After our analysis of the largest merchandise export sector (chemicals at 60% of the total) we will now consider Ireland’s largest services export sector. According to the most recent Balance of Payments data, Computer Services now account for close to 40% of our total service exports.

You can find some analysis of the official CSO data here. The CSO data is great for the quantities but is lacking information on the impact. To this end we have turned to the Annual Business Survey of Economic Impact from Forfás, which by value covers about 85% of our total exports (and the missing proportion is largely tourism and travel).

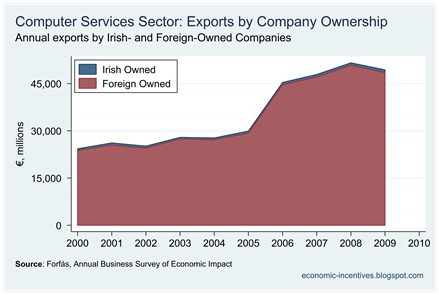

Here’s a run through our Computer Services sector using this data. And like the Chemicals sector we start with the same conclusion. Exports have increased (particularly since 2005) but direct expenditure in the Irish economy hasn’t budged.

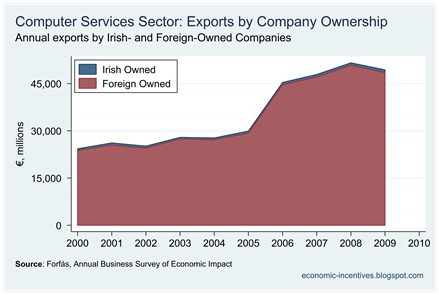

Since 2003 exports of computer services have grown by 76.8% from €27.9 billion to €47.4 billion. During this period direct expenditure in the Irish economy has fallen by 13.1% from €11.5 billion to €10.0 billion.

Like the Chemicals sector, Computer Services are dominated by foreign-owned firms which in 2009 accounted for 98.2% of exports in the sector.

As expected most of the contribution to the Irish economy comes from the foreign-owned sector, but this is down on the levels seen in 2001-2003 period.

The computer services sector does buy nearly €7 billion of materials a year, but the vast bulk of this comes from abroad.

Not surprisingly, these companies buy a lot of services, but unlike the Chemicals sector where only 6.4% of services are bought from Irish sources, in the Computer Services sector the purchase of Irish services makes up 41.7% of the total. In fact, across the companies in the survey purchases of Irish services totalled €13.6 billion in 2009. At €6.4 billion purchases from the Computer Services sector made up 47.3% of the total.

We can get some information about the purchases of these Irish services by looking at a breakdown of the type of companies buying the services.

Over half of the purchases of Irish services are by Computer Programming companies. Computer Consultancy companies purchase the bulk of the remainder with the than 5% bought by Facilities Management companies.

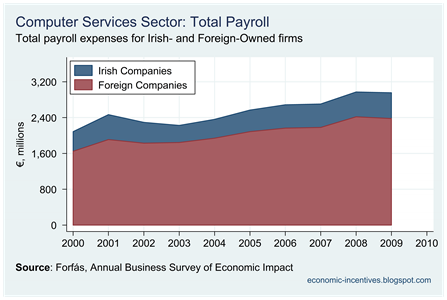

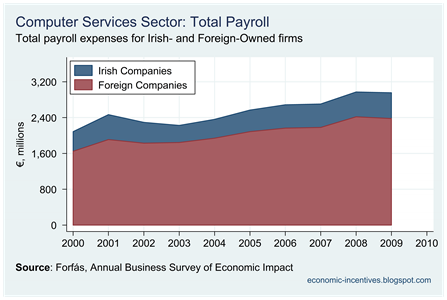

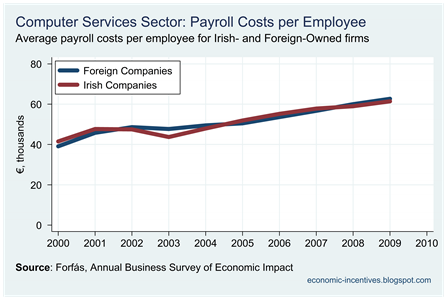

Although the purchases of Irish materials and services by these companies has declined from peaks seen nearly a decade, payroll expenses have risen.

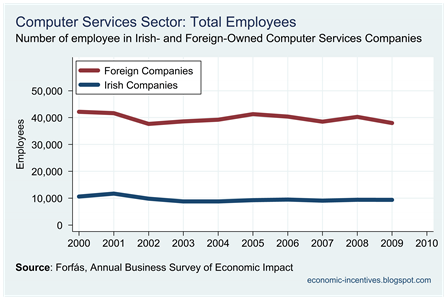

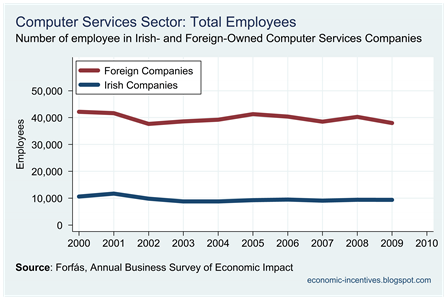

Total payroll expenses rose from €2.1 billion in 2000 to just under €3.0 billion in 2009, with most of this rise coming from foreign-owned companies. However, this has not been because of an increase in employment. Again we have the situation of a sector with booming exports offering no employment growth.

[Forfás do not directly provide the employment numbers. These figures are derived from the Total Sales and Average Sales per Employee figures and are cross checked against Total Payroll and Average Payroll per Employee figures.]

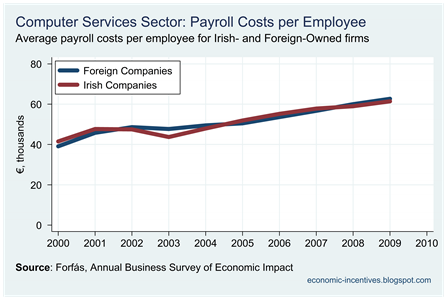

Total employment was 52,800 in 2000 and had FALLEN to 49,700 in 2009. This 5.8% drop in employment took place during the same period when exports rose by 80%. Thus the increased payroll costs are due to increases in the costs per employee.

Average payroll costs in the computer services sector was €62,400 and unlike the Chemicals sector the cost for Irish- and Foreign-owned companies were largely the same.

What isn’t the same is the added value per employee. There was always a gap between Irish and Foreign-owned firms but beginning in 2005, this gap has ballooned. In 2009, foreign-owned firms had an average added value per employee of €745,000, dwarfing €104,000 added value per employee in Irish-owned firms

Here is a breakdown of added value by company type. Can you spot the series break??

Those Computer Facilities Management workers sure are productive!! Looking at a breakdown of exports by the type of company.

We see that, while all categories are growing, most of the growth in computer services exports is attributable to Computer Facilities Management (again with a huge jump after 2005). This sector must be contributing hugely to the economy. Let’s see.

Where’s the jump? Initially I thought that this graph was wrong but unless the original Forfás data is right then this is what has happened. The the Computer Facilities Management sector exports have increased from €1.8 billion in 2000 to €16.2 billion in 2009. This is an increase of nearly 800%.

At the same time the direct expenditure by companies in this sector (i.e. their contribution to the economy) has gone from €733 million to €810 million, a rise of 10%. Maybe it’s worth putting these two lines on the same graph.

And what about employment in this sector that is clearly driving our “export-led growth”?

A sector that has seen exports rise by nearly €12 billion since 2005 (our total exports were €145 billion in 2009) has seen employment FALL from 11,000 in 2005 to 7,600 in 2009.

Sometimes I’m sorry I ask myself these questions.