are no longer reported. Q3 2012 was the first quarter when arrears figures for the Buy-to-Let sector were provided but it may not related.

Ireland’s Regressive Tax System

A recent study from the Nevin Economic Research Institute looked at the combined effective rate of direct and indirect taxes on Irish households along the income distribution. The headline results are summarised in this chart.

The lowest contributions are in the third and fourth deciles and we have previously looked at the composition of the households in those deciles (albeit using the SILC rather than HBS as used by the NERI study).

So what can we say about these estimated tax burdens. The following table gives the estimated nominal amounts paid by each decile.

The estimated average tax burden is €12,900 per household. According to the Census taken in April 2011 there were 1.7 million households in the country. Thus the total amount of tax included in the effective tax rates is €12,900 x 1.7 million = €21.9 billion (of which €12.5 billion is “direct” and €9.4 billion is “indirect”). That is a lot of tax but it is around half of the total tax actually collected in 2010. The 2010 tax take is summarised in this table.

Of course, the incidence of taxation is incredibly difficult to determine. Direct taxes are deducted from income but even that is not enough to isolate the economic incidence of the tax. Do employers need to pay a higher wage to attract workers from a abroad in locations with high income taxes? This is an issue in various soccer leagues. Determining the exact incidence of indirect taxes is almost impossible.

If a household buys something for €123 that includes VAT at 23% then the amount of VAT in the price is obviously €23. However, this doesn’t mean the purchaser paid the full amount of VAT. It depends on what the price would be in the absence of the VAT.

If the VAT was eliminated the price might fall to, say, €110. It is incorrect to say the household has paid €23 VAT when the price absent a VAT would be €110. In this case the retailer, or some other element along the production chain, has absorbed part of the VAT.

The NERI report covers €5.7 billion of VAT (€3,360 x 1.7 million) as opposed to the €9.9 billion actually paid but it is not stated why this gap is present. It could, in part, be because of VAT paid by businesses not fully passed on in the price. Of course, this will be reflected in lower profits and dividends from the business so the burden of the taxation will ultimately be borne by households as is the case for all taxes. Some of those households may be outside the country as with Corporation Tax with around 75% of the total paid by foreign-owned companies.

There will be many small businesses who would regard the rates, excise duties and other taxes which they might not be able to pass on through prices as coming out of their income. Of course, there will also be many cases where rates, duties and other taxes are put into the price but are not explicitly listed. However, in the sense that these may affect all households equally it may not alter the overall results. Then again they may not.

Returning to the household level it is worth looking at the income and expenditure figures for each decile. The tax rates shown in the first chart above are as a percentage of gross income while the dominance of indirect taxes for the lower deciles means that the amount of tax paid is, in the main, a function of expenditure. This table from the report summarises these.

One of the notable features is that average expenditure of households in the lowest decile is almost two times greater than their disposable income. This is also true for the second, third and fourth deciles though not to the same extent.This is not an unusual feature of household surveys and the following is noted by the CSO in their publication of the 2009/10 Household Budget Survey:

There are many reasons why expenditure may exceed income in lower income decile households and this is a common experience internationally in income and expenditure surveys. Households with recently unemployed household members may draw on savings to maintain their expenditures. Self-employed consumers may experience business losses that result in low incomes, but are able to maintain expenditure by borrowing or relying on savings. Third level students may get by on loans or savings from summer employment, retirees may rely on savings and investments. In addition, across all deciles there may be an under-reporting of certain categories of income (e.g. shadow economy employment income).

On the income measure in the HBS the CSO note that:

The HBS [.] calculates income on the basis of the “current income level” of the individual without adjustment for employment activity over the year in question.

The HSB is a weekly survey rather than an annual one with respondents reporting their income and expenditure over a two-week period. Is it appropriate to calculate an effective tax rate using expenditure now when the income may have been earned previously?

In the 2009 SILC the average disposable income of households in the lowest income decile (as measured over a year) was €11,000, around 12% higher than the equivalent figure in the HBS. For the top decile the SILC has a figure of €118,300 versus €119,500 in the HBS, a difference of 1%. The HBS may not the optimum instrument to measure income but it is good at what it is designed to measure: expenditure. Here are the expenditures, estimated indirect tax burdens and effective tax burdens as a percentage of expenditure by decile.

Although VAT has some progressive features with most necessities zero rated it can be seen that the proportion of expenditure accounted for by indirect taxation is inversely related to expenditure. The greater the level of expenditure the lower is the proportion taken in indirect taxes. This is likely due to consumption patterns, particularly in relation to high excise duty goods, and also the disconnect between some indirect taxes and expenditure such as the television license, credit/debit card levies and annual motor tax to a certain extent.

Although there may be difficulties measuring it there can be little doubt that indirect taxation in Ireland is regressive. Whether it is sufficiently regressive to offset the very high progressiveness in direct taxation is less clear cut. Finally, the CSO also give a breakdown of the income by direct income and state transfers for each decile which can be used to infer that Ireland’s overall tax and transfer system is progressive.

Friday, December 13, 2013

The Protected Third Decile

Earlier the week the ESRI published a report that analysed the impact of budgetary policy since October 2008 on household disposable income. It is summarised in this chart.

The commentary on the chart in the report says:

These results do not conform with either a progressive pattern (losses increasing with income) or regressive pattern. (losses declining with income). Over a substantial range (deciles 4 up to and including decile 9 – and also decile 2) the pattern is broadly proportional. But this does not extend to whole income distribution. Contrary to some perceptions of a sharper squeeze on middle income groups, the greatest losses have been at the top of the income distribution, and the next greatest losses at the bottom. Only the third decile had a significantly lower loss (under 10 per cent) than others.

Our focus here is on the final comment. Why did the third decile have a significantly lower loss than the others?

One way to answer this is to look at the composition of households in each decile of equivalised disposable income. This can tell us who is in the third decile. Here is a table that looks at the composition of households by decile in the 2009 SILC. Click to enlarge.

It is pretty clear which households are over-represented in the third decile. Individuals from households with one adult aged over 65 made up 7% of the 12,641 individuals in the households surveyed by the CSO for the 2009 SILC but comprised 22% of individuals in the third income decile. The only other individuals overrepresented in the third decile are those from households with two adults with at least one aged over 65(12% of the sample and 17% of individuals in the third decile).

Combined individuals from these households with adults aged over 65 made up 19% of the sample and 39% of individuals in the third decile.

It should first be noted that the proportions here are those in the survey sample not necessarily those in the population. It is the over/under representation in each decile that provides insight. It should also be noted that the top chart covers changes in disposable income from 2009 to 2014 while the above table of household composition uses data from the 2009 survey only but it is still probably a useful indication of who comprises the protected third decile who have “had a significantly lower loss than others”. Value judgements are left to others.

Aircraft imports take a nosedive

We have looked aircraft imports before and today’s release from the CSO of the Trade Statistics for September further highlight the drop in aircraft imports in 2013.

Imports of large aircraft in the first nine months of 2012 were 51 units worth €2.2 billion. In the same period in 2013 there have been 21 units imported worth €0.7 billion. The most notable changes are the reductions in aircraft imported from Brazil and the United States (which were usefully explained in a comment to the previous post).

The impact of these large changes relative to 2012 is that the balance of trade will be improved and the level of investment (fixed capital formation) will be reduced. The €1.5 billion reduction in aircraft investment will be a significant drag on the measure of “domestic demand” that will be published with next week’s quarterly national accounts but the impact on the ground will be negligible.

Of the large aircraft imported last year 29 units worth €1.6 billion were imported in the first three months. This led to a significant spike in gross fixed capital formation in Q1 2012 in the Quarterly National Accounts that was reversed in Q2.

As item 792.50 in the table above shows imports of spacecraft remain zero. Maybe we don’t need any for the economy “to take off like a rocket”.

Thursday, December 12, 2013

Inflation is near zero but not in all sectors

Today’s CPI release from the CSO puts the headline rate of inflation at +0.3 percent. However, that is being dragged down by mortgage interest (-6.0 percent) and energy prices (-2.8 percent). These make 15 percent of the overall index. If we strip those out to get a measure of ‘core’ inflation we see the following.

Core inflation is running at around +1.0 percent but this in itself is driven by some fairly particular price increases. Details of these are below the fold. The pattern of where the price increases in the Irish economy are coming from should be easy to identify.

Wednesday, December 4, 2013

A profit from the BOI bailout?

This morning Bank of Ireland have announced that they indeed to redeem the €1.8 billion of preference shares held by the National Pension Reserve Fund in the bank. Since the onset of the crisis the State has contributed €5.8 billion to Bank of Ireland. This comprises:

- €3.5 billion of preference shares in February 2009

- €1.3 billion of ordinary shares in July 2011

- €1.0 billion of contingent capital notes in July 2011

That is a total of €5.8 billion. And what has been returned?

In April 2010 it was announced that €1.7 billion of the preference shares would be cancelled as part of a swap with ordinary shares in the bank. That left the €1.8 billion of preference shares in today’s announcement. As part of the swap the State received around €0.5 billion in warrants for the cancellation of the preference shares.

In July 2011 it was announced that around €1 billion of ordinary shares held by the NPRF would be sold to private investors. In January 2013, the sale was completed of the €1 billion of contingent capital notes held by the Minister for Finance were sold.

When the €1.8 billion from today’s announcement is received that will bring the total received from asset transaction to €4.3 billion.

There have also been substantial income receipts from Bank of Ireland over the past four years. These include transaction fees (€0.1 billion), preference share dividends in cash (€0.6 billion), contingent capital interest (€0.2 billion) and various guarantee fees (€1.5 billion). These total €2.4 billion.

Thus total receipts from Bank of Ireland over the past four years are €6.7 billion which is a surplus of almost €1 billion over the €5.8 billion put in.

It can be seen though that the “profit” only arises with the inclusion of the various guarantee fees and not simply from the financial transactions with Bank of Ireland. These were a ‘fee for service’ and providing the guarantee was not a costless operation for the State. Only monies paid to Bank of Ireland are included while costs carried by the State (higher interest rates, reduction/elimination of market confidence) are ignored. It is probably appropriate to omit the guarantee fees when determining the profit/loss from the State’s financial transactions with Bank of Ireland.

That means we are still nursing a €0.6 billion loss. However the State still holds a 15 percent equity stake in Bank of Ireland (which will be diluted slightly by today’s announcement if the State does not participate in the rights issue). With a current market capitalisation of around €8 billion this stake is worth around €1.2 billion. We may yet turn a profit on the bailout of Bank of Ireland.

Saturday, November 30, 2013

Reporting the mortgage crisis

There are huge problems in relation to mortgage debt in Ireland and the issue is deservedly a front-page story. But sometimes the headlines are hugely out of the proportion to the problems we face. Here are two recent front-pages from the Irish Examiner.

The Headlines

Today’s paper has a story under the headline:

“25,000 lose ownership of their homes in six months as banks tackle arrears”

and about two months ago the paper’s lead story had the headline:

“One-third of home loans are two years in arrears”.

Both front pages are reproduced below the fold.

The Reality

In the six months from April to September 2013 there were 139 forced repossessions of primary dwellings homes and 293 cases where owner voluntarily surrender possession. The headline is out by a factor of 60 and is reflective of a misleading statement in the opening paragraph:

More than 25,000 people who were in arrears lost their homes between April and September, according to the latest figures from the Central Bank.

The latest mortgage arrears statistics from the Central Bank show that 31,834 mortgage accounts out of a total of 768,138 accounts are in arrears of two years or more. This is 4.1 percent of the total (at the time of the article the figure was 3.8 percent). The headline is out by a factor of eight. To be fair the claim in the headline is not part of the article.

Today’s Irish Times details a survey which shows massive differences between public opinion and facts. Judging by these front pages it is not difficult to see how such perceptions get a foothold.

Sunday, November 24, 2013

€12 Billion from Corporation Tax – Again!

In today’s Sunday Business Post David McWilliams has an article that runs under the headline “What’s to be done about tax?”. Knowing something about it would probably be a good place to start. [The article is now available here.]

The article repeats a claim made a little over a month ago about American MNCs:

“If these companies were to pay tax at the very low rate – by international standards – rate of 12.5 per cent, the exchequer would net €12 billion in corporation tax per year. €12 billion! No doubt some other jurisdictions would claim they should have a share of this, but Ireland is currently where the profits are booked.”

We looked at this €12 billion claim when it was first made. The starting point for it is data from the US Bureau of Economic Analysis and, in particular, this release on the foreign activities of US Corporations. The very first page shows a “net income” figure of $95.575 billion in the row marked “Ireland”. And 12.5 percent of $96 billion is $12 billion (we will ignore the fact that the Revenue Commissioners collect tax in euro rather than dollars).

But just because the US Bureau of Economic Analysis labels these earnings as “Irish” does not mean they are in Ireland. There are “Irish” people living in close to every country in the world. The details behind the BEA statistics can be found in this methodology with page 12 giving the definitions used for their “Classification by Country”. A quick read will show that place of incorporation is one of the key determinants used when the BEA decide the location of foreign affiliates of US MNCs.

Can we find this $96 billion of net income in Ireland? Let’s see. First, lets try the Revenue Commissioners. Even if the profit is being taxed at a very low rate if should still show up in the the total amount of “net taxable income/profits” in Ireland. In 2010 (the same year as the BEA figures) “net taxable income” was €40.2 billion. See the very last figure in this release. That is €40.2 billion for ALL companies in Ireland.

Second, we’ll try the CSO as they also measure the performance of firms in the Irish economy. In their Business in Ireland 2010 release they say (page 36):

Foreign multinationals in Ireland – the story for 2010

It is estimated from the Structural Business Surveys that

over 3,100 or 1.9% of the 161,200 enterprises in

selected sectors of the business economy in Ireland

were foreign-owned in 2010.Despite the small number of foreign-owned enterprises,

they were very significant in terms of employment,

turnover and GVA. They employed almost 257,000 or

22.3% of the 1,151,000 persons engaged in the

selected sectors. They also generated almost €162.4

billion or 54.8% of the €296.5 billion in total turnover and

over €44.0 billion or 55.6% of the €79.2 billion in total

GVA.

So foreign-owned enterprises generated around €44 billion of Gross Value Added (GVA). To get Gross Operated Surplus (GOS) remuneration of employees would have to be subtracted (257,000 times say €40,000 is a little over €10 billion). That gives around €34 billion of Gross Operating Surplus for ALL foreign-owned companies in Ireland.

“Gross Operating Surplus” as recorded by the CSO is a different measure, though somewhat similar in principle, to “Net Income” reported to the Revenue Commissioners. The point is simply that nothing in Ireland gets us close to the $96 billion income figure reported by the BEA.

The CSO’s Balance of Payments gives us a measure of “repatriated profits” out of Ireland. In the Balance of Payments income flows are accounted for when they are earned rather than when they actually leave the country (one reason for this has to do with the GNP measure of national income). Anyway, here are the income outflows attributed to “Direct Investment Income: Income on Equity” for the past five years:

2009: €33.2 billion

2010: €36.1 billion

2011: €38.0 billion

2012: €38.8 billion

In 2010, equity investment in Ireland (ownership of companies) by foreign nationals had earnings of €36.1 billion. Again this is for ALL foreign nationals not just US MNCs.

So is the US BEA data wrong? No, it is perfectly correct. It is the use and interpretation of it that is wrong. Here are two extracts from the BEA methodology:

If an operation or activity is incorporated abroad—as most are—it is always considered a foreign affiliate.

[.] if a business enterprise that is incorporated abroad by a U.S. person conducts its operations from, and has all of its physical assets in, the United States, it is treated as an incorporated foreign affiliate in the country of incorporation, even though it has no operations or physical assets there. This treatment ensures that the foreign entity is reported to BEA.

Why are these important? These bring us to Apple which has been reporting annual net income of around $40 billion for the last few years. The company was the subject of a very information US Senate investigation in May. Here is an extract from the opening statement given by the committee chairman Sen. Carl Levin (D) to the hearing about three Irish-incorporated Apple subsidiaries:

Take AOI. AOI has no owner but Apple. AOI has no physical presence at any address. In thirty years of existence, AOI has never had any employees. AOI’s general ledger, its major accounting record, is maintained at Apple’s U.S. shared service center in Austin, Texas. AOI’s finances are managed by Braeburn Capital, an Apple Inc. subsidiary in Nevada. Its assets are held in a bank account in New York.

AOI’s board minutes show that its board of directors consists of two Apple Inc. employees who live in California and one Irish employee of Apple Distribution International, an Irish company that AOI itself owns. Over the last six years, from May 2006 through the end of 2012, AOI held 33 board meetings, 32 of which took place in Cupertino, California. AOI’s lone Irish-resident director participated in just 7 of those meetings, six by telephone, and in none of the 18 board meetings between September 2006 and August 2012.

ASI’s circumstances are similar. Prior to 2012, ASI, like AOI, had no employees and carried out its operations through the action of a U.S.-based board of directors, most of whom were Apple Inc. employees in California. Of ASI’s 33 board meetings from May 2006 to March 2012, all 33 took place in Cupertino.

In short, these companies’ decision makers, board meetings, assets, asset managers, and key accounting records are all in the United States. Their activities are entirely controlled by Apple Inc. in the United States. Apple’s tax director acknowledged to the Subcommittee staff that it was his opinion that AOI is functionally managed and controlled in the United States. The circumstances with ASI and AOE appear to be similar.

According to the Senate report, Apple Sales International (ASI) reported pre-tax earnings in 2010 of $12 billion. As the statement from Sen. Levin makes clear ASI carries out all its activities in the US. In the BEA statistics this income is attributed to Ireland because AOI is an Irish incorporated company. These companies are not resident in Ireland for either Revenue or CSO purposes or any purposes.

The McWilliams article asks “where do you think enormous amounts of US multinational money is on deposit? Yes, you guessed right, in the deposit accounts of the big US banks in the IFSC.” Well, in the case of Apple that is plain wrong. In its submissions to the US Senate Apple was clear that its “foreign” cash is “held in a bank account in New York” and “managed by Braeburn Capital, an Apple Inc. subsidiary in Nevada.” There is no evidence that the money ever even passed through Ireland.

The structures of other US companies provide similar conclusions. Companies such as Google and Microsoft have large sales operations in Ireland but these operation do not report very large profits. Why? Because they pay patent royalties for the rights to use their parent company’s intellectual property. Ireland is a low-tax country for corporations but it is not low-tax enough for them to shift the economic rights of their intellectual property here and it is to the IP that most of the profit is attributed.

Here is a chart from the CSO’s Balance of Payments on patent royalty flows in and out of Ireland.

What does it show us? There are massive outflows of royalty payments (€28 billion in 2010) and much smaller inflows (€2 billion in 2010). There have been efforts in recent Finance Acts to make Ireland more attractive for holding companies but the effect is small compared to the outflows of royalty payments. The outflows hugely reduce the profitability in Ireland of the MNCs operating here.

In 2010 there was a €22 billion outflow “other business services”

Where does this money flow to? Much of it flows to small island nations like Bermuda and the Cayman Islands. Google book massive advertising revenues in Ireland but the profit is attributed to intellectual property that is held in Bermuda. The holding company, Google Ireland Holdings is Irish incorporated but the royalty payments made to it are outflows in the Balance of Payments and the profit is not taxable in Ireland. Microsoft’s Round Island One is also resident in Bermuda though Irish incorporated.

In recording massive sales for US MNCs in Ireland the BEA is correct. These are also evident in the CSO data. However, the profit from these sales is shifted out of Ireland in the form of patent royalty payments. The BEA attribute these profits to Ireland as the holding companies are Irish incorporated.

The Apple holding companies are currently tax resident no where and thus pay no corporation tax. (Last month’s Budget announced that such a structure using Ireland will no longer be possible from the start of 2015). Google, Microsoft and other companies are their holding companies, and profits, in Bermuda (the rate of corporation tax in Bermuda is zero).

Companies should not be able to claim “stateless income” and curbs have to be put in place on their ability to shift profits to no-tax jurisdictions. This is one of the goals of the OECD’s BEPS initiative but it is far from clear that anything substantive will be achieved.

Do US MNCs pay their “fair share” of corporation tax in Ireland? This is what they do pay from a recent article by Keith Walsh, economist with the Revenue Commissioners:

In 2009, US companies paid 43% of all Corporation Tax paid in Ireland.

In 2010, the amount of taxable income recorded by the Revenue Commissioners was €41.2 billion. The amount of Corporation Tax paid was €4.2 billion – an effective tax rate of 10.3 percent. In the SBP piece is is argued that:

Multinationals in Ireland do not pay 12.5 per cent; they pay on average 2.5 per cent tax on profits. This is a joke and the joke is on you because that which they don’t pay, you do.

If there was some way we could stop the MNCs shifting their profits out of Ireland this might be relevant. But at the moment we can’t. The sales are booked here but the profits are not. It is a bit of a joke to suggest that:

The gain to Ireland would be huge. The budget deficit would be eliminated immediately and the country would run a surplus.

According to Keith Walsh, US companies contribute close to €5 billion to Ireland’s total tax take. Next year Exchequer tax revenue will be around €40 billion. Now that is really 12.5 percent.

Tuesday, November 12, 2013

Irish Independent 12/11/13

Here is a piece published in the Irish Independent that looks at some of the details behind the collapse of Newbridge Credit Union.

More credit union failures are inevitable - and we'll pay price

Two additional points that space constraints meant they didn’t make it past the sub-editor are:

The €54 million that is being provided to PTSB from the Credit Union Resolution Fund is roughly split as half to cover the existing capital shortfall on the balance sheet and half to cover the additional losses that the special manager has projected.

and

There have been protests from credit unions members but absent this rescue through PTSB the credit union would have crashed in a matter of weeks. Somewhat paradoxically they are protesting against being bailed out.

Tuesday, November 5, 2013

European Growth Map 2014

Here is a slide from a presentation used this morning by Olli Rehn when introducing the Commission’s Autumn 2013 Economic Forecast.

The north/south divide is strong with this one.

Friday, November 1, 2013

DoF Mortgage Arrears Release

Yesterday, the Department of Finance published the first in a new set of monthly mortgage arrears and restructures figures. Hopefully, the series will be expanded because the first issue contains almost nothing that is new and also has some errors.

The errors don’t relate to the arrears figure but to the comparison between the number of houses in the country and the number of mortgage accounts. This is shown in the ‘key highlights’ (click to enlarge):

The left panel of the middle section indicates 700,000 of the 1.9 million houses in the Ireland have “mortgages covered under MART”. This is not correct. Yes, there are nearly 2 million housing units in Ireland, as was measured with Census 2011:

However, the number of units with a mortgage is not the same as the number of mortgage accounts. A separate measure in the Census showed that of the 1.65 million units occupied by the usual residents that just over 580,000 were owner-occupiers with a mortgage.

The 699,674 used in the DoF release would only be appropriate if the relation between mortgage accounts and houses was 1:1. It is not. There are many household who have more than one mortgage account on the principal dwelling house (PHD). This can be because of top-ups, remortgages or splitting a mortgage between different interest rate types.

Previous work by the Central Bank has shown that the ratio of mortgage accounts to PDHs is around 1.27:1. Therefore the 699,674 mortgage accounts in the MART corresponds to roughly 550,000 houses/households. This means 27.6% of houses in Ireland have “mortgages covered under MART” not 35%.

The figures on mortgage restructures add little to what is already known from the quarterly figures published by the Financial Regulators office. There is a breakdown of “permanent” versus “temporary” but this is broadly known from the type of restructure used. It would be useful if this breakdown was further distilled into those accounts which are in arrears and those accounts which are not.

It would be even more useful if the success rates of the restructures were published, i.e. whether the borrowers are meeting the terms of the restructures. The figures from the FR indicate that 76% of the restructures are being adhered to but we do not know which restructures this applies to.

The fact the 75% of mortgages in 90 day arrears or more have not been restructured is not news but it did make the front pages of today’s Irish Examiner (image) and The Irish Times (image).

Most mortgages 90 days in arrears not restructured

Three-quarters of mortgages over three months in arrears at Ireland’s six main lenders have yet to be restructured, figures from the Department of Finance show.

Three in four home loans in long-term arrears are not being restructured by the banks despite lenders having a range of mortgage solutions to offer borrowers.

The data shows 62,210 of these long-term arrears mortgages were not restructured, while solutions were agreed for just 20,424 loans.

It is very unlikely that all loans in arrears will, or even can, be restructured. It is possible that a borrower who has historical arrears may now be back “on track” and hence a restructuring is unnecessary. This highlights another shortcoming with the arrears data – they do not tell us whether a borrower is accumulating arrears now. A measure of the number of accounts in arrears now, or even better, a measure of the number that are currently covering the interest on their loans would be very very useful.

It is also the case that there are many loans where a restructuring is just not possible. For example, Ulster Bank have said that 35% of their customers who are in 90 day arrears are either not engaging or are not paying anything towards their mortgage. It is nearly impossible to put a restructure in place in such circumstances.

It is also worth noting that a further 50,672 mortgages which are not in arrears have also been restructured. This could be because any arrears has been repaid or recapitalised or because the restructure stopped the mortgage falling into arrears in the first place. In total 71,086 mortgages in the sample have been restructured which is a lot of activity.

Finally, the data in this release represents 90% of all mortgage accounts in Ireland. In this sample, 82,824 out 699,674 accounts were in 90 day arrears at the end of August. That is 11.7% of mortgage accounts in the sample.

The most recent data from the FR for the entire mortgage market is for the end of June. At that time, 12.7% of all mortgage accounts were in arrears of 90 days or more. That means the tenth of mortgages that are in institutions outside the MART process have an arrears rate of 21.5% – nearly double the rate of arrears of those in the DoF sample. The lenders here include INBS, BoSI, Start, Danske and although they are smaller than the other lenders in proportionate terms their arrears rates are far worse.

Tuesday, October 29, 2013

Retail sales get stuck

The CSO have published the September update of the Retail Sales Index. Excluding the motor trades, the volume index was unchanged in the month with the value index showing a slight decline. The increases seen during the sunny summer have not been sustained into the autumn.

In annual terms, the 2013 figures are now coming up against the short-lived increase that occurred from June to October 2012 (in part driven by the digital switchover for television signals). This has brought the annual change back towards zero and negative annual changes are likely for the next few months.

A continued drop in the value series will have consequences for VAT receipts. Finally here are the monthly changes in both series.

Monday, October 28, 2013

Loans to Customers in the Covered Banks

A recent post looked at the state of the banks and in aggregate showed that the “Irish-headquartered banks” (AIB, BOI and PTSB) had €214 billion of loans to customers against which they had made €28 billion of provisions giving the €186 billion balance-sheet value for their loan books.

The following table provides some insight by bank, sector and country on the aggregate figures looked at earlier.

It can be seen that about a quarter of the loans the banks have are in the UK, and these loans are performing much better than those in Ireland. The NPL rate in the UK is around 7% (€4 billion out of €55 billion) while the NPL rate in Ireland is around 33% (€54 billion out of €159 billion). It should be noted that the banks use slightly different definitions of non-performing or impaired loans.

How large will the ultimate losses on these loans be? Impossible to say. What we can say is that the covered banks have a lending exposure in Ireland of around €160 billion. Of this nearly €60 billion is already impaired and the banks have made provisions for an average loss rate of around 50% on those loans. That seems conservative but there may be losses above that (and also the amount of NPLs continues to rise).

For example, AIB is still carrying a €18 billion exposure to land, property and construction related lending in Ireland. Only €3.2 billion of that is rated as “satisfactory” with €13.1 billion impaired. AIB also has €11 billion of non-property SME lending but this is similarly tied to property through hotels, pubs and other trading premises.

Of the €16.5 billion of provisions AIB has against its loans, €7.8 billion are for loans to the property and construction sector while €3.3 billion are for non-property SME lending. One concern may be that these are not large enough and another is that AIB may not have made sufficient provisions against other parts of its loan book, particularly Irish mortgages.

PTSB have also made provision of about 50% against their NPLs but the main problem there is the €14.3 billion of Irish and €6.5 billion of UK “tracker” rate mortgages it has. This are a huge drag on any return to sustainable operating profitability though.

In general though, there does not seem to too many skeletons left to unearth in the loan books of the covered banks. The ECB stress test will see some digging around but it is hard to see anything new been unearthed. Dealing with the nearly €60 billion of non-performing loans we can see are problems enough.

Wednesday, October 23, 2013

Alcohol Prices – Ireland is 2nd highest in EU

A minimum price for alcohol in Ireland remains on the agenda (though it’s legality is still uncertain). Data from Eurostat show that Ireland already has the second highest price for alcohol in the EU – at more the 60% higher than the EU average.

The latest data from Eurostat is for 2012 and is available here.

Tuesday, October 22, 2013

The State of the Banks

The quarterly IMF Reports generated as part of the EU/IMF programme now include an useful table that summarises the state of the “Irish-headquartered banks” (known as “covered” before the withdrawal of the ELG). The banks included, and their level of state ownership, are:

- Allied Irish Banks (as merged with EBS) – 99.8%

- Bank of Ireland – 15.1%

- Permanent TSB – 99.2%

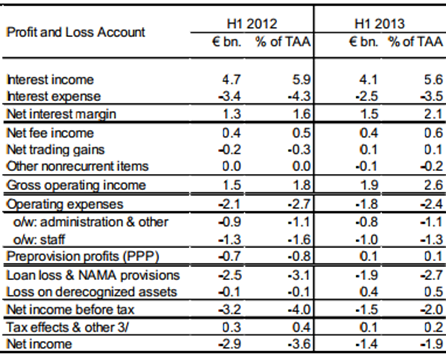

The most recent review, the eleventh, includes the table aggregating the results of the three banks on page 43. First is the Profit and Loss Account:

One important measure of the state of the banks is pre-provision profits. For the past few years the banks have not been able to generate enough income to cover their operating expenses. Regardless of loan losses that is unsustainable. The March 2011 PCAR projected that the banks would make €3.9 billion of operating profits in the three years from 2011 and 2013. This was a wild over-estimate.

Compared to the first half of 2012, the banks managed to slightly increase their net interest margin (from 1.6% of total average assets, TAA, to 2.1% of TAA). A small turnaround in trading gains and a reduction in operating expenses from €2.1 billion in H1 2012 to €1.8 billion in H1 2013 resulted in pre-provision profits swinging around from –€0.7 billion to +€0.1 billion. This is still well shy of what was envisaged under the PCAR.

Although the banks returned a small aggregate pre-provision profit in H2 2013 continued loan loss provisions mean that net income remains negative. If the level of non-performing loans (NPLs) continues to rise the banks will have to continue provisioning for losses which will continue to be a drag on the P&L account.

Next up is the balance sheet where we will ultimately see the effect of these provisions.

The balance sheets of the banks are getting smaller. Total assets dropped €40 billion over the year, falling from €322 billion last year to €288 billion at the end of June this year. Only ‘securities and derivatives’ showed an increase on the asset side, possibly down to valuation effects. All other asset categories fell with net loans dropping by €22 billion.

On the liability side the bulk of the reduction was seen in the money ‘due to Eurosytem’ which fell by nearly 50% over the year. The other drop was in ‘Debt and derivatives’. Both interbank deposits and customer deposits rose over the year. The €3.6 billion rise in customer deposits must be tempered against the fact that government deposits in the covered banks increased by around €10 billion over the year as the NTNA placed around half of the €25 billion cash reserve that has been accumulated with them.

The net equity in the banks (difference between assets and liabilities) was just over €20 billion. The value of the liabilities is easy to determine; the value of the assets is less immutable.

As shown, the banks had €65 billion of debt securities at the end of H1 2013. These are mainly NAMA bonds, Irish government bonds and bonds from each other. “Oh what a tangled web we weave, when we practice to deceive” (Walter Scott).

The loan books of the banks continue to both decline and deteriorate. As good loans are paid off the relative size of the defaulting loans increases. This is a chart on SME lending up to the end of 2012 from the Central Bank’s Macro-Financial Review.

The proportion of impaired loans has risen to around 25% but the amount of lending outstanding has fallen from €60 billion to €43 billion. For Q1 2011, 15% of €60 billion is €9 billion; for Q4 2012, 25% of €43 billion is €11 billion. The proportion of impaired loans has increased far more than the amount of impaired loans. This is not the case in the mortgage market where the level of loan reduction is lower and the increase in impaired loans is faster. The question of whether the ultimate losses will be above those set out in the 2011 PCAR is still uncertain.

Finally, the IMF include some “memorandum items” that give some further insight into the balance sheet and profit & loss account.

We see that the banks have a gross loan book of €213.5 billion. The balance sheet value of €186 billion is as a result of the €28 billion of loan loss provisions that have been set against the loan books. Non-performing loans in the banks grew another €5 billion over the year but that provisions as a percentage of NPLs is almost 50%.

The second half shows that the banks’ Core tier 1 capital ratio fell from 16% to 14% over the year and is still above regulatory requirements. Operating losses eating cash and provision reducing the value of loan assets will have eroded the banks’ capital. A relapse to pre-provision losses and further provisioning on bad loans will erode this further.

This will arise because additional loans go sour or because they banks may not have set aside enough to cover existing non-performing loans (NPLs). For example, AIB may not have been conservative enough with provisions against its Irish residential mortgages. We have seen that AIB has made a provision equal to 34% of its non-performing mortgages, as against 44% for Bank of Ireland and 48% for Permanent TSB. The banks do have slightly different methods of measuring ‘non-performing’ which may be a factor in the provisions they set aside.

So what is the overall state of the banks? Will they pass the forthcoming stress test? It is likely that the Irish banks will pass the stress test. Reports suggest that the ECB will require a 7% CT1 ratio in the stress test with a 1% surcharge for “systemically relevant” banks.

The ECB wants to unearth potential risks hidden in banks' balance sheets before banking supervision is centralised under its roof from November 2014 as part of a broader plan for closer European integration to head off future financial crises.

To do that it plans to run an asset quality review (AQR) early next year, for which it will reveal details on Wednesday.

Two sources familiar with the matter told Reuters on Tuesday that the central bank will ask banks to fulfil an 8 percent capital buffer in its review.

The buffer will require a core tier one capital ratio of risk-weighted assets of 7 percent, as foreseen in the final 2019 stage of the Basel III regulatory framework, plus a 1 percent surcharge for systemically relevant banks.

Could the results show that the Irish banks will drop below this level? It’s possible but unlikely. The Irish banks must strengthen their operating profitability and will have to continue making provisions against bad loans (but at a much reduced rate) but a drop below the level set out in the ECB stress test is unlikely.

What could cause the Irish banks’ capital ratios to drop below 8% (in aggregate)? A further write down in the value of their assets of around €10 billion would probably do it. This could happen for a number of reasons:

- If a further €20 billion of loans become non-performing, the current provisioning rate (c. 50%) would knock €10 billion off the book value of the loans.

- If there was an increase in the provisioning rate against current NPLs from 50% to 66%. Equivalently, if losses on existing NPLs are crystallised at a level above those currently provided for.

- If the book value of loss-making, low-interest ‘tracker’ mortgages was reduced (unlikely to be €10 billion though)

- If the book value of other assets such as Irish government bonds or NAMA bonds was reduced (again unlikely to be €10 billion).

Of course further operating losses and possible changes to the items eligible as Core Tier One Capital will also have a role to play. The above list are fairly pessimistic scenarios and even if they were to play out (and they are possible) they would still bring the aggregate capital ratio across the banks to around 8% – which is the threshold set by the ECB.

Under the conditions set out by the ECB no additional capital would be required. As noted above, the 2011 PCAR was designed around keeping the capital ratios above 10.5% in the base case (and a buffer above that was also provided for).

If something like the above does play out and the capital ratios in the banks do drop to below 8% where will the money come from to make up the gap? The shareholder is mainly the State and the amount of subordinated debt in the banks is relatively small (and any write down there would hit the State which holds €1.4 billion of sub-debt between AIB and PTSB). Similarly there aren’t many senior bonds in issue from the banks. So where to next? A depositor haircut a la the botched Cypriot example?

That is very very unlikely in Ireland. The worst of the banks are now off the stage (Anglo, INBS and Bank of Scotland(Ireland)); the remaining banks are not going to be shutdown. As projected here the “Irish headquartered banks” probably have around €10 billion of headroom before more capital is required (to stay above the 8% level). This will be eroded but it will take even larger problems again to generate a hole that has to be filled. A hole of any substantial size is unlikely but not impossible.

If it comes to it is there a “National backstop” available? Yes, the NTMA have accumulated a cash reserve of more than €25 billion. Using that to recapitalise the banks is an unlikely scenario but the backstop is there. The Irish banks will pass the ECB stress (and maybe we should be doing more stringent tests of our own) but passing a stress test is not a sign that a bank is healthy. It just means it’s unlikely to die. Even when the banks do pass the ECB’s test cleaning up the delinquent loan-book shown on the balance sheet above is a long way from being completed.

Getting to Three Point One

The level of the ‘adjustment package’ in last week’s budget has created some confusion. The basic sum involves the €1.85 billion of new measures for 2014 announced last week, €0.65 billion of carryover effects (measures which were announced last year but kick-in this year) and €0.6 billion of “additional resources and savings”. So we have

€1.85bn + €0.65bn + €0.6bn = €3.1bn

The €0.6 billion of “savings” was not set out in the Budget documents but the Minister for Finance has subsequently confirmed it to be €0.2bn from the activities of the NTMA, €0.1bn extra on the Central Bank surplus, €0.15bn due to Live Register “fluctuations” (!), and another €0.15bn arising mainly from state asset transactions.

It is not clear why these items should be counted as adjustments, measures or savings. It is hard to see how policy changes have impacted them and most are things that would, or should, happen regardless of what was in the Budget.

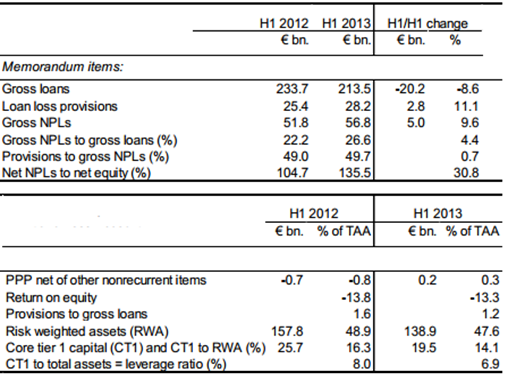

The new measures in the budget were €0.35bn of net tax measures and €1.5bn of expenditure measures. There was around €0.65bn of new taxes introduced but some of this was offset by the retention of the special 9% VAT for tourism etc. which cost around €0.3bn. The tax measures are summarised in Table 7 of the Economic and Fiscal Outlook.

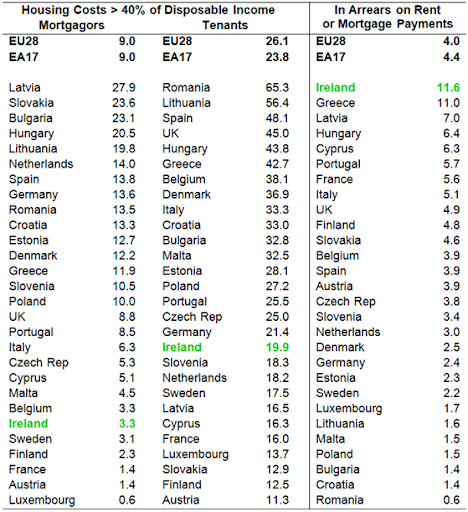

A summary of the €1.5bn of expenditure measures (€1.4bn current and €0.1bn capital) is not provided but it can be quickly extracted from the Expenditure Allocations report. There are two current expenditure measures we can look at:

- Central Policy Developments: Pay policy measures

- Savings measures introduced in 2014 to adhere to the ceiling

The first are the savings that arise from the Haddington Road Agreement brokered between the government and the public sector unions earlier this year and the second are the measures announced in the Budget. All comprise the adjustment made to current expenditure for 2014 and are summarised here (in €million).

The total of €1.9bn might suggest that there was over-achievement on the expenditure contributions but some of the savings here were used to loosen the pressure elsewhere. In last year’s budget a ceiling of €49.2bn was set for gross voted current expenditure in 2014. As a result of decisions taken the ceiling was increased to €49.6bn. This means some of the savings above were used to fund expenditure elsewhere bringing the net expenditure adjustment to €1.5bn.

For example, Education shows €226 million of pay savings for 2014 but the Department’s pay bill in the Estimates shows a fall of €184 million. The difference is explained by additional staff (mainly teachers and teaching assistants). Staff numbers under the remit of the Department of Education will rise from 94,490 this year to 95,745 in 2014 – an increase of nearly 1,300. Capital expenditure on education is also set to increase by around €135 million in 2014 – a rise €65 million greater than what was budgeted for last year.

So now it seems we are left with the following budgetary sum.

Whatever about their precise nature the €0.6bn of “additional resources and savings” are needed to bring the sum to three point one.

Monday, October 21, 2013

Income and Repayment Stress for Mortgagors and Tenants

The understanding we have of Ireland’s massive mortgage arrears problem remains scant. Many reasons have been put forward for the continued growth in arrears: unemployment, income decreases, negative equity, regulatory response, lack of repossessions and something called “strategic default”.

Up to recently actual evidence on any of these was absent but this is slowly improving. In some recent speeches Governor of the Central Bank, Prof. Patrick Honohan has focussed on the role of income in explaining the very high level of mortgage default. Recently he has said:

“Examination of the Standard Financial Statement (SFS) returns of defaulting borrowers in Ireland has shown that, indeed, monthly amounts due on the original monthly schedule represent a remarkably small portion of current monthly income, for a relatively high fraction of borrowers.”

And back in May he stated:

“The decline in after tax incomes for most employees has been significant, but aggregate data suggest that in the bulk of cases this decline is not so large as to make the continued servicing of debts impossible. Unless the household was already over-borrowed, a relatively moderate adjustment of spending patterns in response to lower income would allow the average household to remain on track.”

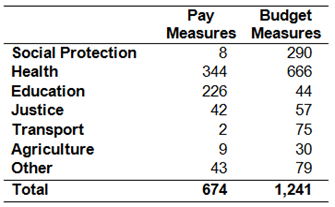

The Central Bank will be formally publishing the results from this research over the coming months. Here is a table extracted from Eurostat’s results from the Survey of Income and Living Conditions. It is a measure of housing cost overburden for owners with a mortgage and tenants renting at the market rate:

Around one-fifth of tenants renting at the market rate face a housing cost that is greater then 40% of their disposable income. For occupiers with a mortgage that rate is 3.3%.

The rate for mortgagors is, in proportionate terms, a large increase on the rates of 1.5% and lower that were the case from 2005 to 2007. However, the increase does not seem sufficiently large to explain why 12.7% of mortgage accounts are now 90 days or more in arrears.

Here is a table that compares gives the comparable housing cost overburdens in EU member states and also provides the proportion of households in each country who are in arrears for either rent or mortgage payments. Again the data are taken from the EU-SILC. The numbers in the first two columns represent the percentage of households within each category; the final column is the percentage of all households.

The first two columns seem to indicate that it is something other than payment to income that explains Ireland’s position at the top of the third column. The proportion of households in Ireland in arrears on rent or mortgage payments is almost three times the EU average and is more than twice the rate it is in all EU countries bar four.

The position of Ireland so low down the first column seems unusual. How can so few mortgaged households face a housing cost of more than 40% of disposable income? This is down to the definition of housing costs used in the survey. From this Eurostat publication we can see that it is:

Housing costs include mortgage or housing loans interest payments for owners and rent payments for tenants. Utilities (water, electricity, gas and heating) and any costs related to regular maintenance and structural insurance are likewise included.

Capital repayments on mortgages are excluded as these are considered a form of saving. Lots of Irish mortgagors may have what appear to be low housing costs because of cheap ‘tracker’ mortgages but they face huge capital payments on an asset that has lost around 50% of its value. It might be saving in the strictest sense of the word but it would not feel like it to households in deep negative equity.

The proportion of households by country in each category is given in a table below the fold. This explains why Romania is at the top of the second column and can then end up at the bottom of the third (96% of households are owner-occupiers with no mortgage).