These issue of €1 million+ mortgages is back in the news today following a presentation by Prof Morgan Kelly to the Irish Society of New Economists yesterday. He first made the claim of 10,000 million plus mortgages in his Hubert Butler lecture in Kilkenny two weeks ago and which was examined on this site here and I also have a piece here.

An article in today’s Irish Times provides a fresh defence of the claim.

Yesterday he told a meeting of the Irish Society of New Economists in Dublin that this “anecdote” had “taken on a life of its own”. He had been called “irresponsible” for using it. “I read this in a newspaper a year ago, it has to be true,” he joked.

Prof Kelly said he had since used econometric calculations to analyse how many of these large investment mortgages there were, concluding that the anecdote “seems to be correct”.

Yesterday he said the investors probably took out more than one mortgage so it was 10,000 mortgages not 10,000 people who owed €11 billion.

Prof Kelly also calculated that two-thirds of investor loans were interest-only. “These interest-only loans seem to concentrate among investors, and my guess would be this is large properties.” This large number of interest-only investor mortgages was “ bad news” for the Irish banking system and the taxpayers, he said yesterday.

These investors “typically bought property that was designed for investors”. Prof Kelly predicted “very large losses” on these properties. Demand for property was driven by the flow of lending from banks. “The flow of lending to these investors is only 1 per cent of what it was back at the peak,” he said.

“There is no demand for this stuff, so I think there is going to be very large losses on these things.

This time the focus is on investment or buy-to-let mortgages. In most cases the most important demand for these properties is in the rental rather than real estate market. There may be some investors who bought investment properties for resale but the majority would have been bought to rent.

The most recent Daft report indicates that rents have fallen by an average of 25% since 2007. This would be bad news for investors but it is cancelled by the drop in interest rates, particularly tracker rate mortgages.

The key ECB rate has fell from 4.25% in July 2008 to 1.00% in May 2009. It now stands at 1.50%. This is still lower than at any time during the 2002 to 2007 period. Recent indications are that further rate increases by the ECB will be put on hold.

If two-thirds of these loans are interest only as claimed then the repayments on these loans will have fallen by more than the drop in rent.

We can get an insight into the residential investment market in Ireland from an interview in The Irish Examiner with Hubert Kearns, chairman of the project agency which handles the collection of the Non-Principal Primary Residence charge of €200 on behalf of the country’s local authorities. This includes all second properties and not just those for investment.

One of the most surprising features of the new tax regime was the level of compliance, about 80%, for the self-declaration tax on non-principal private residence (NPPR).

"There was a very high level of compliance by people before the due date both last year and this year. Another thing that surprised us is that there is a very large number of individuals who own a sizeable number of properties.

"There are 99,000 people with one property, but there are 35,000 people who have between two and 10 properties and who have paid the charge on two to 10 properties. In effect, this means of course that they own between three and 11 properties.

"And the figures go up, 970 people have between 12 and 21 properties; 230 people have between 22 and 31 properties and 100 people have between 32 and 41 properties."

Although there are 35,000 people who have paid the charge on between two and 10 properties, it is likely that most of these are in the range of two to four and are unlikely to have mortgages of more than €1 million. Still there could be a couple of thousand people with five to 10 properties.

There is 1,300 people who paid the charge on more than 10 properties. There is no doubt that a sizeable proportion of this group could have one (or more) mortgages in excess of €1 million.

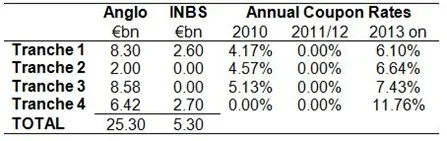

If we look at the banks we see that the covered banks had a buy-to-let loan book of around €24 billion as reported in the stress tests. The loan balances for AIB, BOI, PTSB and EBS are summarised in this table. There was also about €600 million of buy-to-let loans in INBS. Click to enlarge.

Of the total buy-to-let loan book of €24 billion it is hard to imagine that €11 billion would be concentrated in fewer than 10,000 people. It could be the case though.

The stress tests allow for €6.3 billion of loan losses in buy-to-let loans. The “three-year loss provision” of the Central Bank means that capital was provided for around €3.5 billion of losses between now and 2014.

Unlike owner-occupied mortgages we do not get data from the Financial Regulator on arrears for buy-to-let loans. The banks themselves have given us an insight into this. It’s not pretty. When announcing their half-year results AIB said.

One in five of its 44,000 Irish buy-to-let mortgages was in arrears or had been restructured to help borrowers at the end of June, compared with one in 12 of the bank’s 126,000 home loans.

The stress test loss of €6.3 billion in the adverse scenario would require about €12 billion of defaults in buy-to-let mortgages assuming that, on average, the property repossessed is worth 50% of the loan value. That is a default on half the loan book.

The buy-to-let loan book is a mess but we still lack evidence that these 10,000 jumbo loans exist.

UPDATE: This morning we have had some useful information on whether the banks have 10,000 mortgages of more than €1 million on their books. The numbers come from the Askaboutmoney.com website and can be seen here. A fairly robust defence of the numbers was provided over on Namawinelake in this comment.

The numbers provided by the banks seem more realistic to me. Although it seems to be “sources within the banks” rather than an official publication, the evidence is that the covered banks have about 2,500 mortgages on their books of more than €1 million. This includes owner-occupied AND buy-to-let mortgages.

If 20% of these loans defaulted the banks are looking at losses of around €250 million.